-

A broker-dealer firm built around military veterans achieved a milestone with its largest deal as bookrunner.

November 8 -

The bipartisan infrastructure bill passed over the weekend, offering munis an indirect win by providing an influx of funds to state and local authorities.

November 8 -

The state could see nearly $45 billion, the lion's share for highways and public transportation.

November 8 -

Dallas Area Rapid Transit is enjoying a lift in tax revenues amid a drop in ridership during the pandemic.

November 8 -

Two major pieces of President Joe Biden's domestic agenda, which carry implications for the municipal bond market, advanced in the House Friday.

November 6 -

The long end of the municipal curve rallied under a backdrop of stronger-than-expected October jobs data and upward revesions to the prior two months ahead of the arrival of $9.6 billion next week.

November 5 -

While this hurdle has apparently been cleared, the road to approval for the Plan of Adjustment remains bumpy.

November 5 -

Moody's joined the other three rating agencies in returning O'Hare's outlook to stable as Chicago plans to tap an up to $2.3 billion new money and refunding authorization next year.

November 5 -

A first-time home buyer program would be fueled by a huge bond component, if Sen. Robert Hertzberg gets lawmakers to put it on the ballot and voters approve it.

November 5 -

The county said the increase in shipping volume at the port didn’t cause any congestion for boats or delays in product shipments.

November 5 -

CDFA is advocating for a holistic solution from Congress to address private activity bond challenges.

November 5 -

The board's 8th debt restructuring plan improves funding for a pension trust as well as eliminating cuts to benefits for current retirees, just ahead of the confirmation hearing that begins Monday.

November 5 -

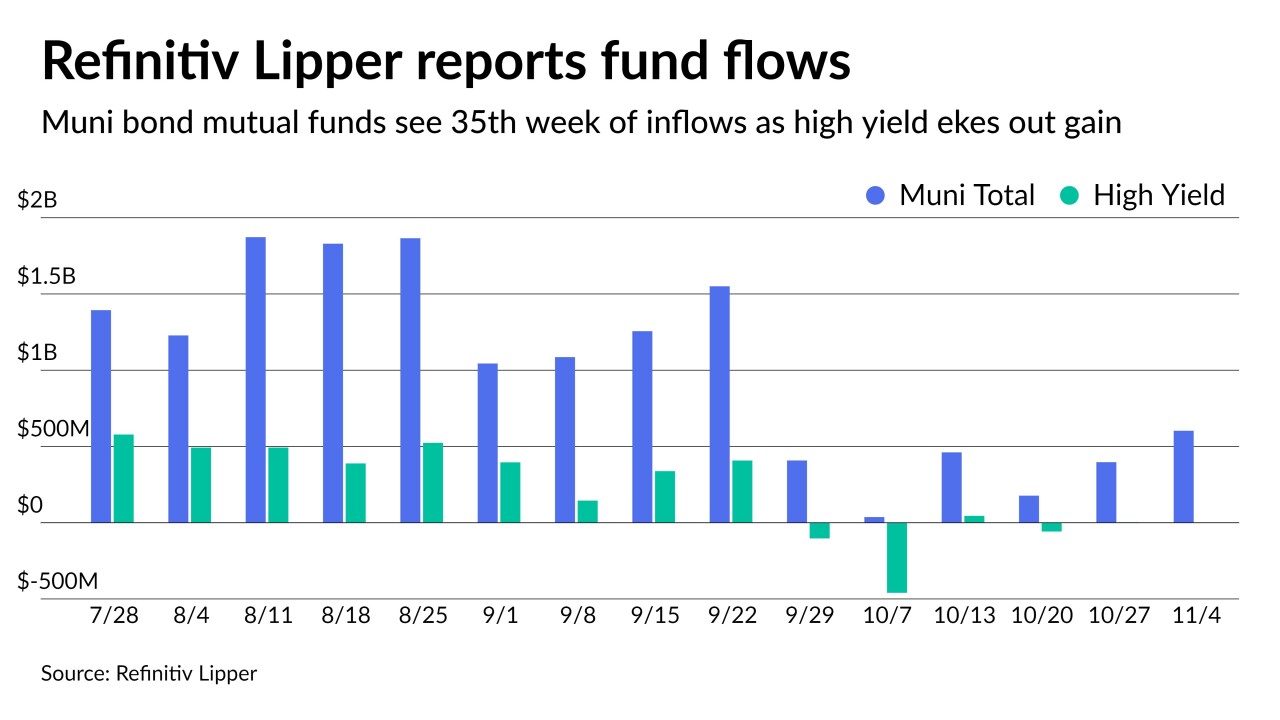

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

November 4 -

The municipal bond market is closely watching proposals from the House and the Senate to overhaul the SALT federal deduction cap.

November 4 -

California faces a $117 billion highway repair backlog and the highest gas tax in the country. The question is whether the fuel-tax funded SB 1 is doing enough.

November 4 -

While the economy is stronger than a year ago, it is still down from two years ago.

November 3 -

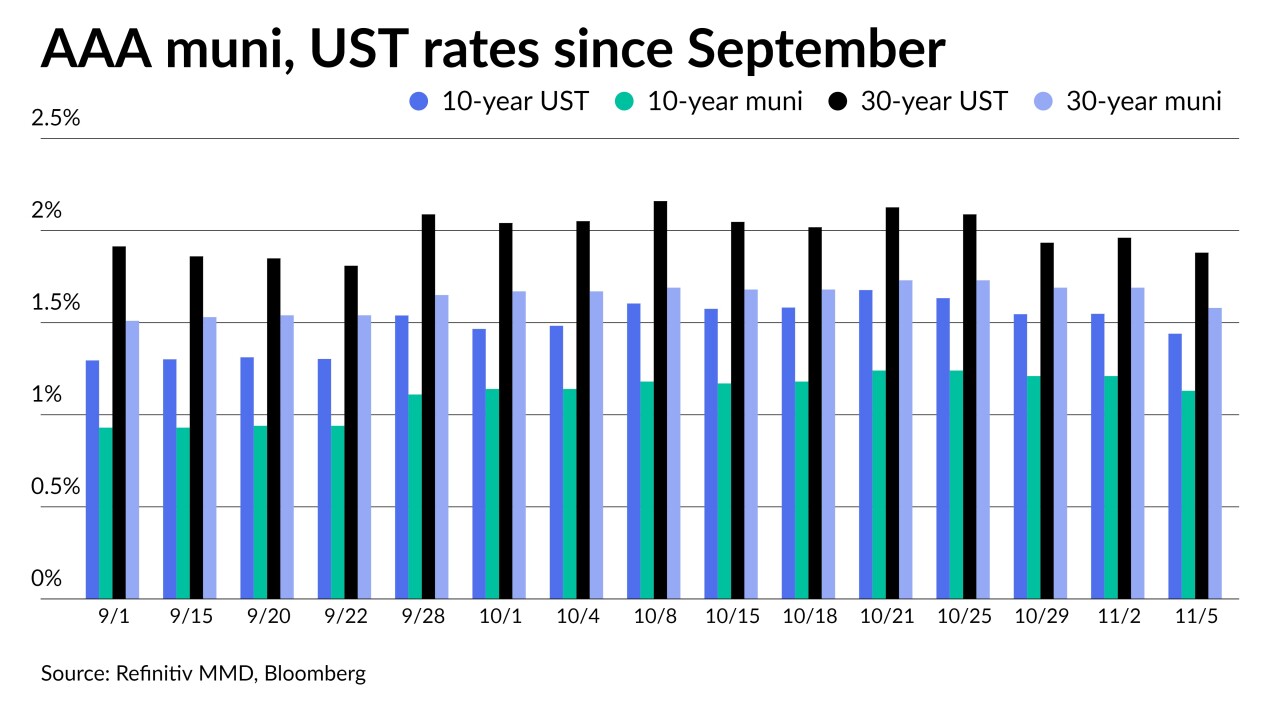

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

November 3 -

The biggest bond measure in the nation Tuesday appears to have passed narrowly, but Texas voters took a negative view of several big bond proposals.

November 3 -

A study by the Reason Foundation attempts to solve the problem of paying both tolls and fuel taxes on the same highway and offers a blueprint for how states can allocate toll revenue.

November 3 -

Puerto Rico bankruptcy judge approved the board’s plan to notify parties of pension limitations, a key to allowing the Plan of Adjustment to move forward.

November 3