-

Muni yields rose up to eight basis points, depending on the scale, while UST yields rose up to six basis points at 30 years.

January 18 -

The December consumer price index came in slightly stronger than expected, perhaps eliminating the possibility of a rate cut in March, analysts said.

January 11 -

The muni market enters this year from a relative position of strength, said Jeff Lipton, managing director and head of municipal research and strategy at Oppenheimer.

January 4 -

This year has favorable potential for 1Q activity, noting an unusually large scheduled reinvestment potential in January and February, including $19 billion of maturities plus calls in January and $24.9 billion in February, noted MMA's Matt Fabian.

January 3 -

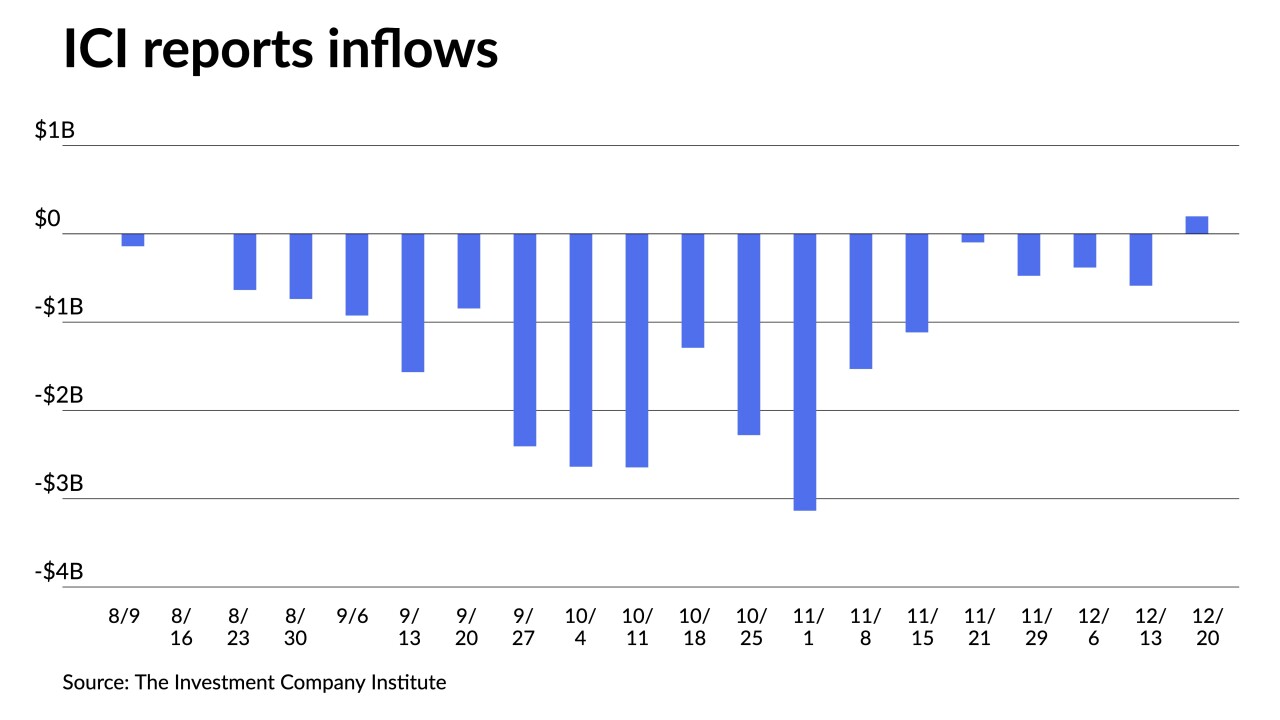

LSEG Lipper reported Thursday that investors pulled $463.7 million from muni mutual funds for the week ending Wednesday after inflows of $147 million the week prior.

December 28 -

Late-month volumes are "waning as it appears the year's tax-loss harvesting was accomplished leading up to the holiday period," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 27 -

The large drop in yields since the end of October can be reflected in sentiment that investors expect a potentially dovish Fed next year, and that a soft landing narrative gives them "permission to finally purchase the bonds they've been admiring," said MMA's Matt Fabian.

November 21 -

"The combination of higher yields and this week's heavier new-issue calendar will attract attention from income-focused individual investors as well as from institutional investors who are underweight munis," said CreditSights strategists Pat Luby and Sam Berzok.

October 16 -

Minutes from the September Federal Open Market Committee meeting were "not much of a market mover" Wednesday, said Scott Anderson, chief U.S. economist and managing director at BMO Economics.

October 11 -

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28 -

Data for the second quarter show the face amount of munis outstanding rose 0.4% quarter-over-quarter, or $15.5 billion, to $4.043 trillion.

September 26 -

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20 -

With around 30% of bonds trading near the de minimis threshold, a new study takes a deep dive into how the rule drives illiquidity as mutual funds dump paper that's approaching the threshold.

September 7 -

Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week.

August 31 -

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday after $264.046 million of outflows into the funds the previous week.

August 24 -

Continued pressure on the UST market coupled with the end of the summer reinvest may begin to test new issues as investors are able to be more selective.

August 21 -

Refinitiv Lipper reported $264.046 million of outflows from municipal bond mutual funds for the week ending Wednesday after $278.559 million of inflows the previous week.

August 17 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

Municipal bond mutual fund saw outflows return with Refinitiv Lipper reporting investors pulling $989.852 billion from funds for the week ending Wednesday, led by ETFs and long-end funds.

August 3