-

Data for the second quarter show the face amount of munis outstanding rose 0.4% quarter-over-quarter, or $15.5 billion, to $4.043 trillion.

September 26 -

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20 -

With around 30% of bonds trading near the de minimis threshold, a new study takes a deep dive into how the rule drives illiquidity as mutual funds dump paper that's approaching the threshold.

September 7 -

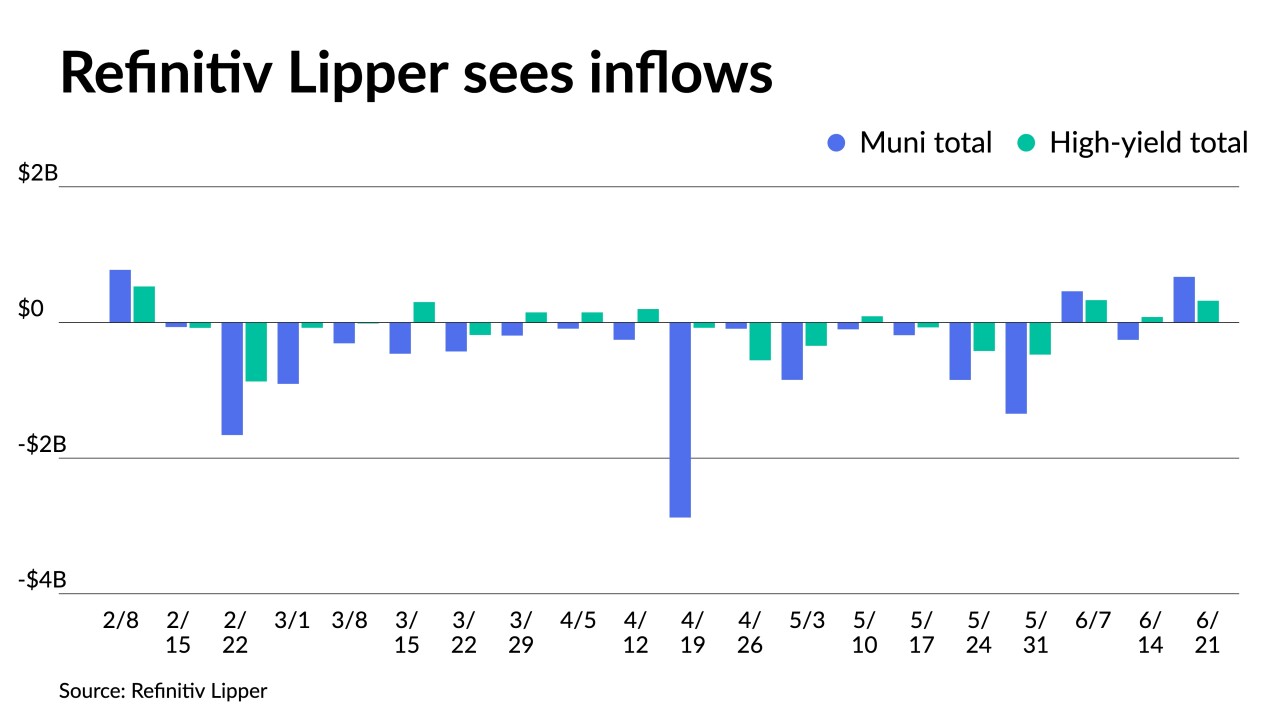

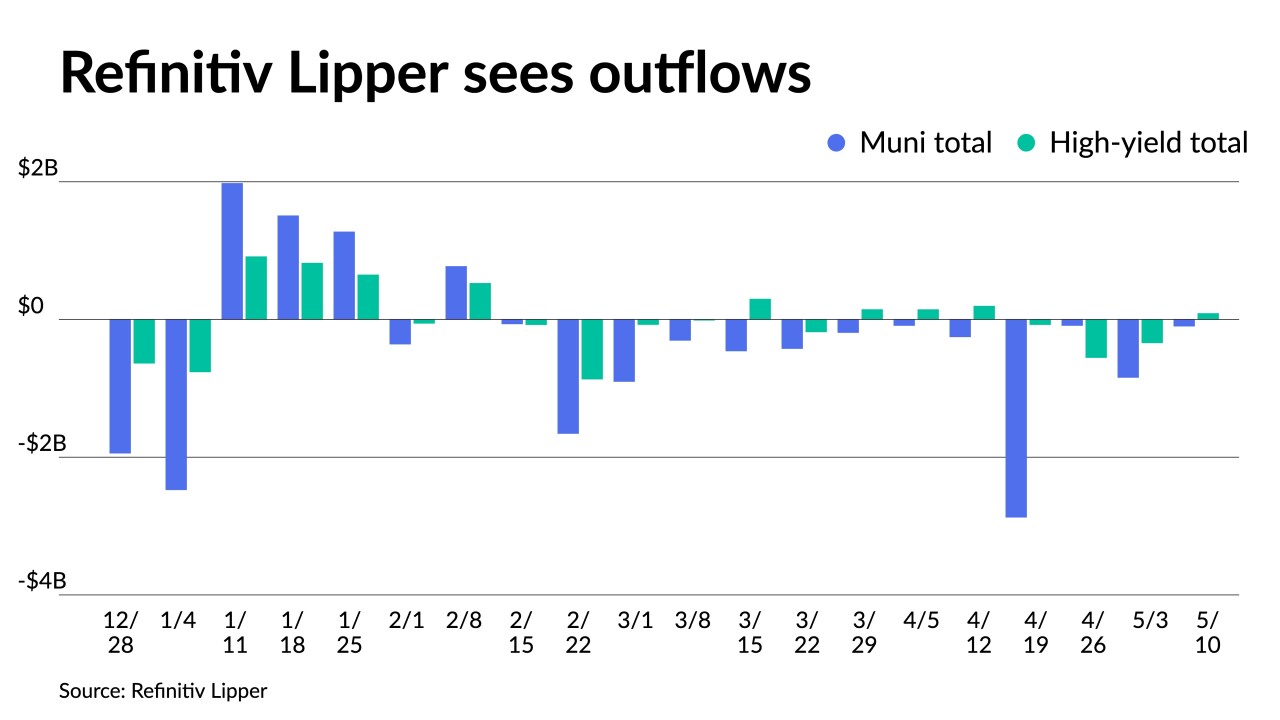

Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week.

August 31 -

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday after $264.046 million of outflows into the funds the previous week.

August 24 -

Continued pressure on the UST market coupled with the end of the summer reinvest may begin to test new issues as investors are able to be more selective.

August 21 -

Refinitiv Lipper reported $264.046 million of outflows from municipal bond mutual funds for the week ending Wednesday after $278.559 million of inflows the previous week.

August 17 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

Municipal bond mutual fund saw outflows return with Refinitiv Lipper reporting investors pulling $989.852 billion from funds for the week ending Wednesday, led by ETFs and long-end funds.

August 3 -

This week kicks off a flip of calendar to the final month of the summer reinvestment season and one of the larger new-issue calendars of the year.

July 31 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper on Thursday reporting investors added $552.219 million to funds for the week ending Wednesday following $1.040 billion of outflows the previous week.

July 27 -

The Investment Company Institute reported investors pulled $136 million from municipal bond mutual funds in the week ending June 28, after $338 million of inflows the previous week.

July 5 -

Municipal bond mutual fund inflows returned as Refinitiv Lipper reported investors added $672.288 million for the week ending Wednesday following $256.532 million of outflows the week prior.

June 22 -

Federal Reserve data shows that retail ownership of municipals rose $58.8 billion, or 3.7% quarter-over-quarter, to $1.67 trillion. Bank ownership fell in the first quarter by $13.3 billion.

June 12 -

Outflows continue as Refinitiv Lipper reported investors pulled $1.345 billion from municipal bond mutual funds for the week ending Wednesday.

June 1 -

"Ultimately, the case for fixed income generally, and munis specifically, is much stronger today than it was a year ago," said Nick Vendetti, municipal bond fund portfolio manager with Allspring Global Investments.

May 22 -

"Steep corrections occurring inside 10 years on the curve reflect an ongoing process to reduce a deep inversion," said Kim Olsan, senior vice president of municipal bond trading.

May 18 -

Outflows were seen again from municipal bond mutual funds, though they lessened this week as Refinitiv Lipper reported $101.664 million was pulled as of Wednesday.

May 11 -

Outflows from municipal bond mutual funds intensified as Refinitiv Lipper reported $846.116 million was pulled from them as of Wednesday after $92.055 million of outflows the week prior.

May 4