-

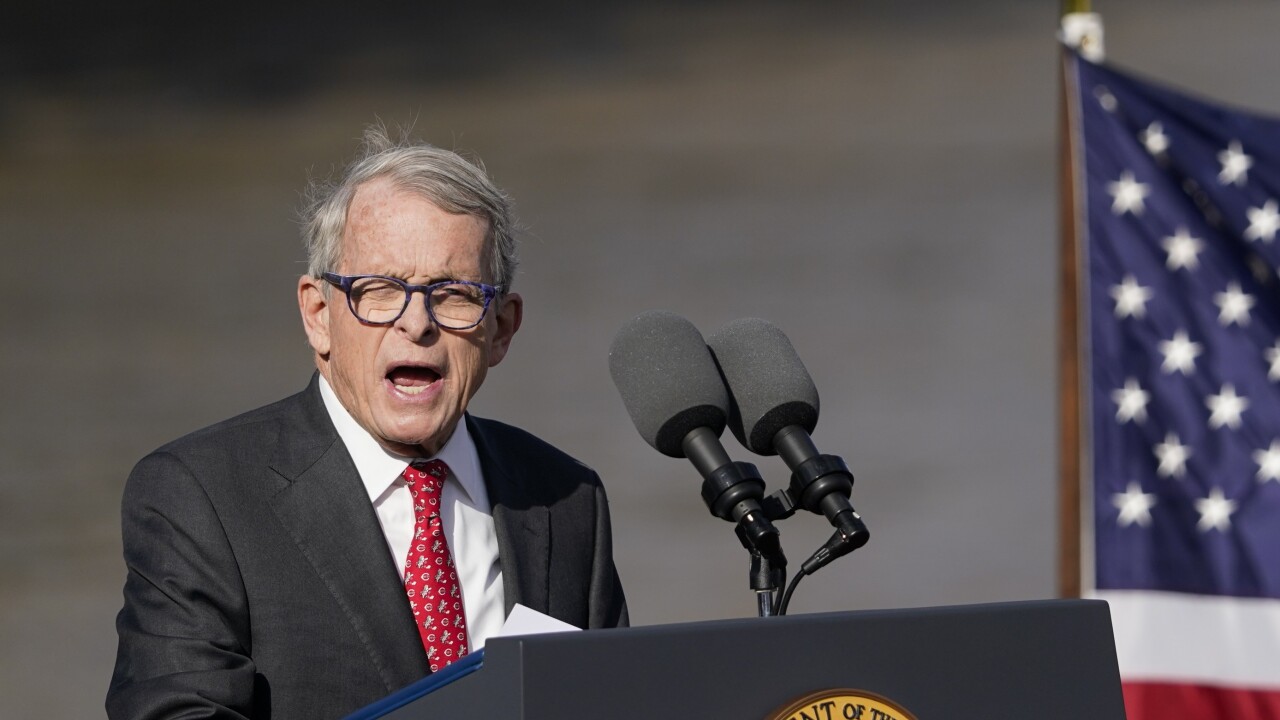

When Ohio Gov. Mike DeWine signed property tax reform bills, there was hope in Columbus it would appease voters who backed a push to abolish property taxes.

December 31 -

A federal judge set oral arguments for Jan. 28 in the legal fight over the Metropolitan Transportation Authority's congestion pricing tolls in Manhattan.

December 29 -

Enrollment began to drop in the middle of the school year as rumors about immigration raids circulated through Fresno, Aspen Public Schools told bond investors.

December 24 -

State tax policy is playing a role in the location of data centers which have turned into a lightning rod attracting debt financing, local opposition, and federal involvement.

December 23 -

The Kansas City Chiefs will leave Missouri for Kansas, where sales tax and revenue bonds will help finance a $3 billion domed stadium expected to open in 2031.

December 23 -

Credit pressures are expected to persist for municipal bond issuers facing water scarcity and increasing costs for projects to produce new supply.

December 23 -

The Governmental Accounting Standards Board has issued an end of the year Statement which addresses inconsistencies in the financial reporting and definition of an accounting wormhole.

December 22 -

The dramatic downgrade projects a default by January 2027 on bonds issued to finance the Miami-to-Orlando passenger train service.

December 19 -

A California Supreme Court ruling could eliminate the need for validation lawsuits before issuing pension obligation bonds, the winning attorneys say.

December 19 -

In a case stemming from a PACE bond authorization, the majority said language in Florida law giving finality to bond validations must be respected.

December 19 -

-

The Equitable School Revolving Fund, which has more deals in the works, has maintained its strong credit profile even as the sector has experienced headwinds.

December 19 -

The city's rejection of the petition, which aims to stall or submit the largely bond-financed convention center project to voters, is being challenged in court.

December 18 -

The House Finance Committee is making good on a promise to address housing affordability by advancing a bill that increases the public welfare investment cap to 20% from 15%.

December 18 -

Two student housing developments in Orlando and Tampa, Florida, financed by speculative-grade bonds in 2024, have shown signs of strain.

December 18 -

A looming government shutdown marks an uncertain future for the country as economists and muni leaders point to the positive effects of stubborn inflation on state tax revenues.

December 17 -

The Ohio State University went to market Tuesday with a $560 million deal to refund taxable Build America Bonds into tax-exempt debt.

December 17 -

With large language models parsing EMMA filings and investor relations sites, municipal issuers must modernize their disclosure so both humans and algorithms can accurately understand their credit story and avoid unintended red flags.

December 16

-

"The steps that would be necessary to restore a sound fiscal profile are becoming increasingly drastic," the rating agency said in downgrading Jersey City.

December 15 -

A review Moody's launched in September ended with rating downgrades and negative outlooks for the city's outstanding general obligation and revenue bonds.

December 12