-

The number of municipal bond delinquencies declined in the third quarter, despite some dramatic outliers that Moody's Investors Service characterized as idiosyncratic in a report released Monday.

October 31 -

While the FOMC statement will likely have very few changes, the post-minutes release press conference will be the wildcard.

October 31 -

The deal has new-money and refunding components and is expected to hit the market in a negotiated sale the week of Nov. 13.

October 31 -

The data indicates that 2023 could be "the potential start of a long-feared trend toward more higher ed impairments and, possibly, defaults," MMA's weekly Outlook report said.

October 31 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

The rating agency cited ongoing positive financial and enplanement trends at the airport, which is planning a refunding.

October 31 -

The whistleblower who brought the case, Minnesota-based municipal advisor Johan Rosenberg, will receive $14.4 million under the deal.

October 31 -

The relief means little for traditional municipal issuers but will have an effect on some conduit borrowers and issuers "adjacent" to the municipal market.

October 31 -

Bond Buyer Senior Reporter Keeley Webster shares an interview with California Treasurer Fiona Ma on her run for lieutenant governor as a prelude to a fireside chat Wells Fargo Director Julia Kim conducted with the state treasurer at The Bond Buyer's California Public Finance conference.

October 31 -

The board askeds the judge to dismiss objections that claim its plan of adjustment is unconfirmable.

October 30 -

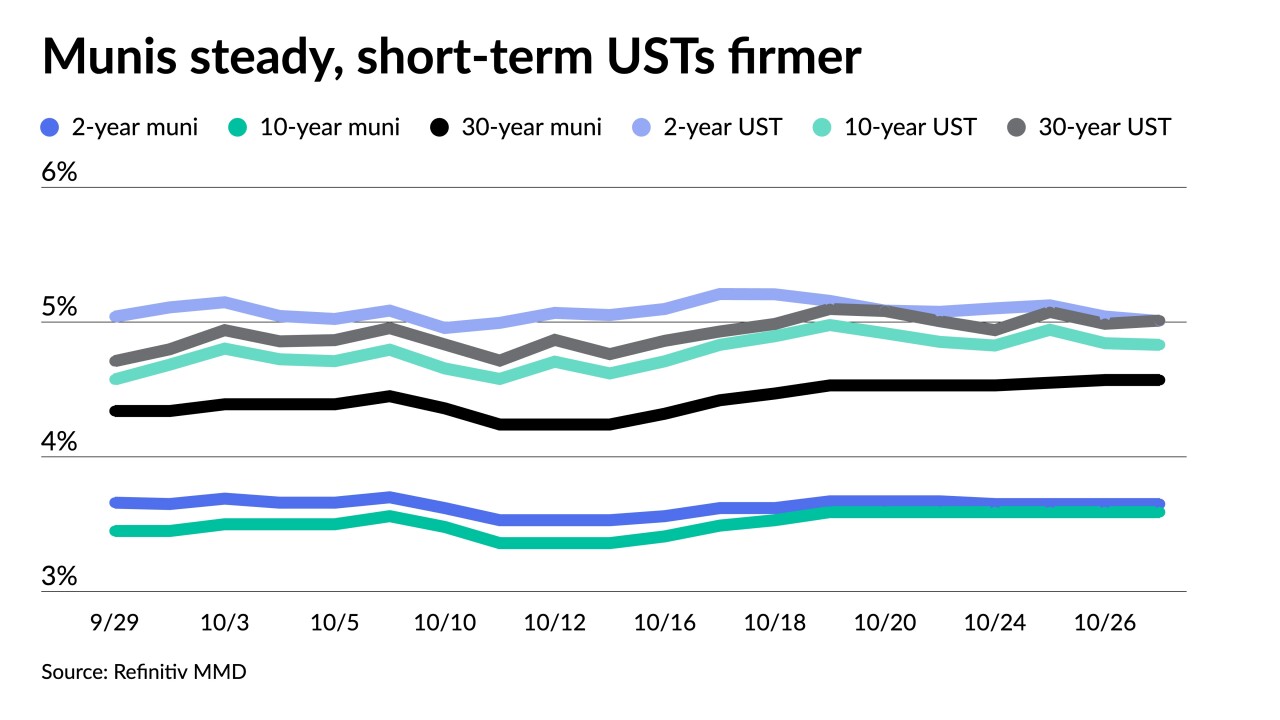

Another month of muni losses "may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers," Birch Creek Capital said in a weekly report.

October 30 -

The application criteria for the grant programs handcuffs $5.5 billion in transportation spending to progressive priorities," said Texas GOP Sen. Ted Cruz.

October 30 -

Public schools account for most of the $28.48 billion of bonds on Texas ballots Nov. 7.

October 30 -

This could be the first time the bond market has posted three consecutive negative total return years, according to John Hancock Investment Management Co-Chief Investment Strategist Matt Miskin.

October 30 -

States use tax proceeds in a way that appeals to voters because recreational marijuana is often legalized through a referendum process.

October 30 -

Gov. Kathy Hochul this week signed into law a trio of bills passed by New York's Legislature leveraging state resources to accelerate affordable housing in New York City.

October 27 -

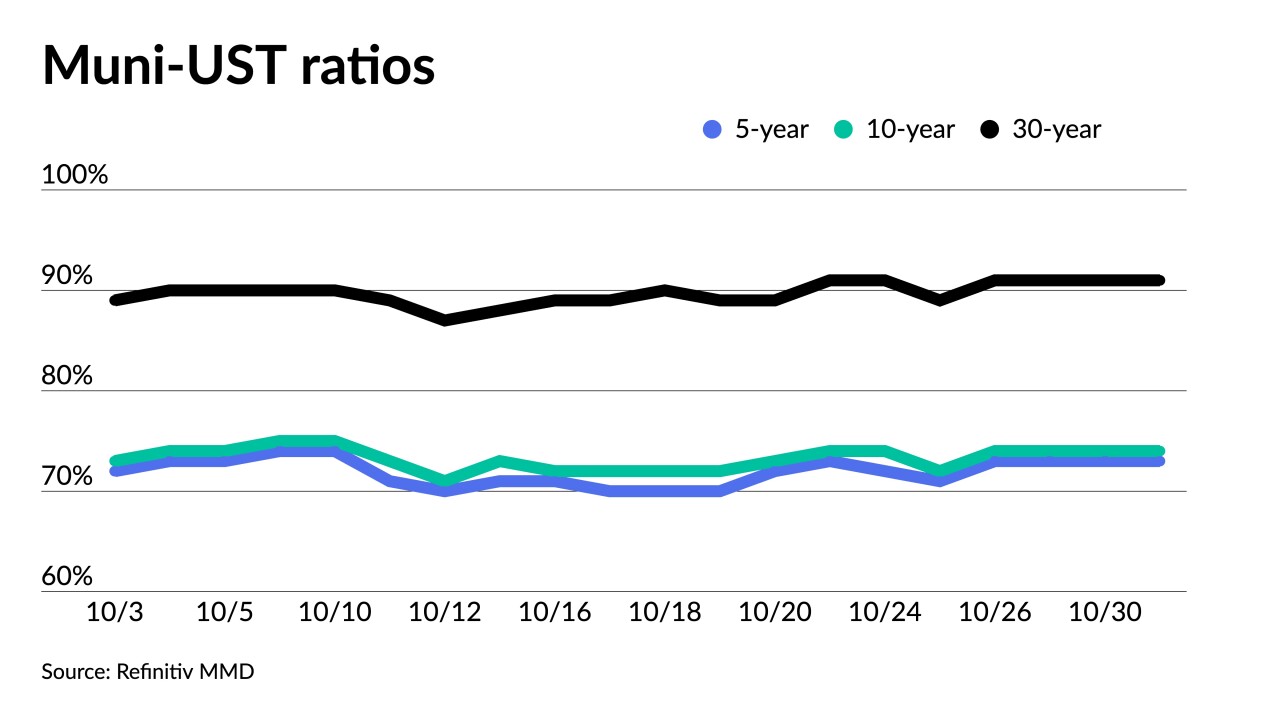

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

The Biden administration announces new emphasis on transit-oriented development.

October 27 -

The tool will deliver users historical deal-based spreads to help in the new-issue market as well as find potential refunding opportunities, said SOLVE's Gregg Bienstock, senior vice president and group head of municipal markets.

October 27 -

The Grand River Dam Authority, the state's largest public power utility, is expected to start issuing the debt later this year.

October 27