-

Local rainfall standards, which affect the design of everything from roads to bridges and stormwater systems, offer a clue whether a city or state is taking infrastructure resilience seriously. Outdated standards remain in many areas, like in the Pacific Northwest.

May 23 -

Palm Beach County residents are using a Florida law passed last year aimed at ESG investing to challenge its county's investment in Israel bonds.

May 23 -

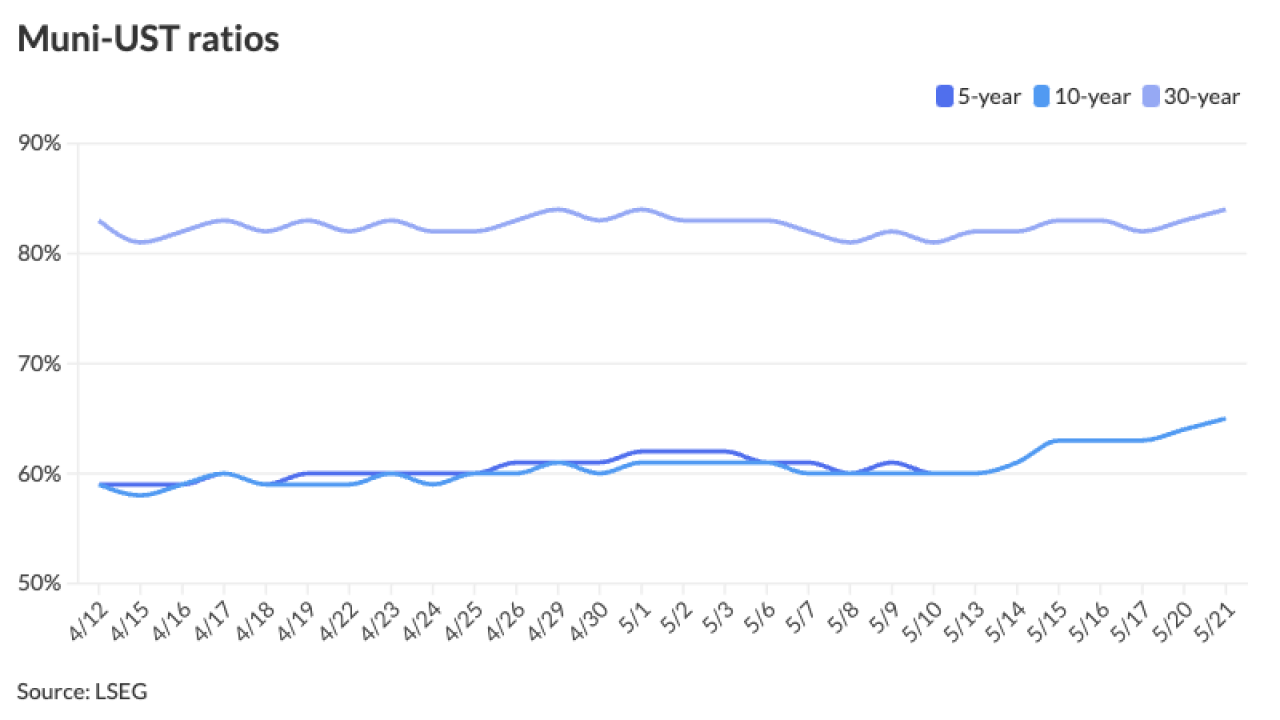

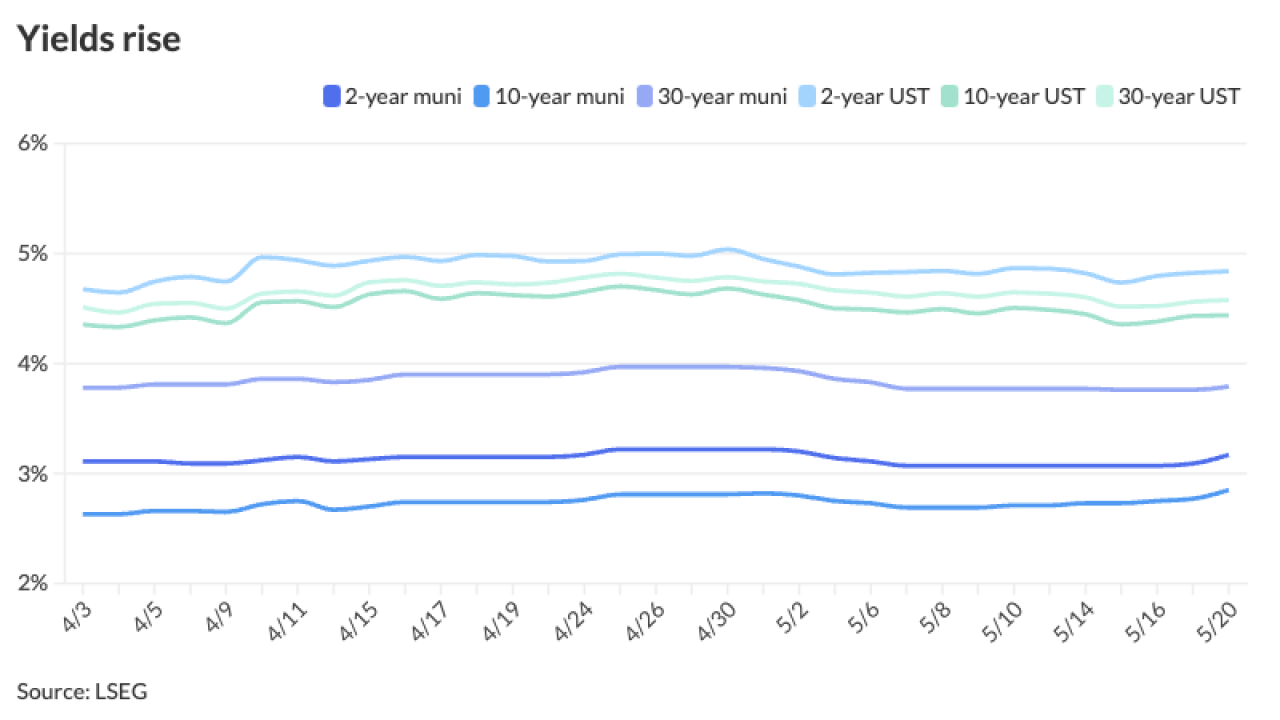

The ongoing influx of new-issue supply has pushed muni-UST ratios to at or near year-to-date highs, J.P. Morgan strategists said.

May 22 -

Indiana officials celebrated the completion of the first of three major commuter railway upgrades, which together represent the state's largest rail project.

May 22 -

More than two dozen issuers have announced plans to refund their BABs this year, despite objections from investors.

May 22 -

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

May 22 -

Signature Bank owned nearly $15 billion of mortgages across four of New York's five boroughs, making it the largest lender to rent-regulated housing in the city.

May 22 -

Mayor Brandon Johnson and Chicago's finance team talked up the Windy City's economy and talked up bond sale plans at an event for municipal bond investors.

May 22 -

Several weeks of elevated supply should theoretically be "weighing more on performance, but the market is now just ahead of its largest reinvestment season, which so far in 2024 has become even more pronounced, with an additional $19.5 billion scheduled for call/redemption between [June 1 and August 30]," said Matt Fabian, a partner at Municipal Market Analytics.

May 21 -

A professional basketball arena costing at least $900 million moved forward in Oklahoma City with the city council's approval of a development agreement.

May 21 -

CPS Energy, which provides electricity and natural gas in the San Antonio area, has a $1.05 billion revenue bond issue pricing in early June.

May 21 -

Fitch said Illinois has to resolve questions on Tier 2 pension benefits, and fixing Tier 2's failure to meet IRS safe harbor provisions would be credit neutral.

May 21 -

A strong project pipeline has P3 advocates hopeful for the future, despite some lackluster recent numbers.

May 21 -

Its state university systems face a funding freeze for noncompliance with a 2023 state law banning diversity, equity, and inclusion offices.

May 21 -

Fitch raised its rating on about $260 million of municipal bonds, backed by payments-in-lieu-of-taxes, from C — the lowest category before default — to CC.

May 21 -

The debt was approved for Greensboro and Raleigh.

May 20 -

"While we acknowledge that the market tone is weaker [Monday], we are generally constructive regarding valuations and expect this week's supply to be absorbed fairly well after last week's giveback of the richening witnessed over prior weeks," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

May 20 -

A strong tax collection season combined with compromise to seal the deal in a special session.

May 20 -

Recipients included Marjorie Henning, retired deputy comptroller for public finance for the New York City Comptroller's office; Albert Simons, retired partner at Orrick, Herrington & Sutcliffe; and New York City Budget Director Jacques Jiha.

May 20 -

"The industry is built on relationships, and it's powered by technology," said Josh Rosenblum, head of algorithmic trading at Brownstone.

May 20