-

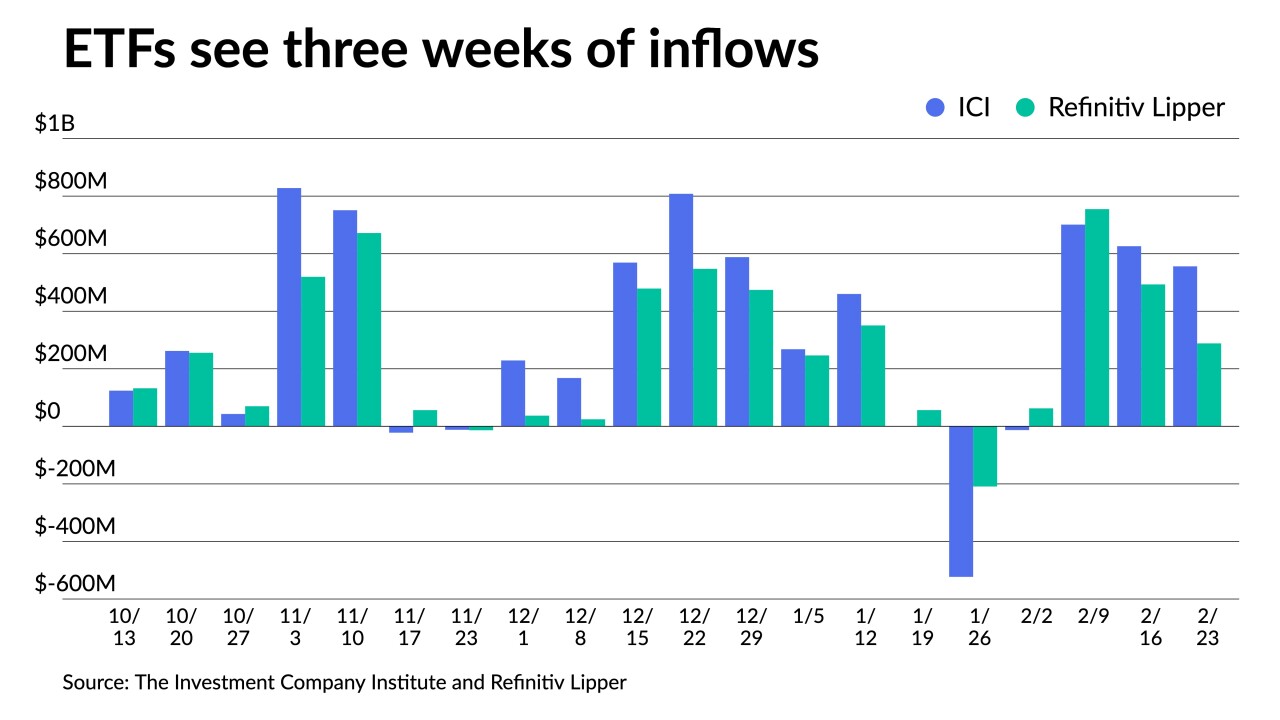

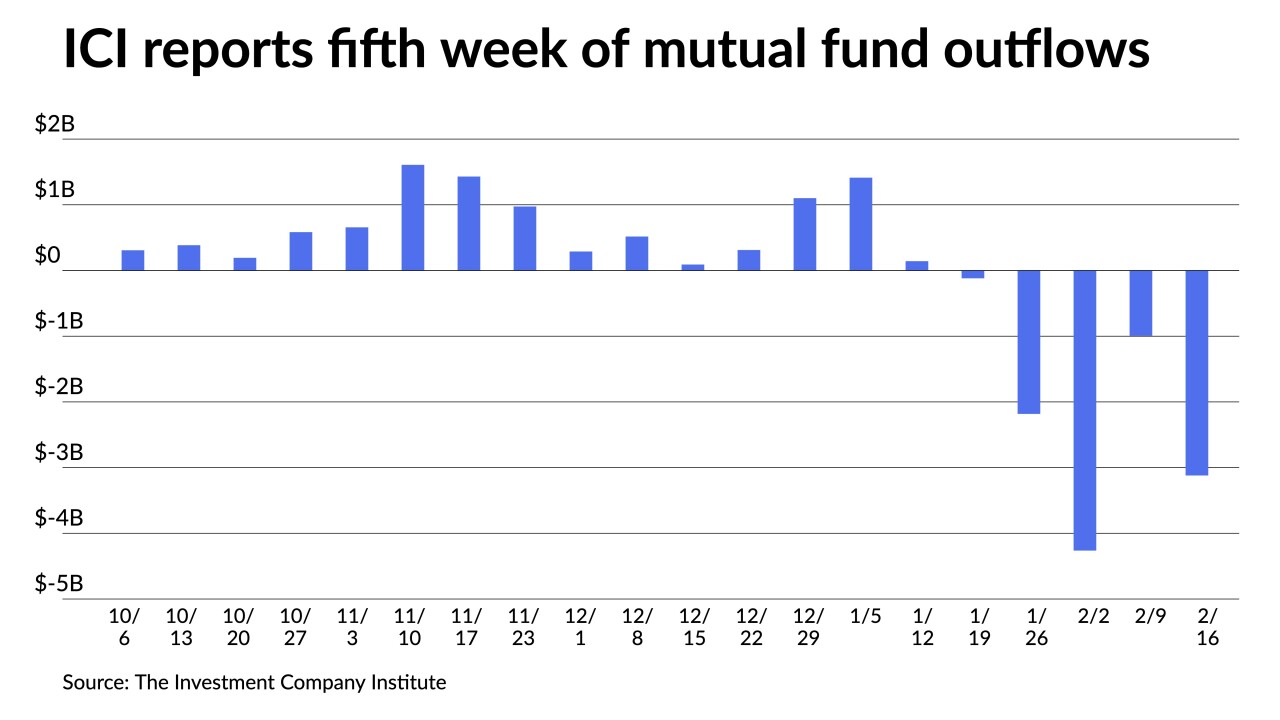

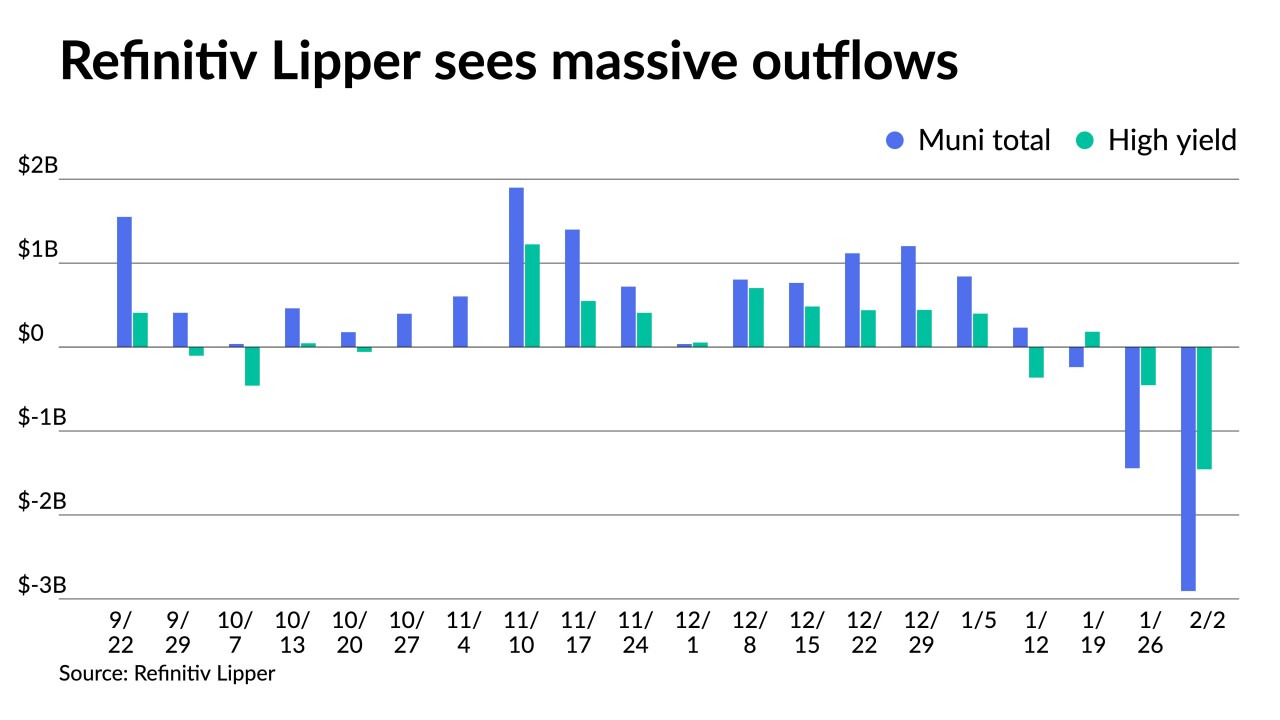

ETFs pulled in just more than $2 billion in February while muni mutual funds saw $8.5 billion of outflows.

March 4 -

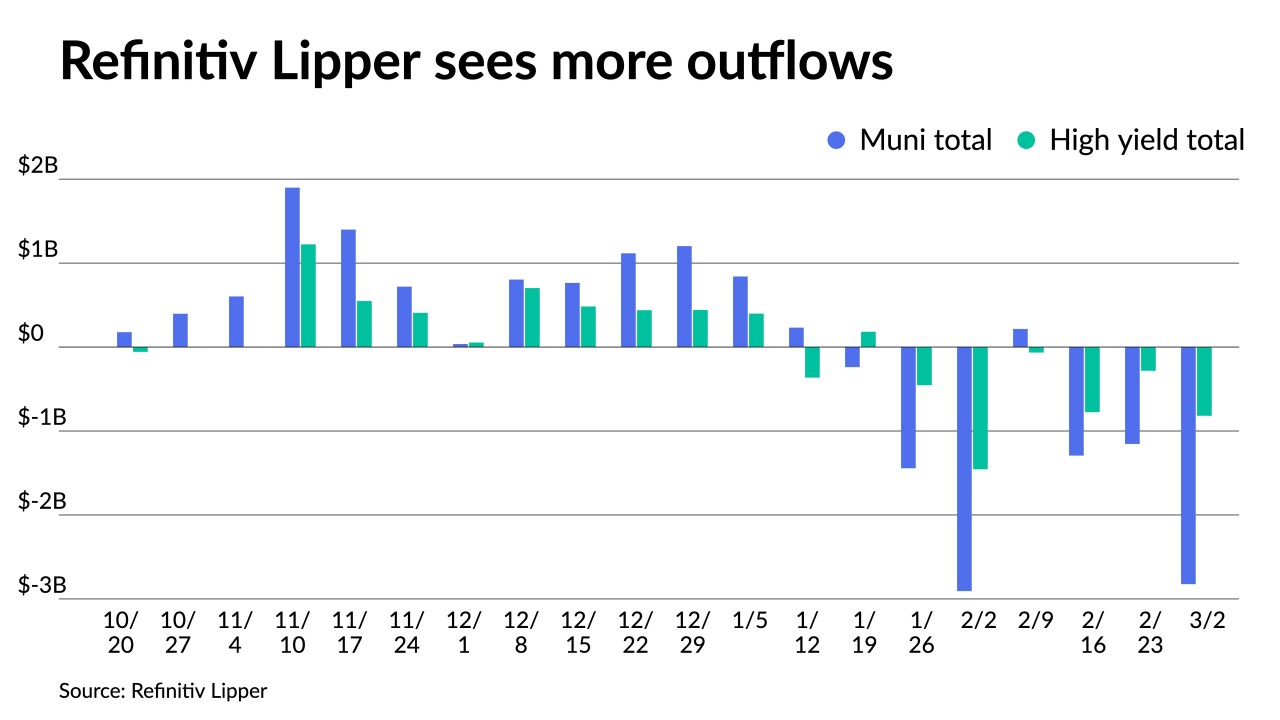

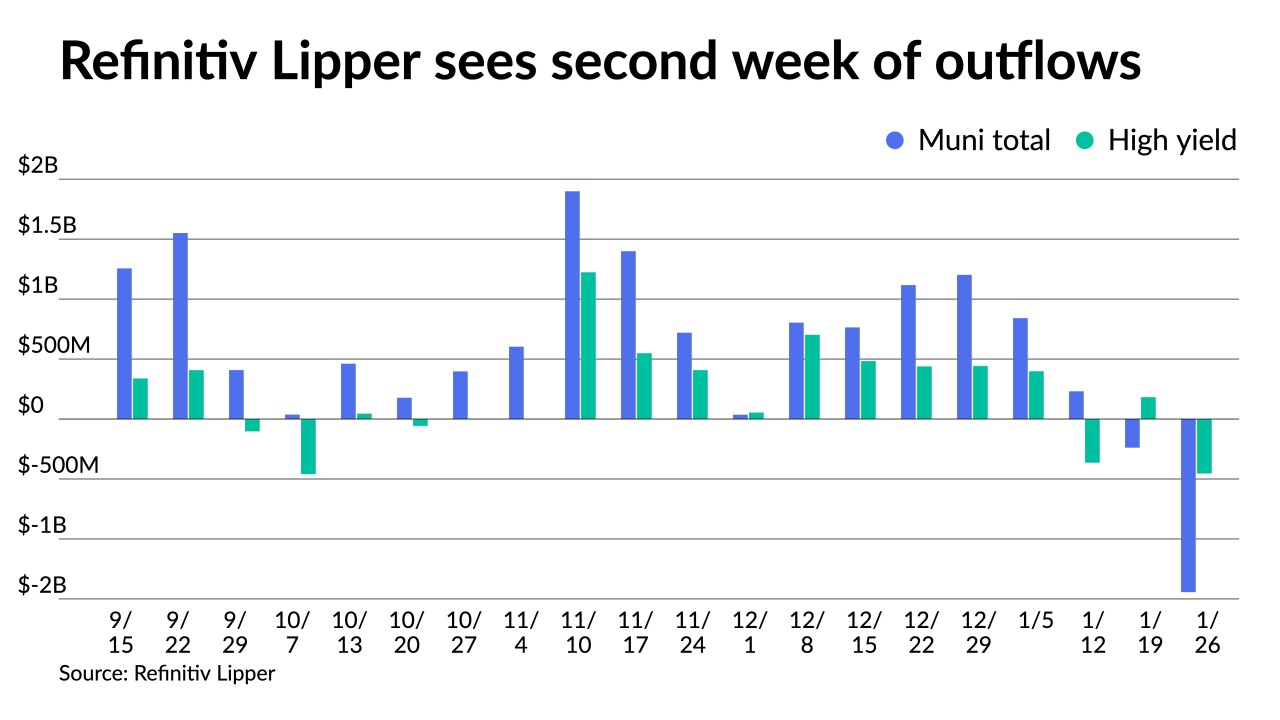

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24 -

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

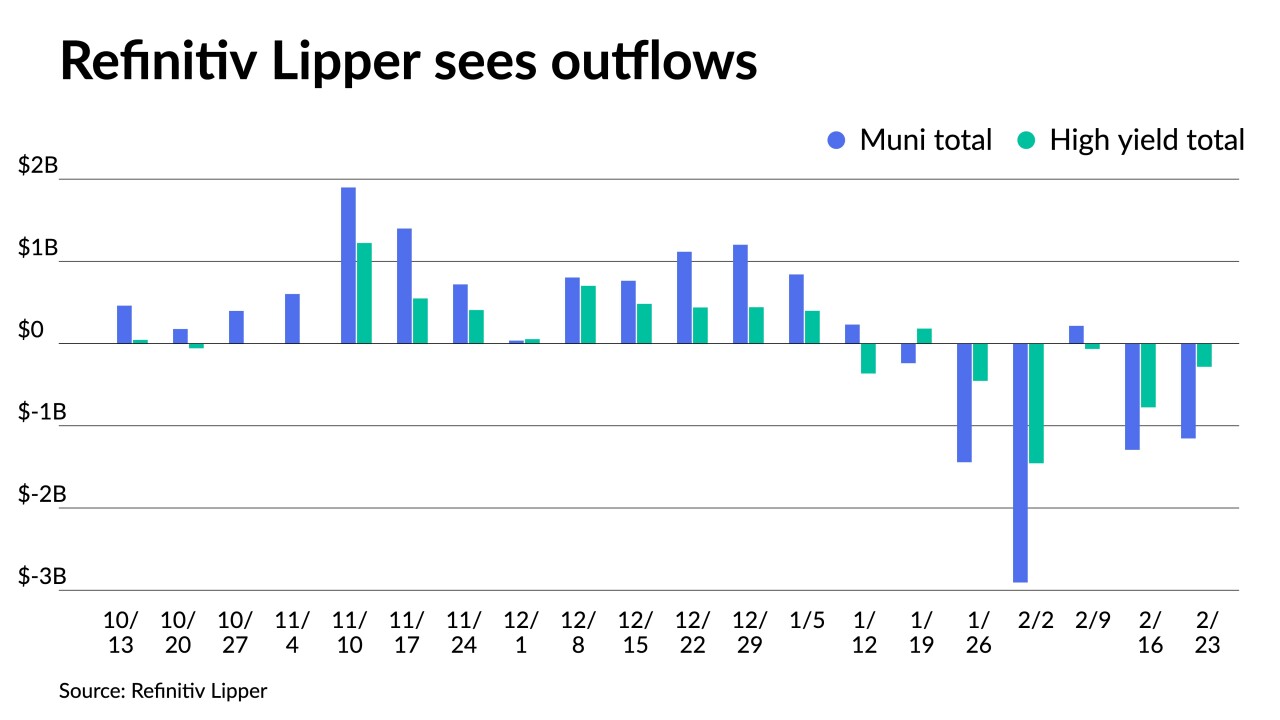

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

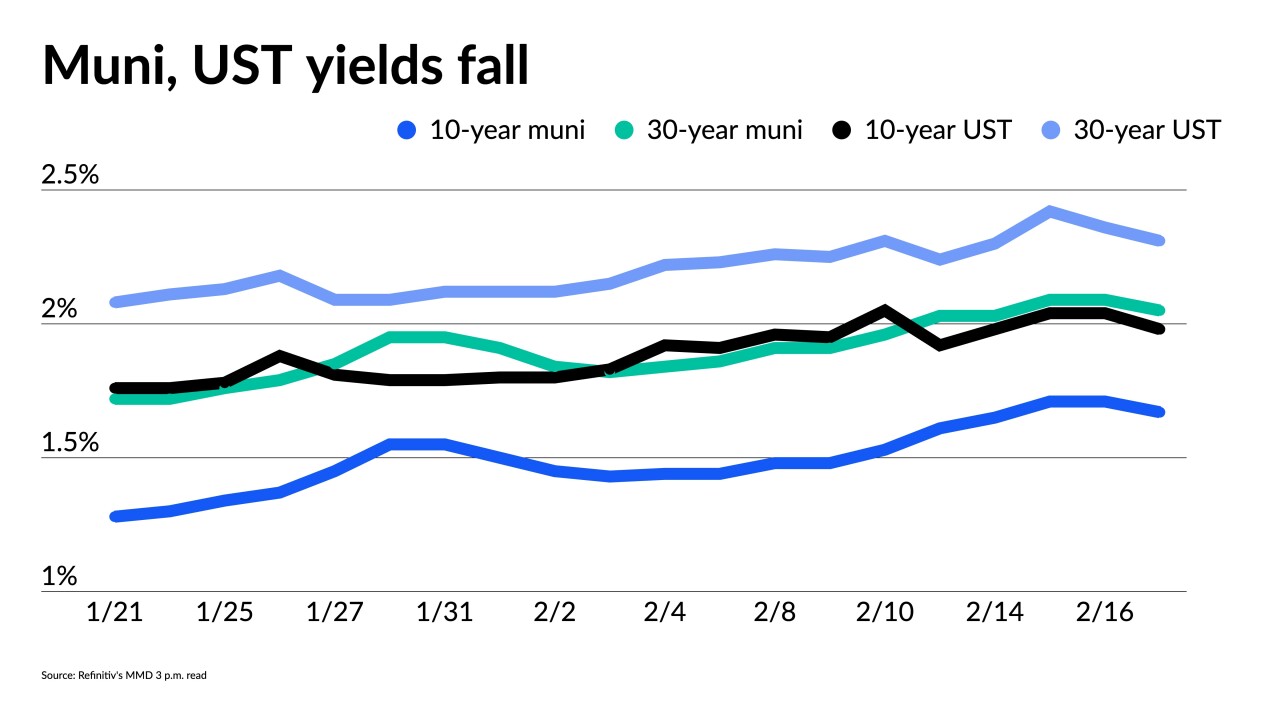

Washington will bring $742 million of general obligation bonds in competitive sales Tuesday, providing guidance for triple-A benchmark yields.

February 7 -

Municipals were stronger again on the day, though, and new-issues were repriced to lower yields.

February 3 -

The UST selloff and rate fears spooked investors in January, but experts predict more opportunity and a stronger tone for munis in the remainder of the first quarter.

February 3 -

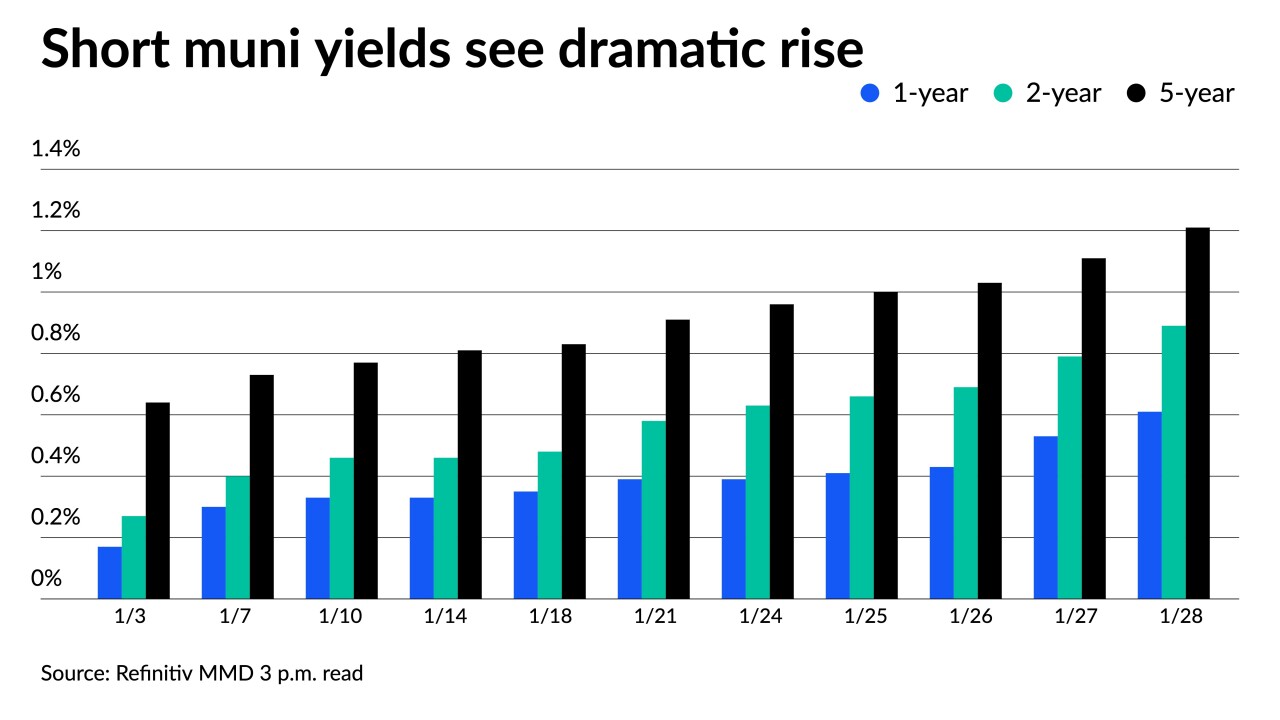

Short-end muni yields have risen more than 30 basis points on some triple-A scales over the past five trading sessions.

January 28 -

Returns are deep in the red with the Bloomberg Municipal Index at negative 1.85%, while high-yield sits at negative 1.81%.

January 27