-

A bearish market sentiment and elevated muni to UST ratios often represent a buy signal. Taxable equivalent yields are compelling for buy-and-hold investors, analysts say.

June 27 -

Municipals head into the final week of the first half of 2022 on more stable footing, but a cautious tone hangs over the market.

June 24 -

Cook County projects a surplus this year and a $18.2 million gap for fiscal 2023 while it readies two bond sales.

June 24 -

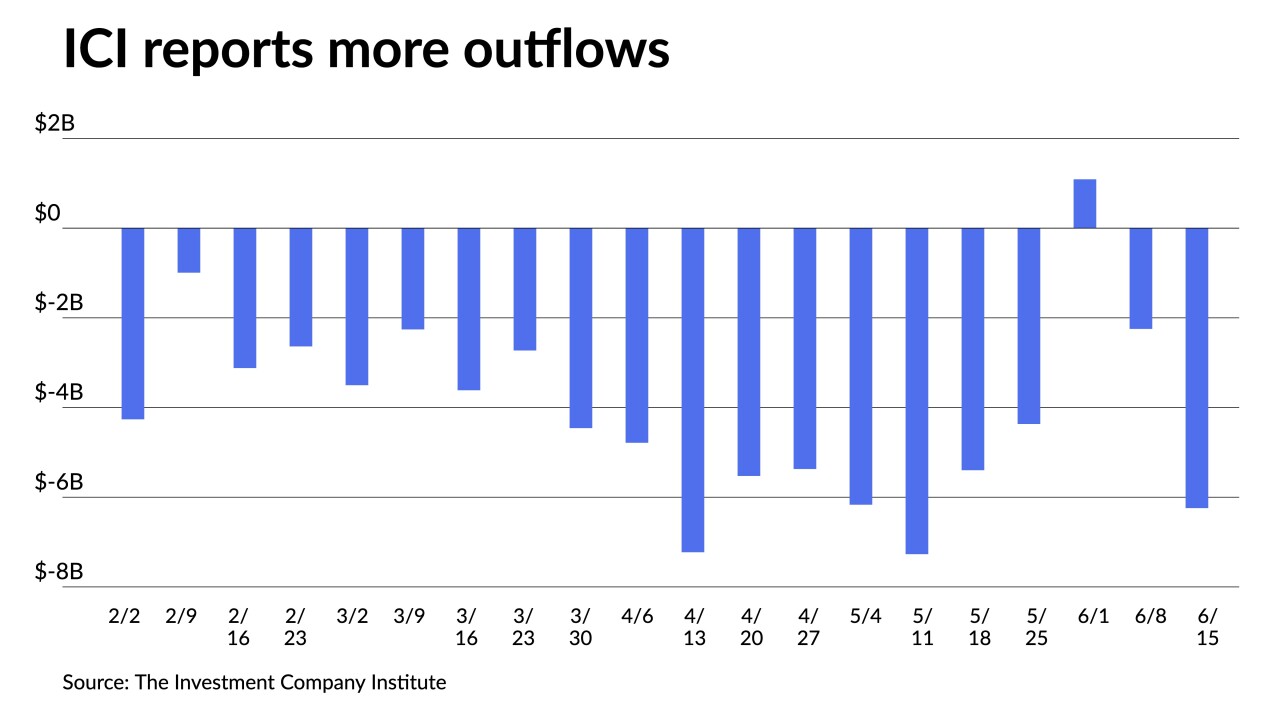

Refinitiv Lipper reported smaller outflows at $1.6 billion, down from the $5.6 billion the week prior. It brings the total outflows to $45.7 billion year-to-date.

June 23 -

The Investment Company Institute reported investors pulled $6.243 billion from muni bond mutual funds in the week ending June 15.

June 22 -

Moody's downgraded the university and its housing and parking borrowing arm ahead of a bond sale to support the school's goal of increasing on-campus housing.

June 22 -

After a deal fell apart last year amid controversy over private prisons, the state returns with new underwriters and a traditional municipal finance structure.

June 22 -

The lighter calendar may help ease the imbalance between demand and supply, as selling pressure in the secondary has weighed significantly on the market tone.

June 21 -

This week's $61.8 million Wisconsin Health and Educational Facilities Authority deal folds two new subsidiaries into the obligated group.

June 21 -

Investors will be greeted Monday about $6.4 billion of new issuance led by triple-A Georgia general obligation bonds and Los Angeles notes.

June 17