-

While the latest read of manufacturing from the New York region suggests slowing, with COVID vaccines starting to be rolled out, the future index gained.

December 15 -

The data continue to offer a mixed picture, with manufacturing expanding, services hurting, and while construction spending rose more than expected, it followed a downward revision to the previous month's number.

December 1 -

Pending home sales unexpectedly declined in October, the second consecutive month they dropped.

November 30 -

The consumer confidence index suggested expectations have slipped, and the Richmond Fed's services survey also offered a dim view ahead.

November 24 -

The Federal Reserve’s changed policy framework is “an evolution, not a revolution,” according to Vice Chair Richard Clarida.

November 16 -

No one expects any change to the fed funds rate target when the Federal Open Market Committee meets on Wednesday and Thursday, but that doesn’t mean there’s nothing to watch for.

November 2 -

Personal income increased 0.9% in September after a 2.5% decline in August, the Commerce Department reported Friday, while personal consumption grew 1.2% after a 0.7% gain in August.

October 30 -

Consumers cut back on purchasing plans, suggesting they see a tough fourth quarter, economists said.

October 27 -

The economic news was mixed again Monday, with home sales unexpectedly dipping, while two reads of manufacturing showed expansion continued, but one suggested a slower rate of growth.

October 26 -

Jobless claims fell to below 800,000, existing home sales soared, leading indicators rose more than expected and the Kansas City Fed manufacturing index also climbed in the latest reading.

October 22 -

The economic news Friday was mostly positive, with consumers spending on clothes, cars and eating out, while manufacturing continues to suffer.

October 16 -

Initial jobless claims rose in the latest week, while the Empire State manufacturing index slipped, and the Philadelphia Fed's rose.

October 15 -

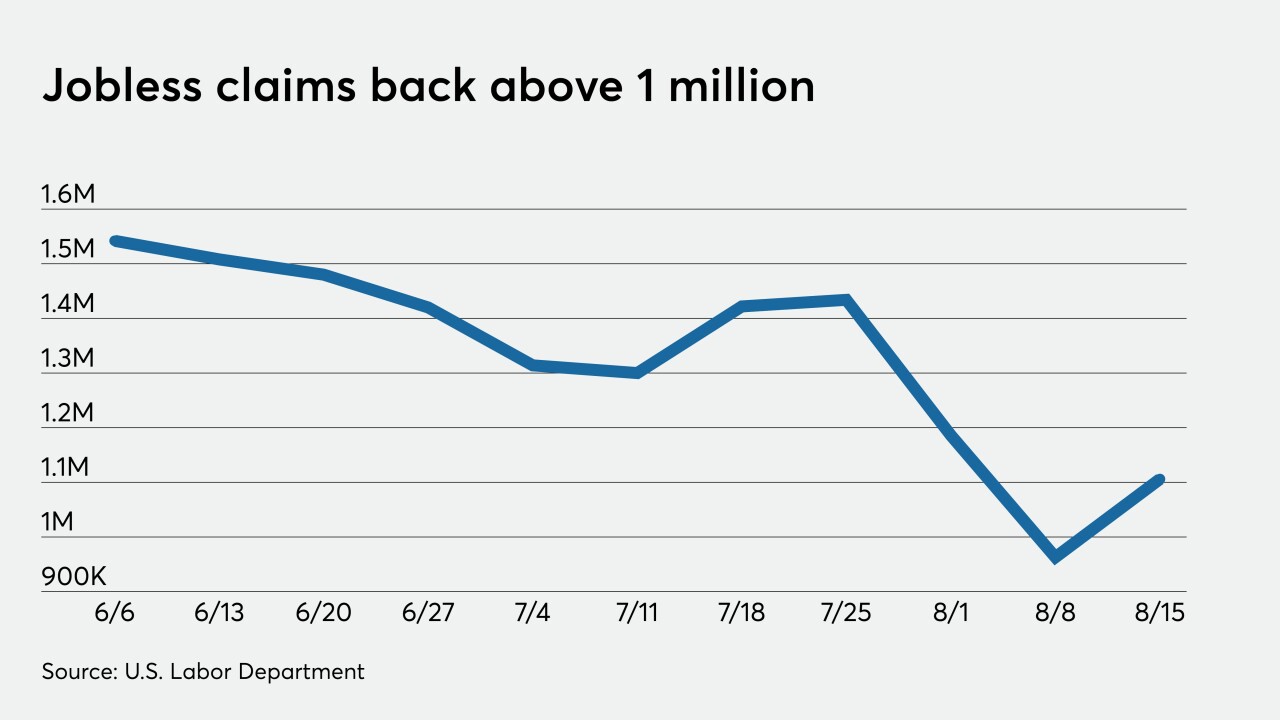

Months after the pandemic caused a surge in initial claims, the numbers remain elevated.

October 1 -

The end-of-month economic data was positive, with even GDP coming in above expectations.

September 30 -

The housing market continues to lead all sectors in recovery, althoough a manufacturing and two services surveys also showed signs of recovery.

September 22 -

With a need to replenish inventories, experts expect the manufacturing recovery to continue.

September 15 -

The pace of recovery will not only be fragmented, but will take a lot longer than originally thought, according to Raphael Bostic, Federal Reserve Bank of Atlanta president.

August 31 -

The big gain suggests the manufacturing sector will be a positive for economic growth in the near term.

August 26 -

Consumer confidence sputtered even as new home sales surged, highlighting an uneven economic recovery.

August 25 -

Jobless claims grew, manufacturing expansion weakened and leading indicators grew less than last month.

August 20