-

The tender/exchange offer is built into a more than $1 billion refinancing the city plans to price in early December.

November 17 -

The state is selling $1.2 billion of GOs, and a recent deal from Vicksburg highlights a structure that makes a difference to the state's local governments.

November 17 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

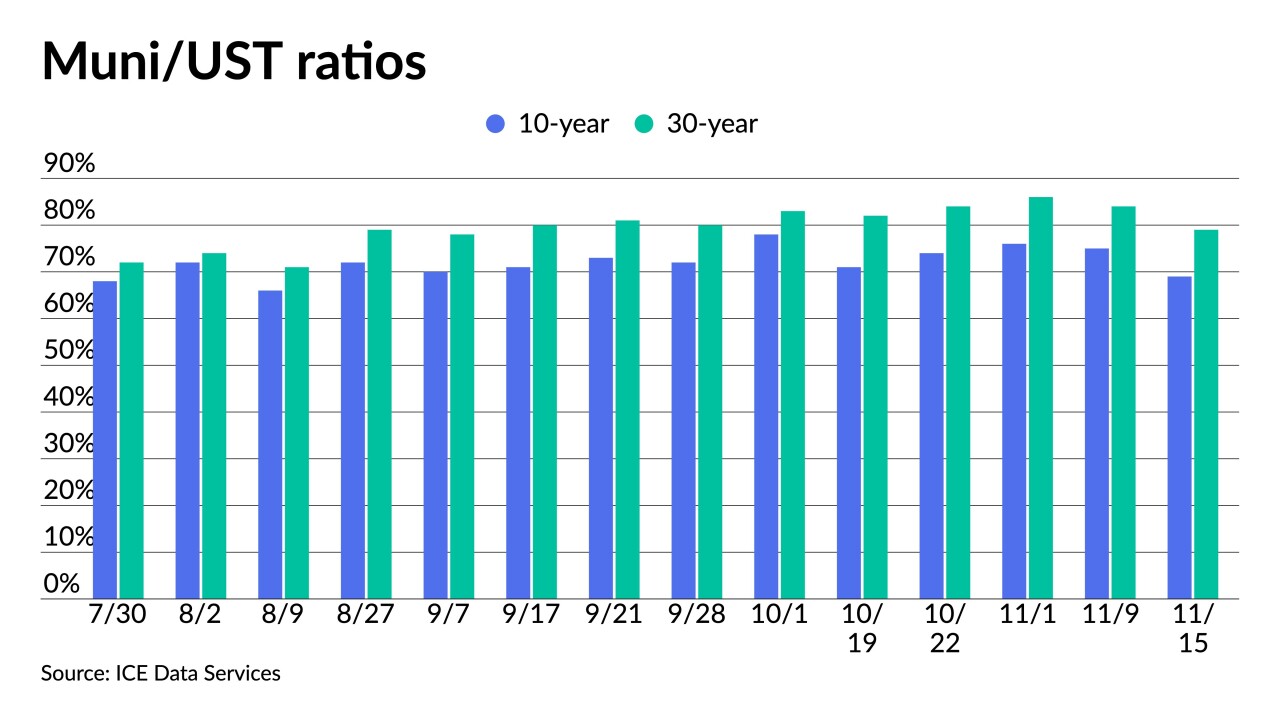

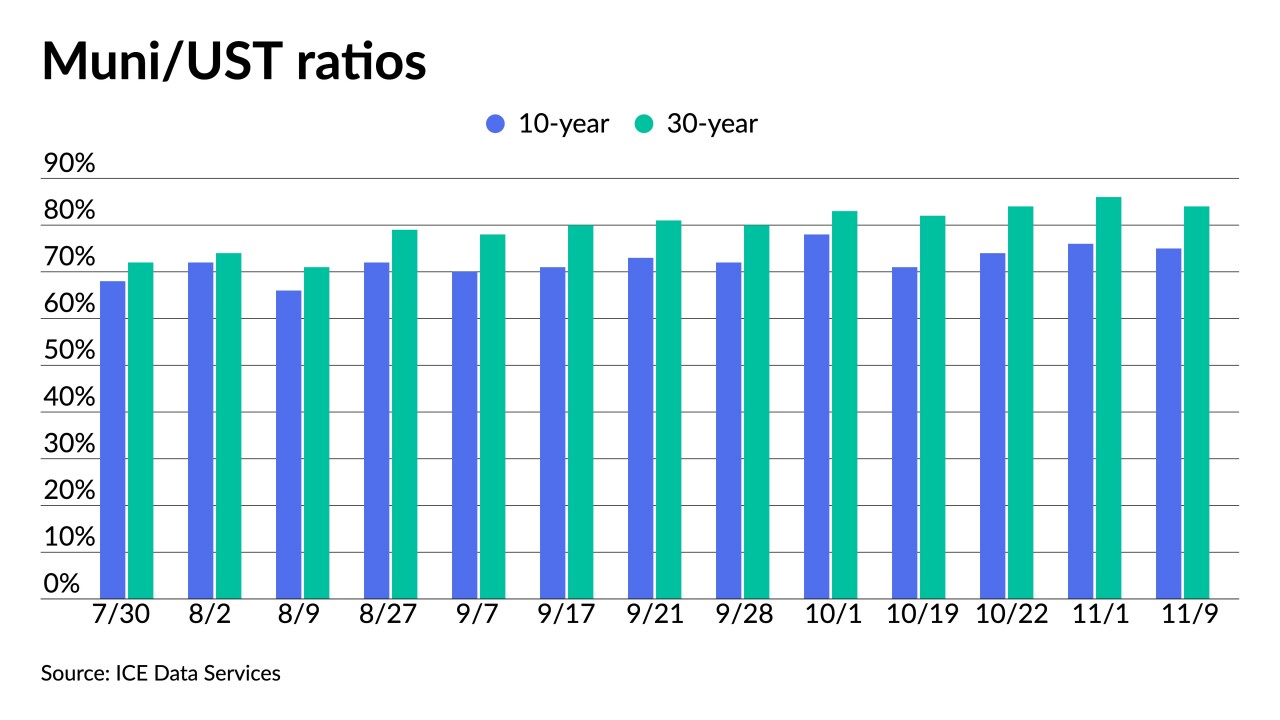

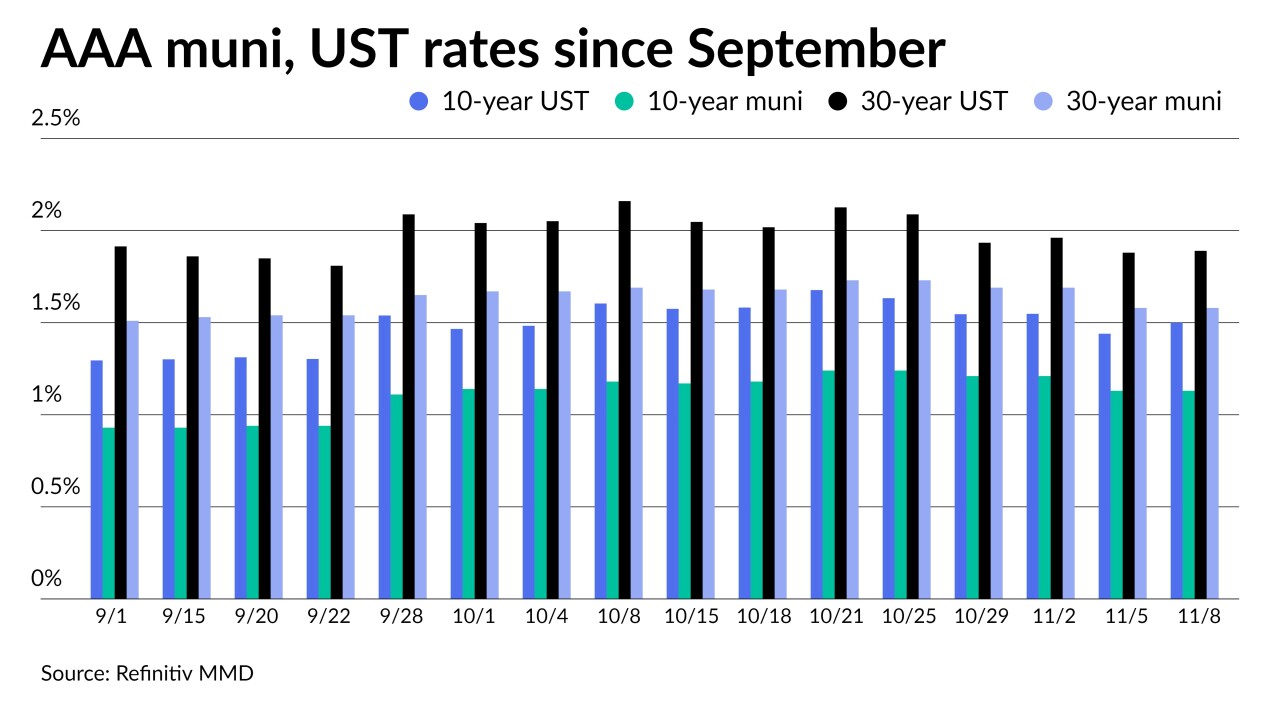

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

November 15 -

The Metropolitan Water Reclamation District of Greater Chicago green bonds will fund its its deep tunnel project and waste and storm water management projects.

November 15 -

The speculative grade bond sale is part of the financial process of returning the Phoenix-based university to nonprofit status after years as a for-profit.

November 15 -

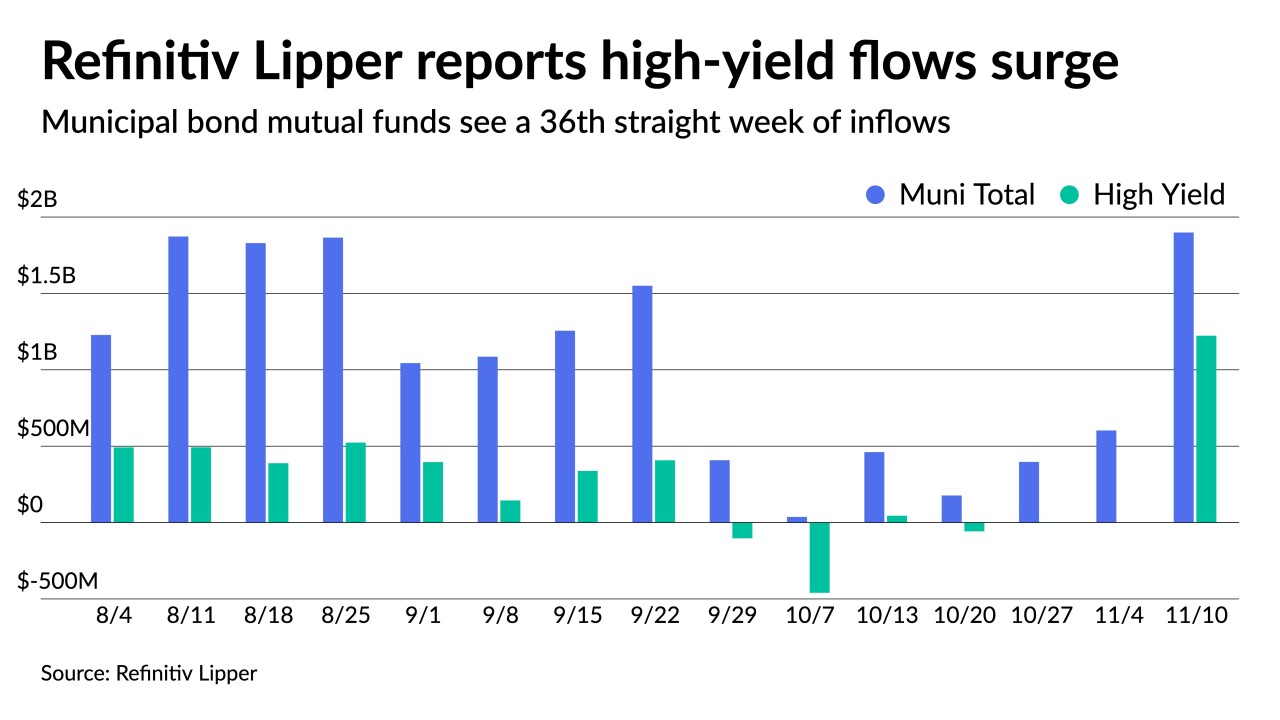

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

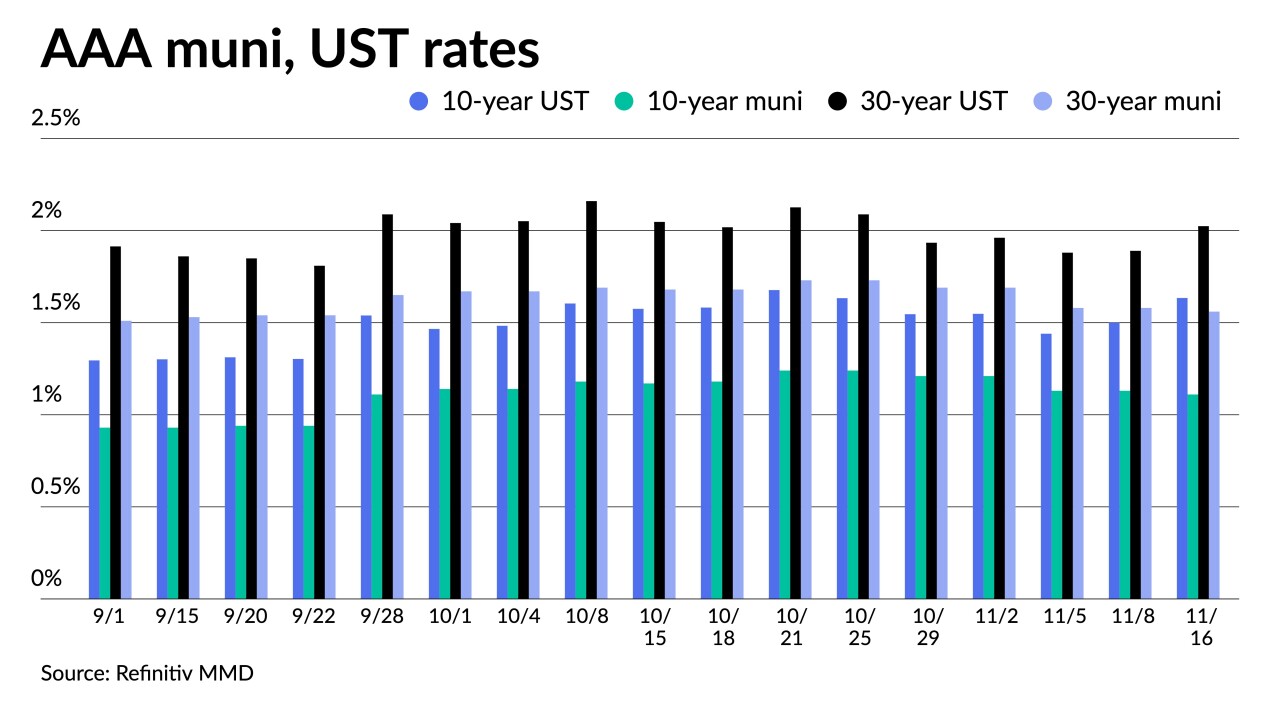

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

November 9 -

The nation's second-largest county heads into the market next week with a GO refunding buoyed by an upgrade and an outlook boost.

November 9 -

Municipals were quiet on Monday following Friday's rally and ahead of the $9.6 billion estimated to be priced early in the week before the Veterans Day holiday close Thursday. Connecticut priced for retail.

November 8