-

Barclays' Mikhail Foux talks shifting demand, BABs refundings, election effects and what it means for the asset class in a volatile market.

April 16 -

Investor demands and lower account minimums have grown separately managed accounts across fixed-income markets, particularly in munis. Russell Feldman, CEO and co-founder of IMTC, discusses this evolution and how technology has contributed to changing market dynamics.

March 5 -

What do investors want for their investment strategies, a look at the various demand components in the market, as well as the uptick of alternative financing products issuers are using and what they mean for the buy-side community.

February 16 -

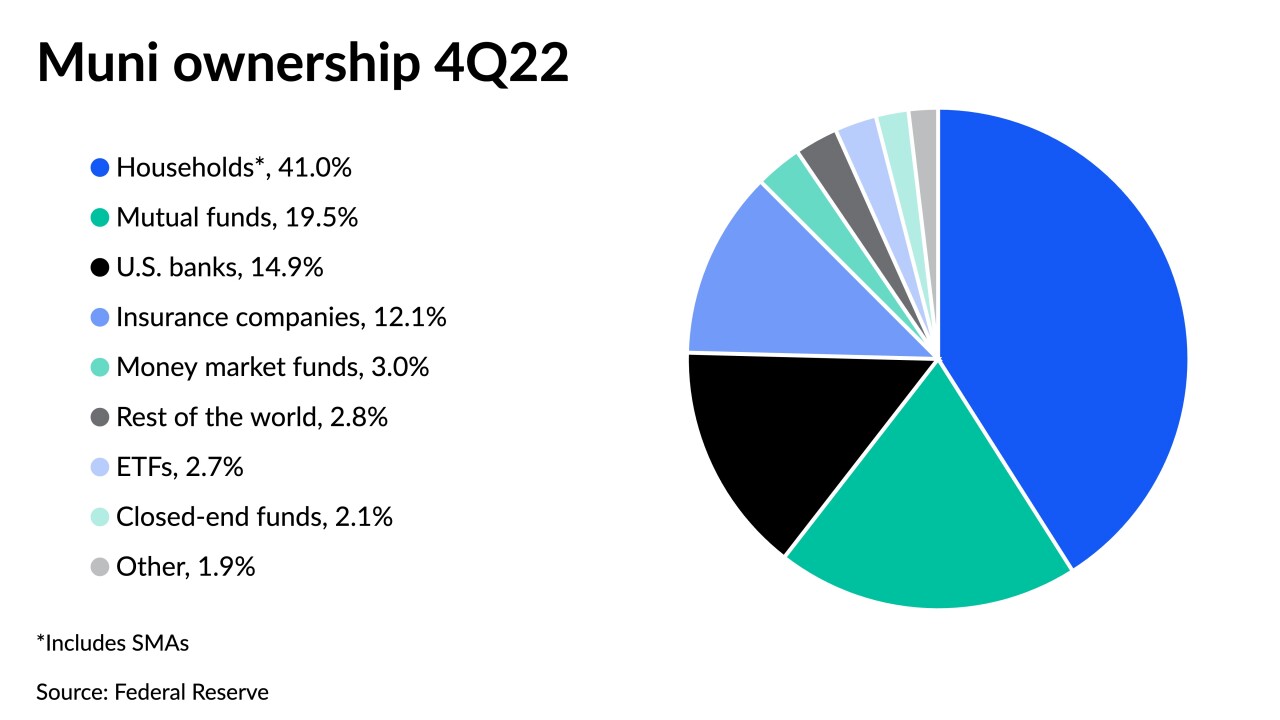

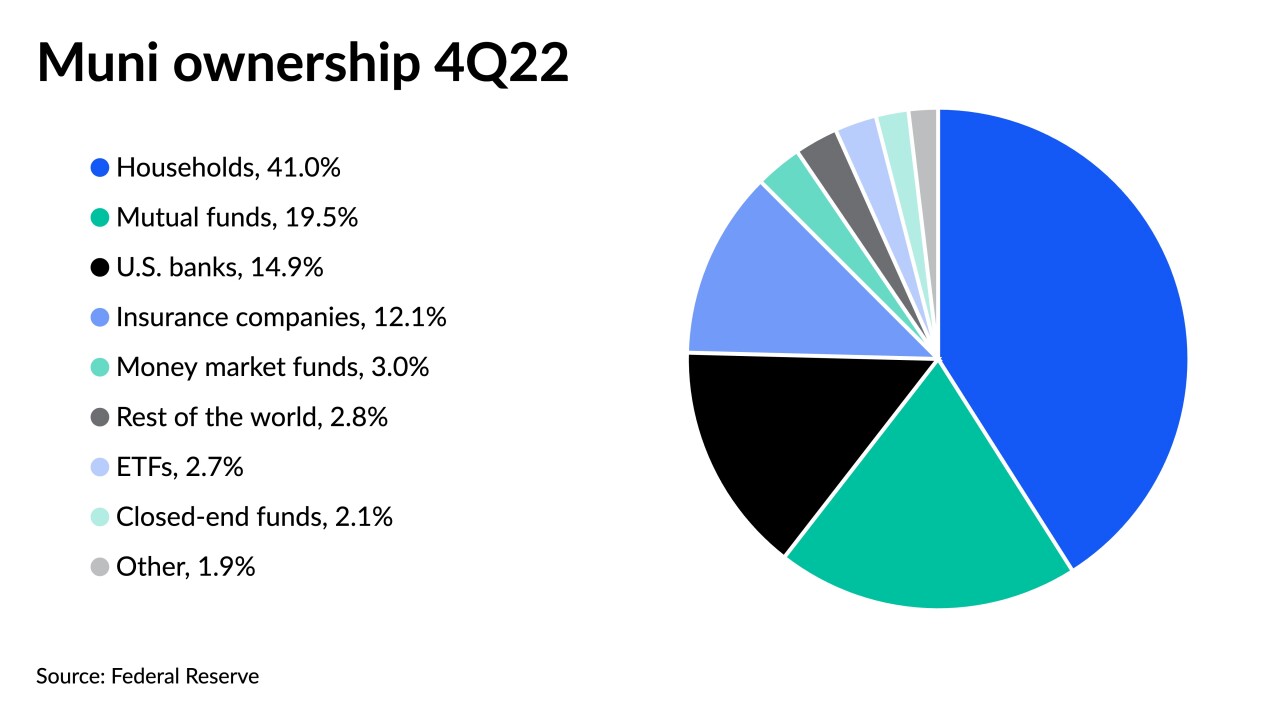

Some participants on the Street estimate that SMAs hold as much as $1.5 trillion of munis while others peg it closer to $1 trillion to $1.3 trillion.

February 8 -

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

"BNP Paribas choosing Miami to open its newest office reinforces our community's status as a top financial market within the global economy," said Miami-Dade County Mayor Daniella Levine Cava.

December 7 -

"We're in a market right now where there's heightened volatility in prices, inconsistent pace of supply, and for investors who need to put money to work, muni ETFs continued to play that role," CreditSights' Pat Luby said.

April 26 -

Household and U.S. bank ownership of individual bonds fell and the total face amount of munis outstanding was down 0.6% quarter-over-quarter and down 1.4% year-over-year, Fed data shows.

April 10 -

The value of the municipal bond market decreased by 4.3% in the third quarter of 2022, said Pat Luby, a strategist at CreditSights.

December 30 -

Retail investors may be moving out of municipal bond mutual funds and into separately managed accounts, largely due to the headline shock of the massive outflows from the funds, participants say.

September 23 -

-

Largely attributable to Fed interest rate increase-led volatility, outstanding municipal bonds lost $300 billion of market value in the first quart of 2022, a Municipal Securities Rulemaking Board report said.

June 29 -

As ETFs take a larger bite of the market, VanEck discusses how sustainable investing will contribute to the muni space.

-

ESG investing has grown complex enough that it’s time we recognize what strategy or product is best suited for a given situation.

April 19 VMG Ventures

VMG Ventures -

Recognizing what ESG strategy or product is best suited for a given situation is a crucial first step for the market to establish long-needed standards and guide usage into the effective outcomes participants wish to see.

April 19 -

For investors who want a customized portfolio and a greater ability to control taxable events, SMAs may be the product they're searching for.

March 23 -

The platform allows advisors to tailor portfolios that have characteristics including state-specific credits, ESG considerations, duration targets and other criteria.

January 28 -

Experts explore the E, S and G and what it means for issuers and investors.

December 22 -

Modern economic growth in the U.S. is dependent on credit creation — which has perpetuated a cycle of suppressed yields and inflated asset prices. While credit creation has been accelerating away from GDP growth for the last 15 years with no signs of stopping, retirement investors are left in the intractable situation of watching the value of their savings erode. What can be done?

October 13 Build Asset Management

Build Asset Management -

The deal qualifies as both an environmental impact bond and as a green bond under the International Capital Market Association's Green Bond Principles.

June 28