-

The market will look for clues about monetary policy when Fed Chair Jerome Powell testifies before Congressional panels this week.

July 8 -

Consumers see inflation rising 2.7% in the next three years and expect the Fed to cut rates, according to the Federal Reserve Bank of New York’s June Survey of Consumer Expectations.

July 8 -

The Federal Reserve reiterated its openness to cutting interest rates to extend the longest U.S. economic expansion on record while noting that the pace of growth had slowed in the second quarter of 2019.

July 5 -

The Federal Reserve should reduce interest rates even though the economy is strong and the latest payrolls report was positive, said Larry Kudlow.

July 5 -

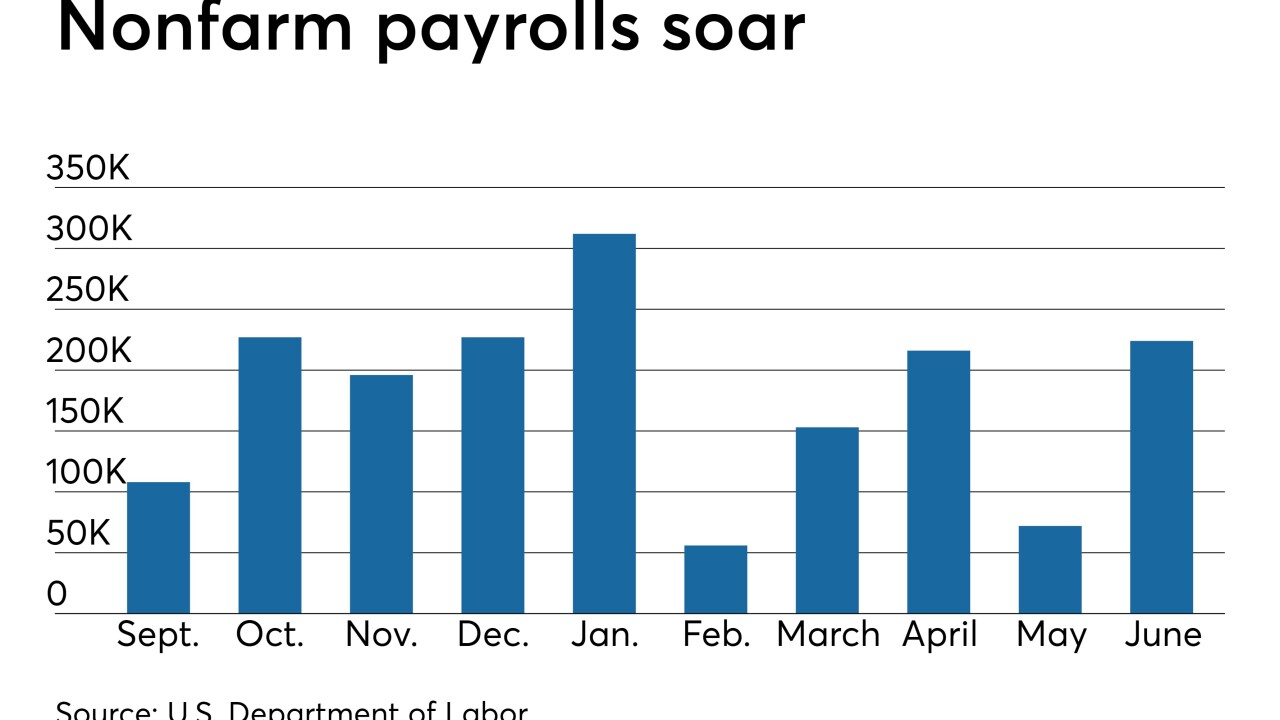

Nonfarm payrolls rose 224,000 in June, more than expected, throwing cold water on expectation that the Federal Open Market Committee will cut rates at its July meeting.

July 5 -

After a string of proposed candidates who didn’t pan out, Trump picks new Fed nominees.

July 3 -

Christopher Waller is a conventional choice drawn from within the Fed’s own ranks. Judy Shelton has spent decades outside mainstream economics. But both are expected to echo the president’s call for lowering interest rates.

July 3 -

The dot plot showed the Federal Open Market Committee evenly split between cutting and holding rates, but it's not clear whose dots are whose.

July 2 -

The U.S. and China are again attempting to work out trade differences, and manufacturing numbers show somewhat weaker expansion. Will this be enough to spur the Federal Reserve to lower interest rates later this month?

July 1 -

Data were mixed from Commerce Department reports on personal income and spending and the University of Michigan's indexes.

June 28