-

Much of the Oregon Health & Science University deal funds a hospital expansion, but it also includes a tender exchange and a privately placed forward refunding.

December 6 -

The weaker-than-expected employment report sent U.S. Treasury yields lower and equities sold off. Munis did what they've been doing — mostly ignored it.

December 3 -

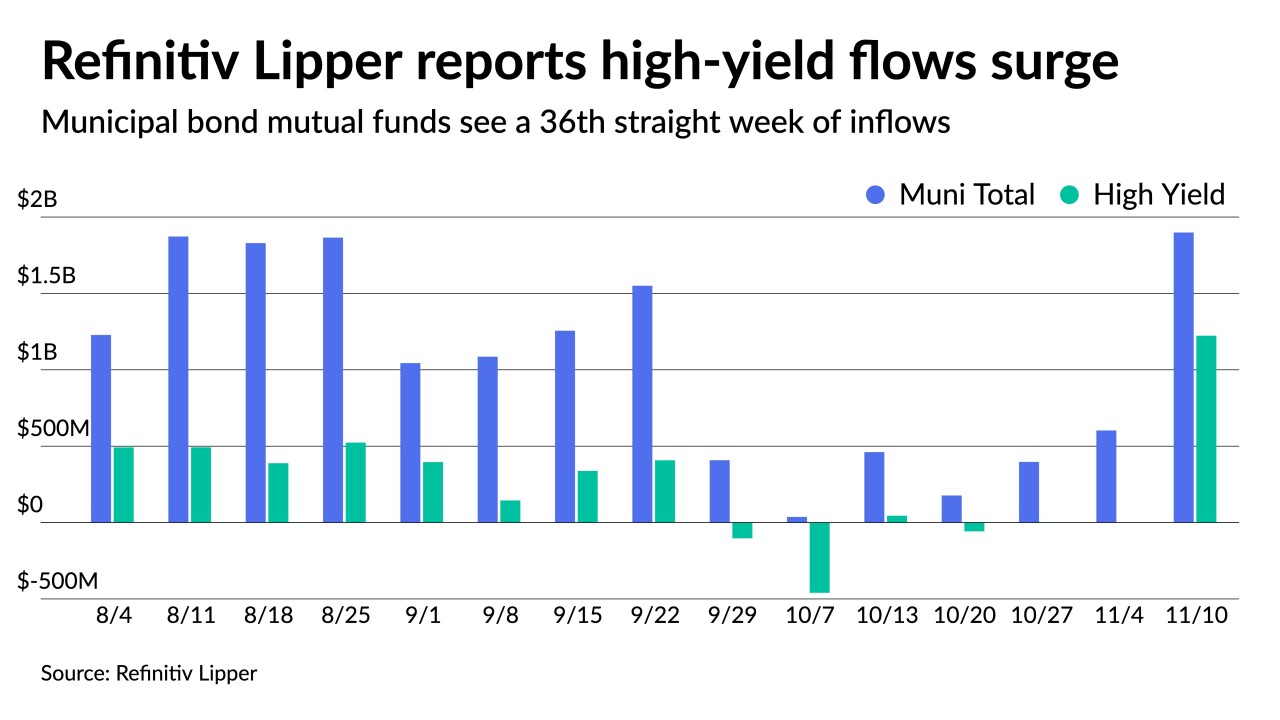

Refinitiv Lipper reported a significant drop in municipal bond mutual fund inflows at $36 million in the latest week, a signal the volatility of other markets may be creeping in. High-yield saw $53 million of inflows.

December 2 -

The Investment Company Institute reported $974 million of inflows into municipal bond mutual funds in the week ending Nov. 23, down from $1.430 billion in the previous week.

December 1 -

Powell says the FOMC will consider ramping up tapering when more information about Omicron and its impacts are known, further flattening the UST yield curve.

November 30 -

Economists appear to be less concerned about Omicron, with some saying that even if the variant causes another pandemic wave, it is more likely to "slow rather than interrupt" the global economic recovery.

November 29 -

A majority of firms anticipate less volume in 2022 than the record hit in 2020, but how policies from Washington and the path of overall economic activity in a still-recovering global economy with COVID overhang make predicting volume more difficult.

November 29 -

ICI reported $1.43 billion of inflows into municipal bond mutual funds in the week ending Nov. 17, down from $1.61 billion in the previous week.

November 24 -

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

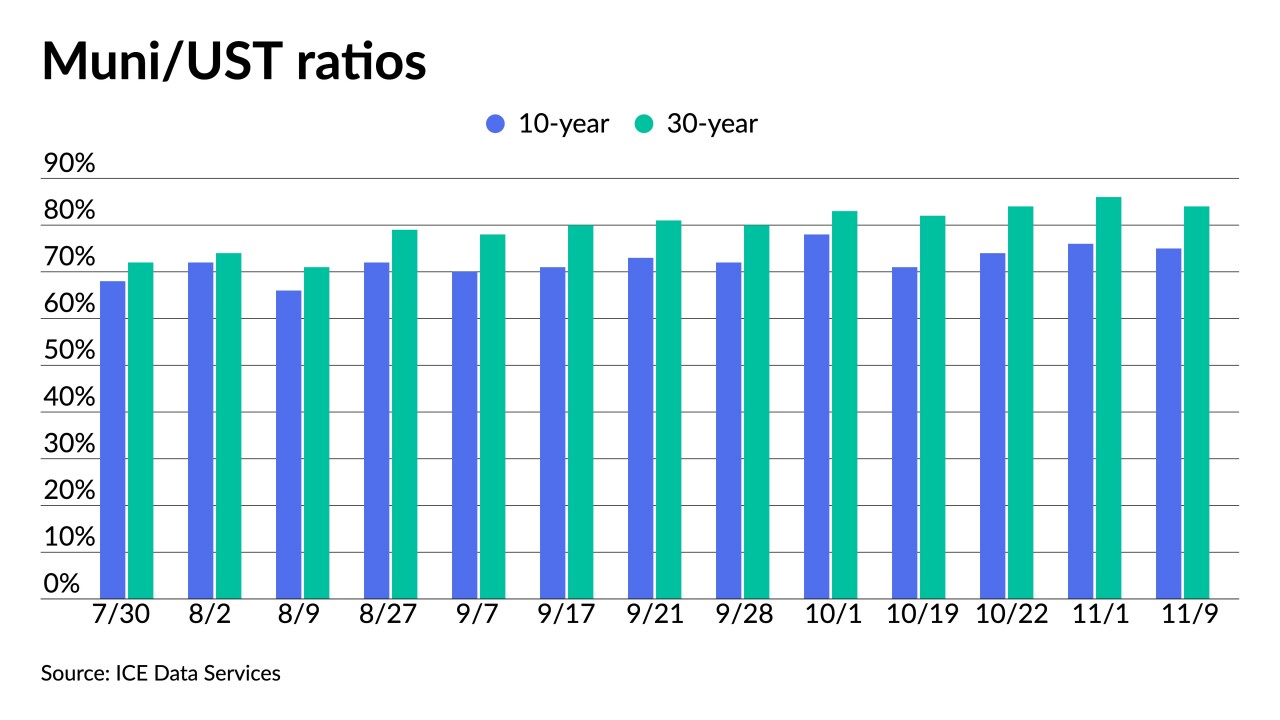

Month over month, the municipal market is in a much better position, as heavy demand and flows continue to drive it.

November 18 -

The state will take a fresh dose of good rating news into the market when it competitively sells $400 million to fund pension buyouts and capital expenditures.

November 18 -

The Investment Company Institute reported $1.608 billion of inflows into municipal bond mutual funds for the week ending Nov. 10, up from $657 million a week prior.

November 17 -

The tender/exchange offer is built into a more than $1 billion refinancing the city plans to price in early December.

November 17 -

The state is selling $1.2 billion of GOs, and a recent deal from Vicksburg highlights a structure that makes a difference to the state's local governments.

November 17 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

November 15 -

The Metropolitan Water Reclamation District of Greater Chicago green bonds will fund its its deep tunnel project and waste and storm water management projects.

November 15 -

The speculative grade bond sale is part of the financial process of returning the Phoenix-based university to nonprofit status after years as a for-profit.

November 15 -

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

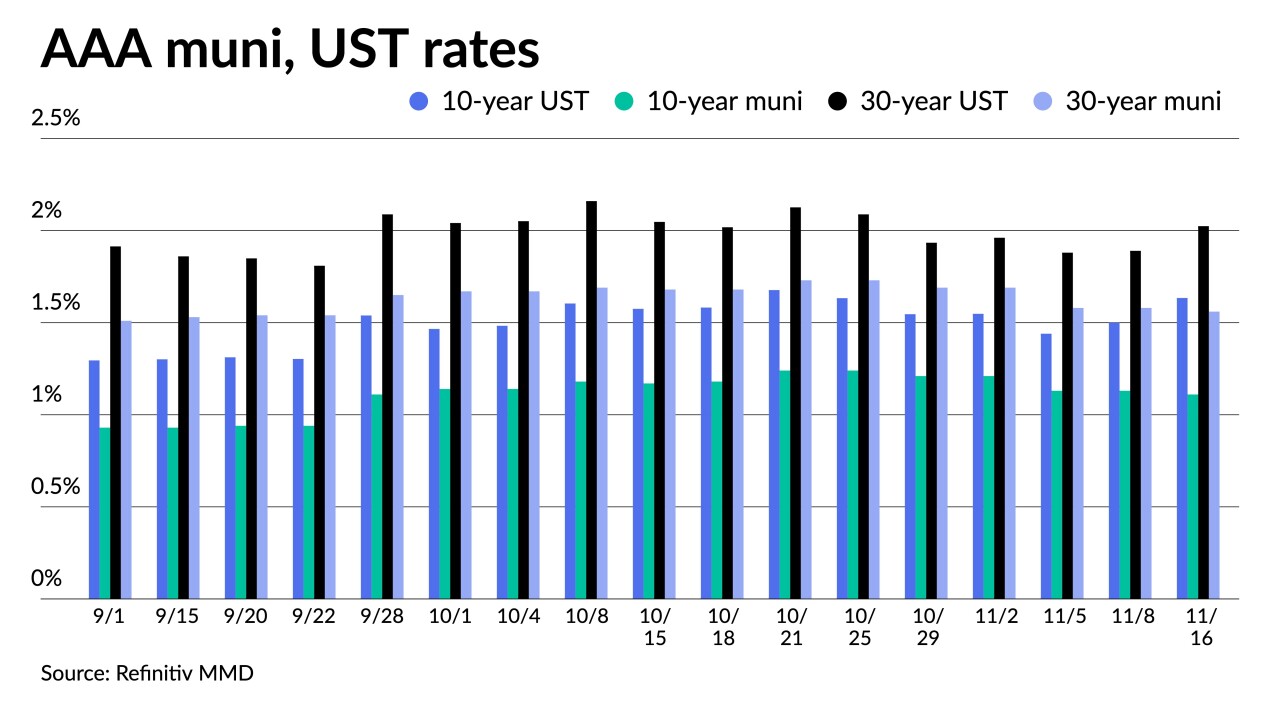

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9