-

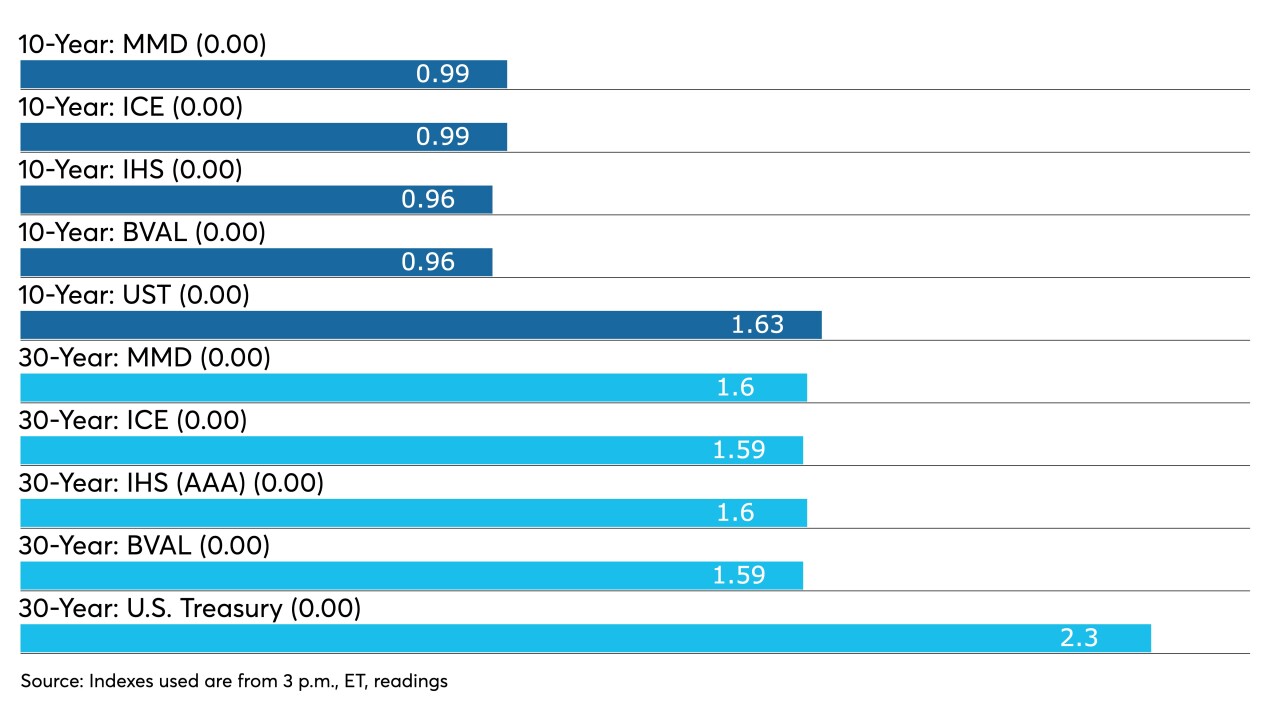

After just one session, the 10-year muni is back below 1% with ICE Data Services and Refinitiv MMD at 0.99% while Bloomberg BVAL is at 0.96% and IHS Markit at 0.95%.

May 4 -

Regina Egea, president of the Garden State Initiative, analyzes New Jersey's fiscal landscape, including the proposed state budget, unfunded pension liability and deficit borrowing. Paul Burton hosts. (20 minutes)

May 4 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

May 3 -

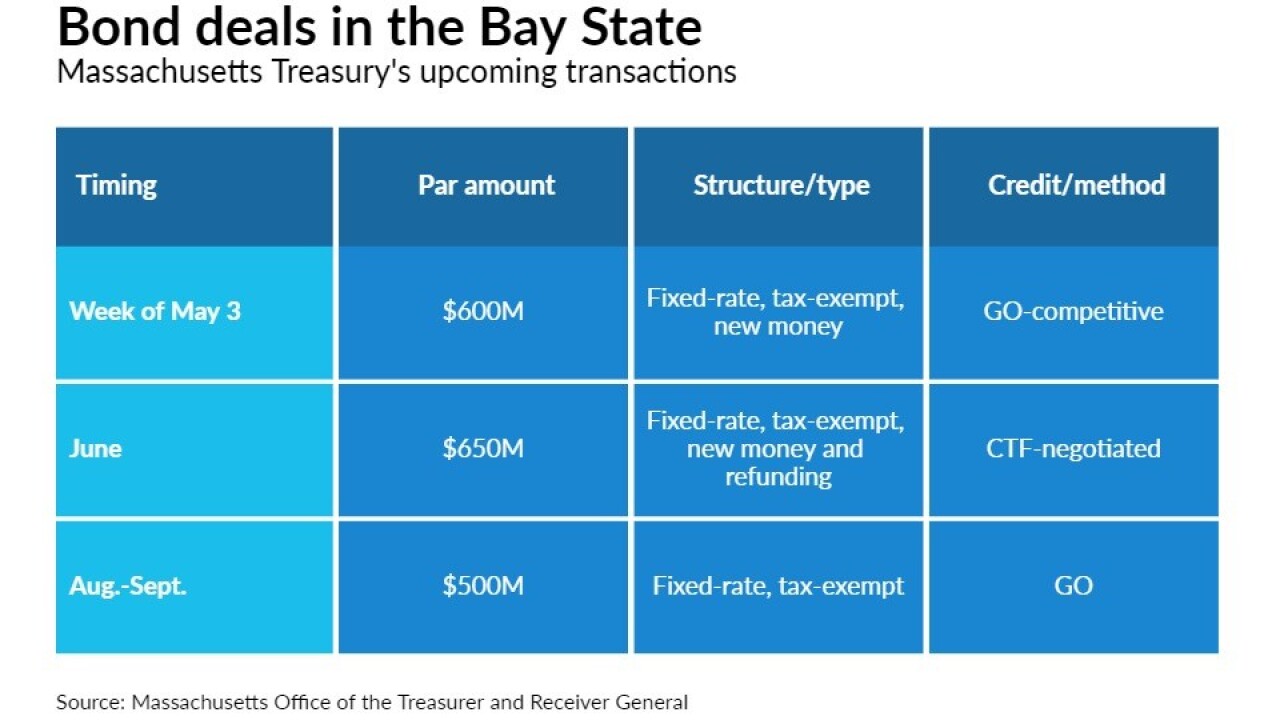

The states intend to come to market with $600 million and $1 billion, respectively, bringing state GO credits in an improving credit environment that has held yields down.

May 3 -

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

April 30 -

With federal aid rolling out, the municipal credit picture is improving and issuers are coming to market at a faster clip. An infrastructure package could push issuance levels even higher.

April 30 -

The North Texas Tollway Authority will sell a mix of taxable first-tier and tax-exempt second-tier bonds in the refunding transaction.

April 30 -

Refinitiv Lipper reported another week of inflows at $1.64 billion, with $630 million headed into to high-yield. Benchmark yields rose as much as four basis points following weaker U.S. Treasuries, resistance to ultra-low yields.

April 29 -

The municipal market largely ignored the FOMC news that it would hold rates steady. New Jersey was 20 times oversubscribed and ICI reported $2.5 billion of inflows into long-term municipal bond mutual funds.

April 28 -

Data released Tuesday show an improving economy, which continues to stoke fears of impending inflation. Muni investors await New Jersey's $1.57 billion transportation deal.

April 27