-

The market is being led more by supply and demand than ratios or even rates. As ratios sit at extremely tight levels, there are buyers engaging at these levels, but large amounts of cash continue to sit on the sidelines.

March 7 -

This decision will accelerate foreign buyers' reduced presence in the muni market, said Vikram Rai, head of municipal markets strategy at Wells Fargo.

February 16 -

Municipal bond mutual funds saw the second week of outflows, with LSEG Lipper reporting $142.2 million of outflows for the week ending Wednesday. High-yield funds saw inflows.

February 15 -

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14 -

Municipals were steady to improved in spots in secondary trading as another day of sizable new-issues were well-received in the primary market.

February 8 -

The primary saw strong demand with the Triborough Bridge and Tunnel Authority doubling the size of its deal to $1.6 billion.

February 1 -

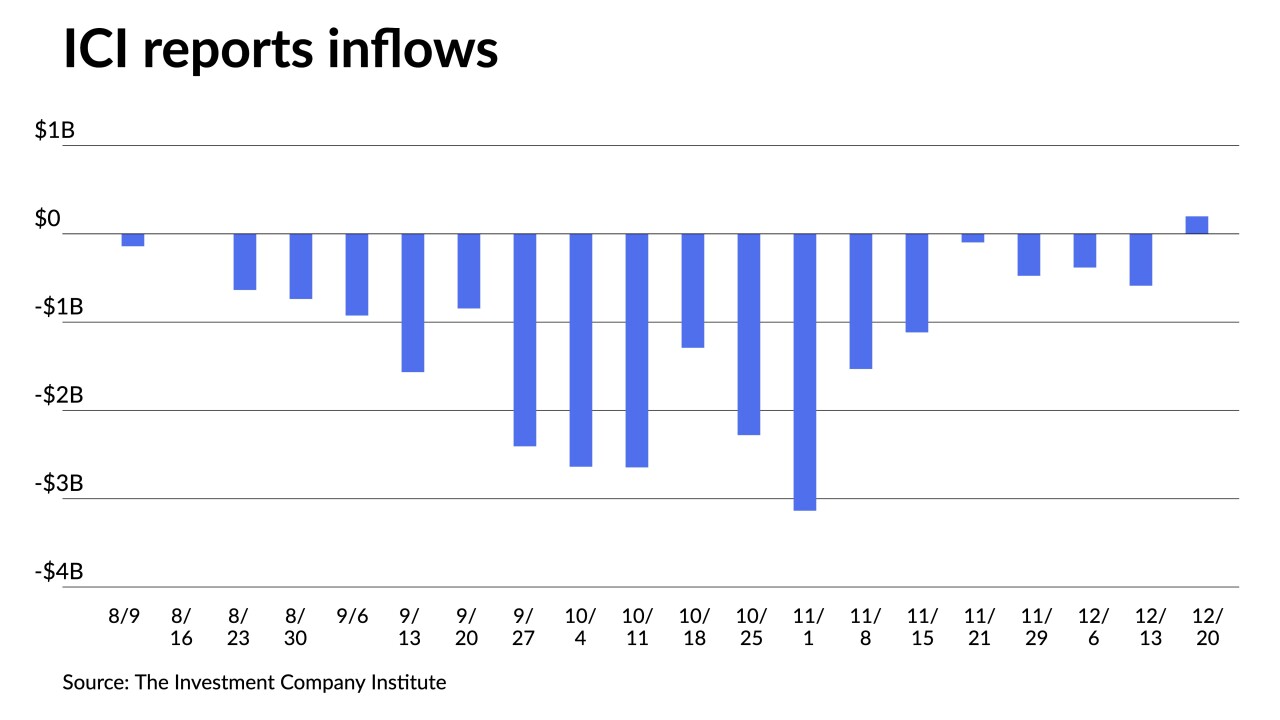

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

LSEG Lipper reported Thursday that investors added $210.6 million to municipal bond mutual funds for the week ending Wednesday — the third consecutive week — after inflows of $898 million the week prior.

January 25 -

Despite fixed-income seeing losses this month, Jeff Lipton, managing director of credit research at Oppenheimer, believes "a performance sea change is nearing."

January 24 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

Muni yields rose up to eight basis points, depending on the scale, while UST yields rose up to six basis points at 30 years.

January 18 -

The December consumer price index came in slightly stronger than expected, perhaps eliminating the possibility of a rate cut in March, analysts said.

January 11 -

The muni market enters this year from a relative position of strength, said Jeff Lipton, managing director and head of municipal research and strategy at Oppenheimer.

January 4 -

This year has favorable potential for 1Q activity, noting an unusually large scheduled reinvestment potential in January and February, including $19 billion of maturities plus calls in January and $24.9 billion in February, noted MMA's Matt Fabian.

January 3 -

LSEG Lipper reported Thursday that investors pulled $463.7 million from muni mutual funds for the week ending Wednesday after inflows of $147 million the week prior.

December 28 -

Late-month volumes are "waning as it appears the year's tax-loss harvesting was accomplished leading up to the holiday period," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 27 -

The large drop in yields since the end of October can be reflected in sentiment that investors expect a potentially dovish Fed next year, and that a soft landing narrative gives them "permission to finally purchase the bonds they've been admiring," said MMA's Matt Fabian.

November 21 -

"The combination of higher yields and this week's heavier new-issue calendar will attract attention from income-focused individual investors as well as from institutional investors who are underweight munis," said CreditSights strategists Pat Luby and Sam Berzok.

October 16 -

Minutes from the September Federal Open Market Committee meeting were "not much of a market mover" Wednesday, said Scott Anderson, chief U.S. economist and managing director at BMO Economics.

October 11 -

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28