-

Speakers at the LGBTQ+ History Month mixer pushed back against attacks on diversity.

October 2 -

The board kicks off the new fiscal year with a new budget, a 2.9% increase from the prior year.

October 2 -

Through the integration, Investortool's clients can calculate analytics based on predictive trade levels, filter the live market based on "what's rich or what's cheap" compared to the predictive price and power automation, said James Morris, senior vice president at Investortools.

October 2 -

The U.S. District Court for the Southern District of California entered a final judgment against Matthias O'Meara and Choice Advisors, fining them $312,572 and $187,337, respectively.

October 2 -

The Ohio Water Development Authority planned to sell $400 million of new money bonds in addition to a refunding driven by a tender offer.

October 2 -

The larger supply calendar should be "taken down well given the persistent inflows into our market and investors are still sitting on plenty of cash," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 1 -

The California State School Board Association has sued over an education funding work-around included as a trailer bill in the budget.

October 1 -

The Texas city expects to finance 72% of the expansion program, which includes an arrivals and departures hall, with general airport revenue bonds.

October 1 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

Disruption was on the minds of those gathered in Chicago last week for MuniTech, a conference billed as a magnet for the "tech-forward" in public finance.

October 1 -

Litigation in Arizona, Oklahoma, Texas, and Utah could determine bond issuance, culpability for defaults, or the constitutionality of underwriter bans.

October 1 -

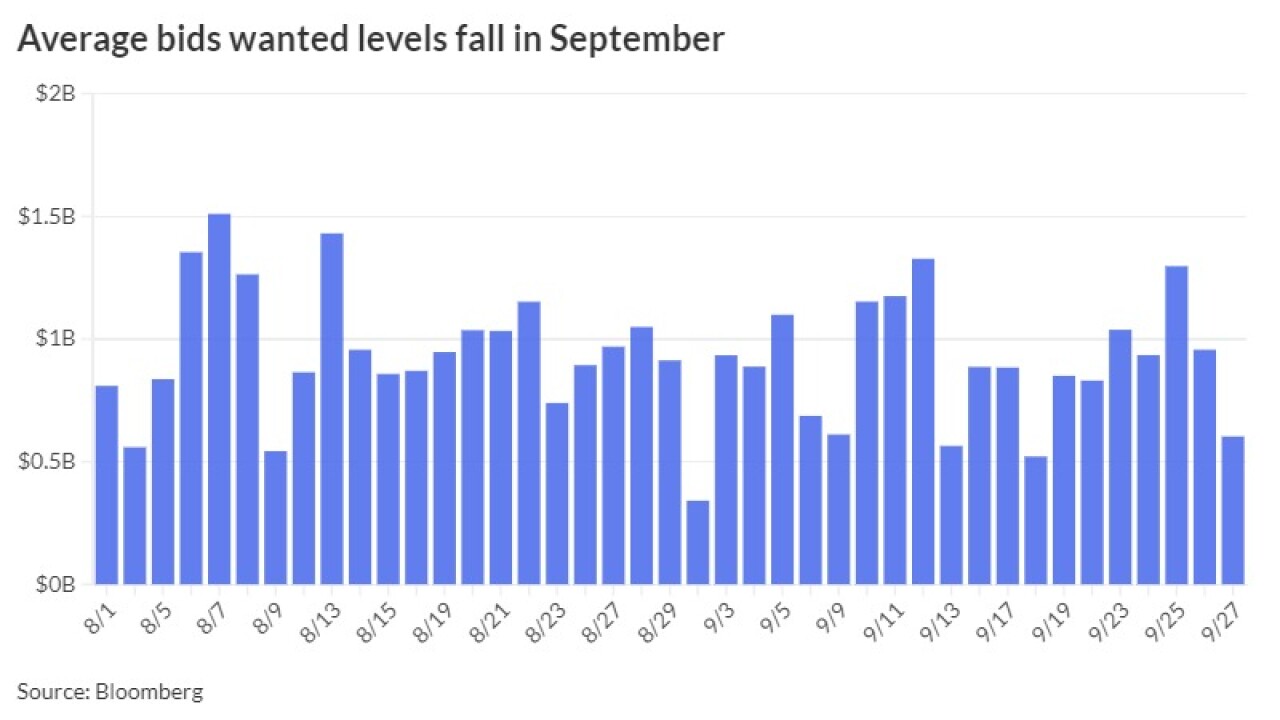

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

September 30 -

September volume came in over $44 billion leading volume year-to-date to hit more than $380 billion, just shy of 2023's full-year total issuance.

September 30 -

Puerto Rico's electric reliability is likely to continue to deteriorate without access to the capital markets, the investors said.

September 30 -

Bonds will finance construction of the South Coast Rail Project, which will restore commuter rail service between Boston and southeastern Massachusetts.

September 30 -

Advocates hope to use the data to persuade lawmakers of the usefulness of tax-exempt bonds as Congress tackles tax policy next year.

September 30 -

The MTA's biggest-ever capital plan focuses mostly on upkeep for the system. But it's more than $33 billion short of funding for the five-year program.

September 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

September 27 -

Minneapolis will sell $123.6 million of Series 2024 general obligation bonds via competitive sale on Tuesday, buoyed by triple-A bond ratings.

September 27 -

Florida's catastrophe fund will weather the storm and shouldn't need reinforcements yet. Two Florida-related sales are still expected next week.

September 27