-

Even though yields have moved to higher ground, some participants say that even cheaper levels are needed to bring about more retail conviction. Muni-to-UST ratios are still rich.

April 20 -

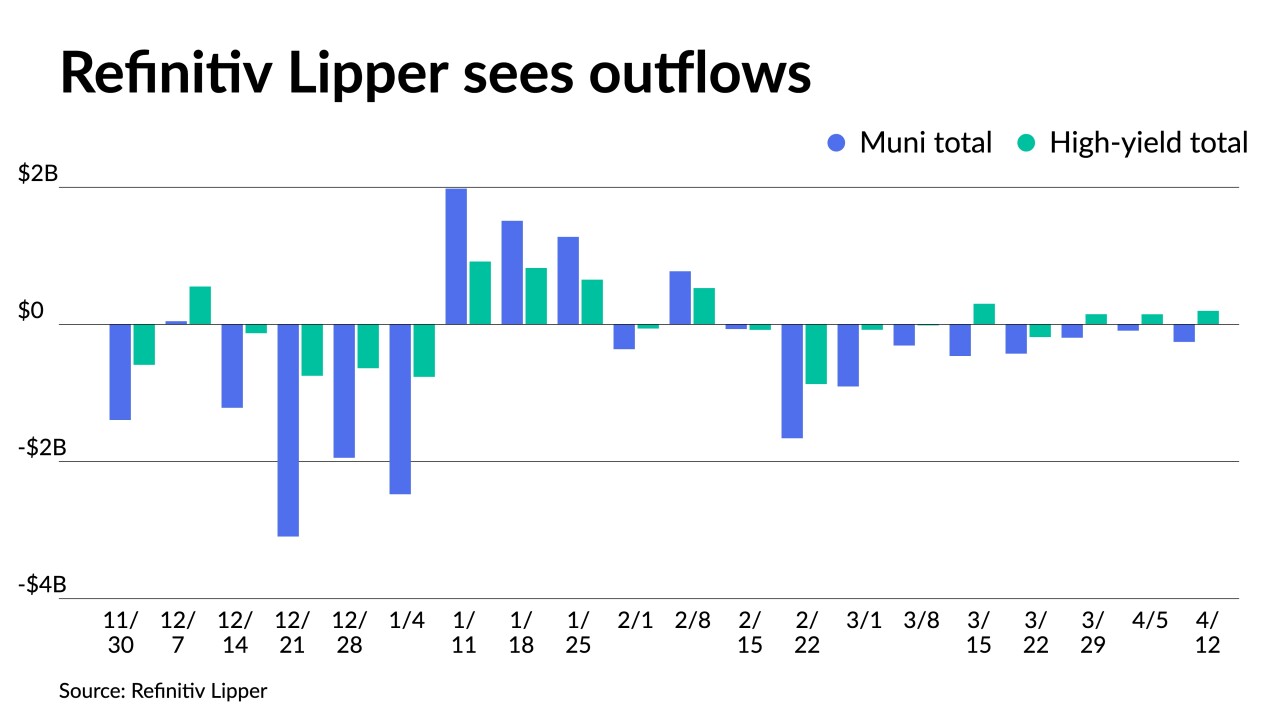

For the week ending Wednesday, outflows intensified as Refinitiv Lipper reported $255.794 million was pulled from municipal bond mutual funds after $91.713 million of outflows the week prior. High-yield saw inflows.

April 13 -

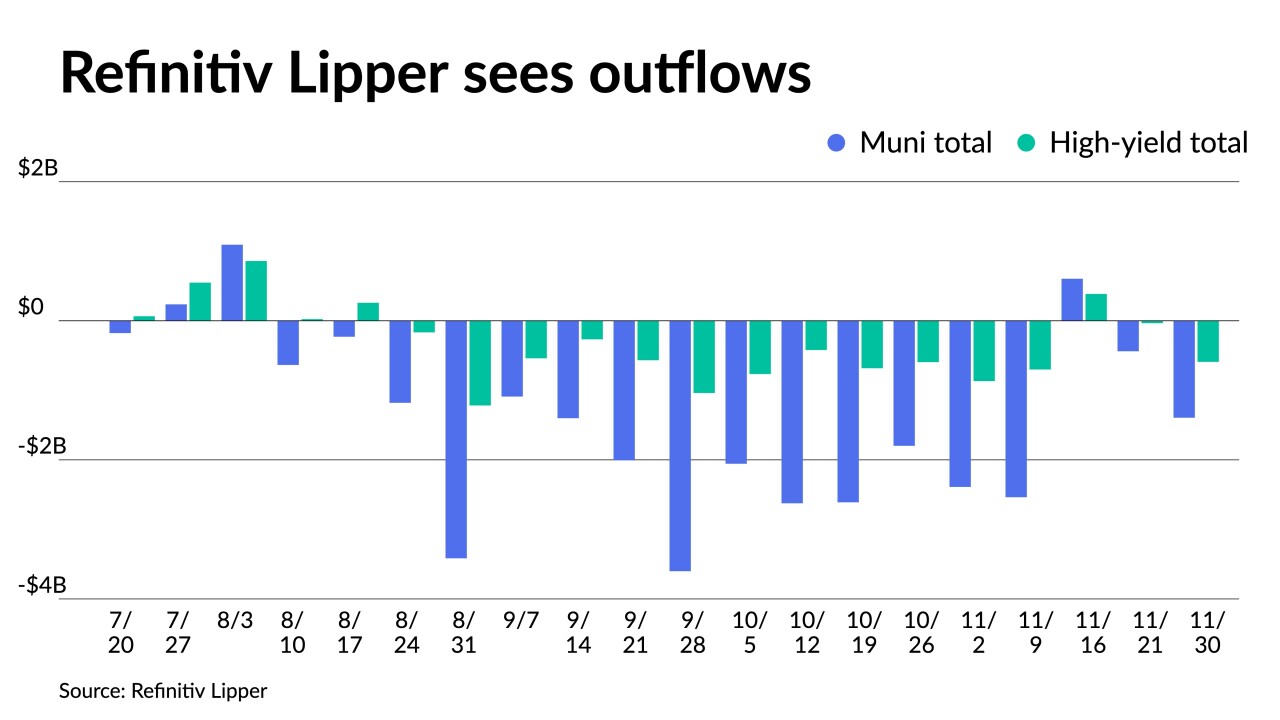

The value of the municipal bond market decreased by 4.3% in the third quarter of 2022, said Pat Luby, a strategist at CreditSights.

December 30 -

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

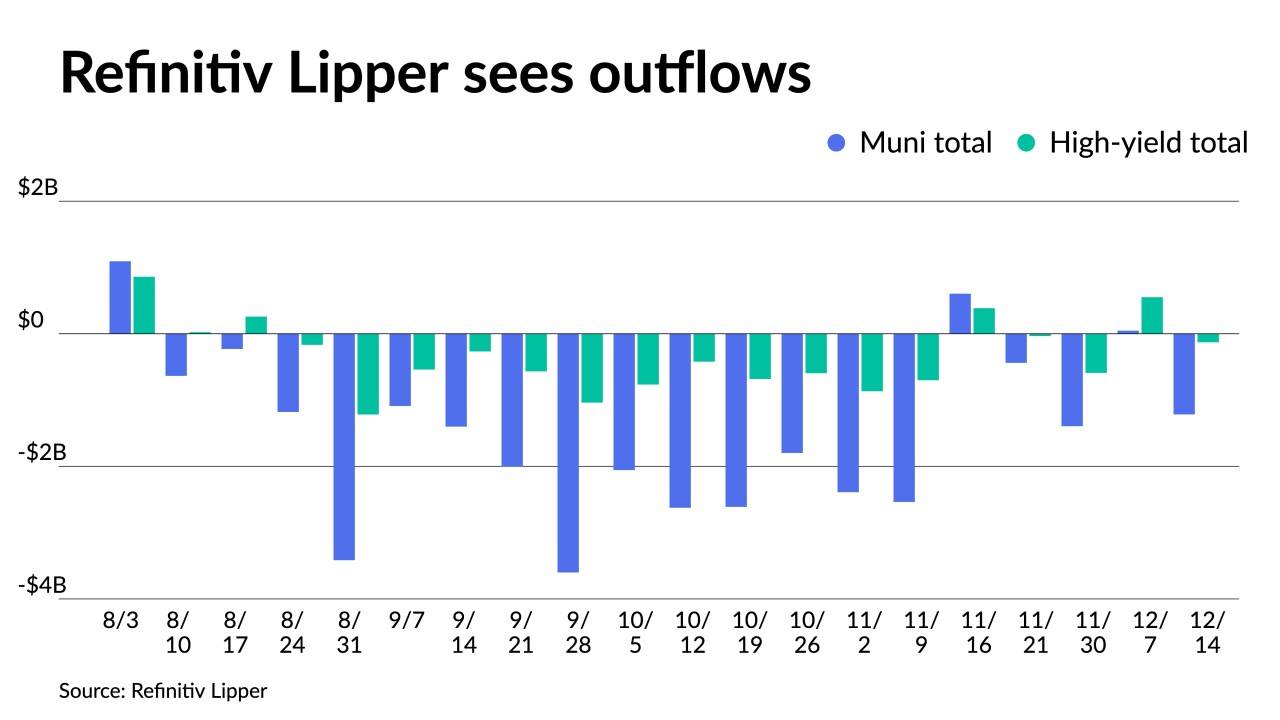

Outflows returned as Refinitiv Lipper reported $1.217 billion was pulled out of municipal bond mutual funds for the week ending Wednesday after $46.912 million of inflows the week prior.

December 15 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

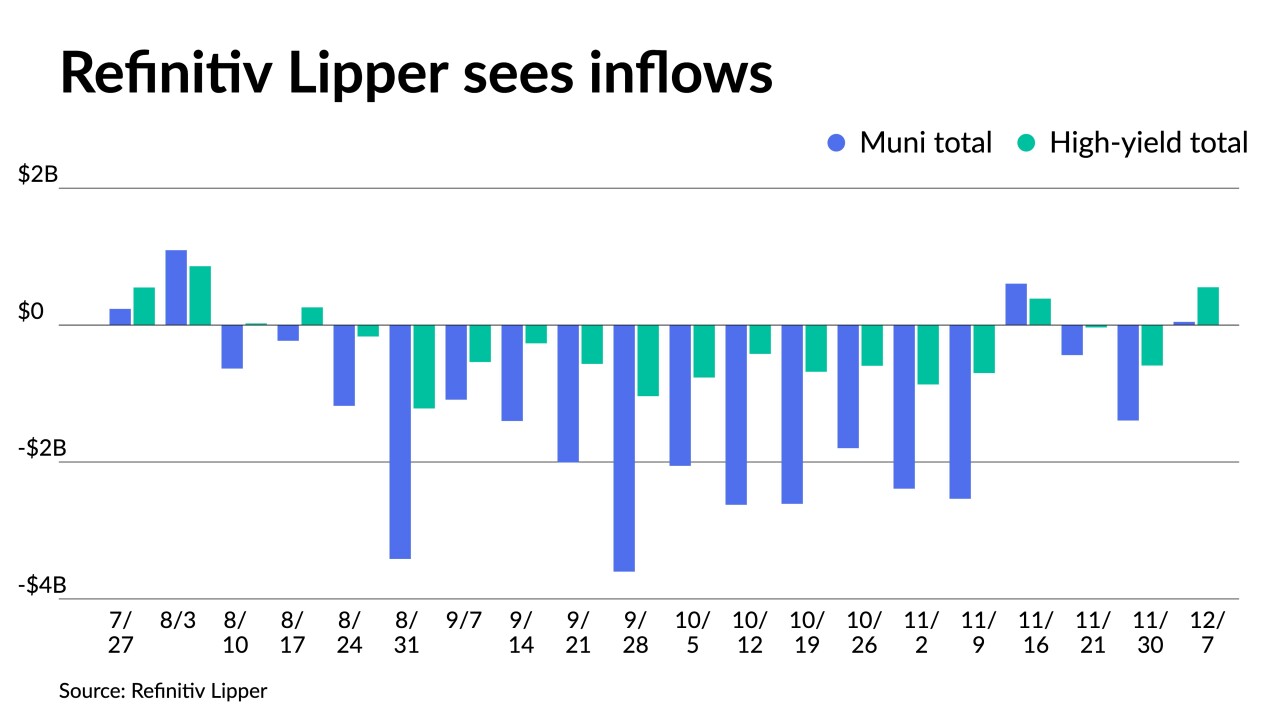

Refinitiv Lipper reported $46.912 million was added to municipal bond mutual funds for the week ending Wednesday after $1.394 billion of outflows the week prior.

December 8 -

"Yield curve inversion deepens and nears a four-decade low which is clearly setting up this economy for a recession that won't be a mild one," OANDA's Edward Moya said.

December 7 -

"Munis are poised to continue this rally into December as we can end 2022 on a high note and close out the worst-performing year on record for munis," said Jason Wong, vice president of municipals at AmeriVet Securities.

December 5 -

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1