-

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

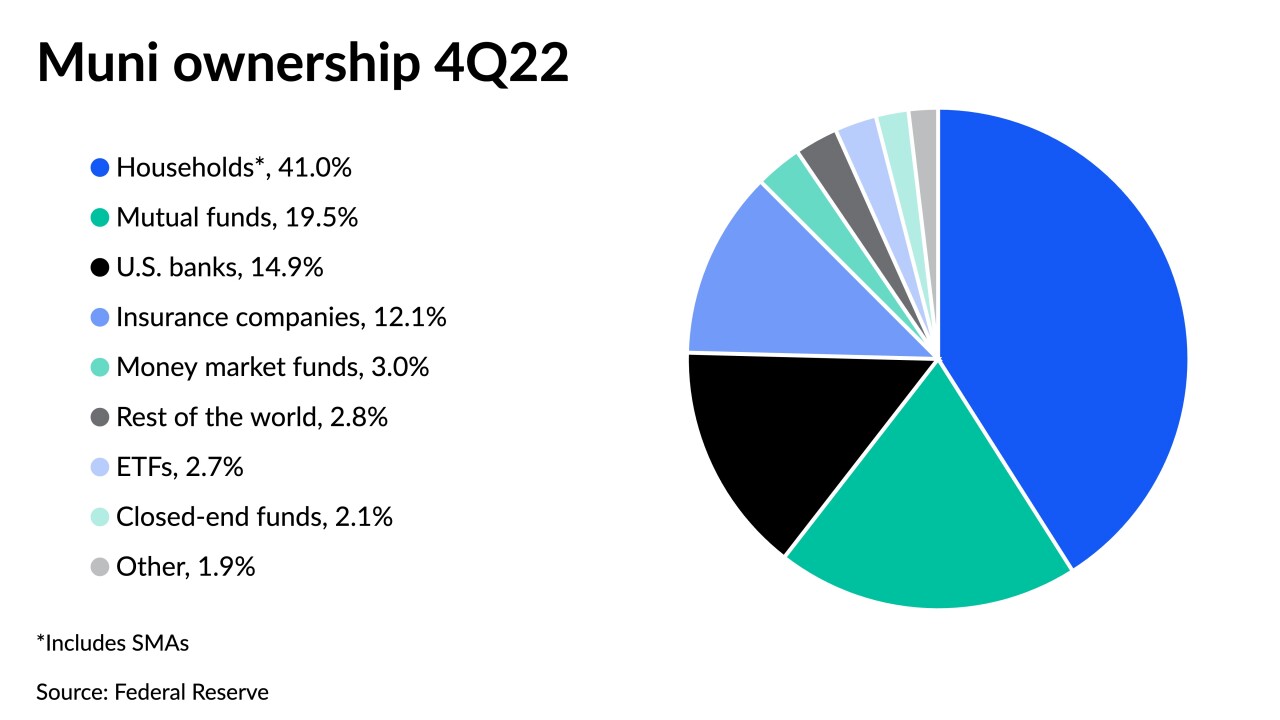

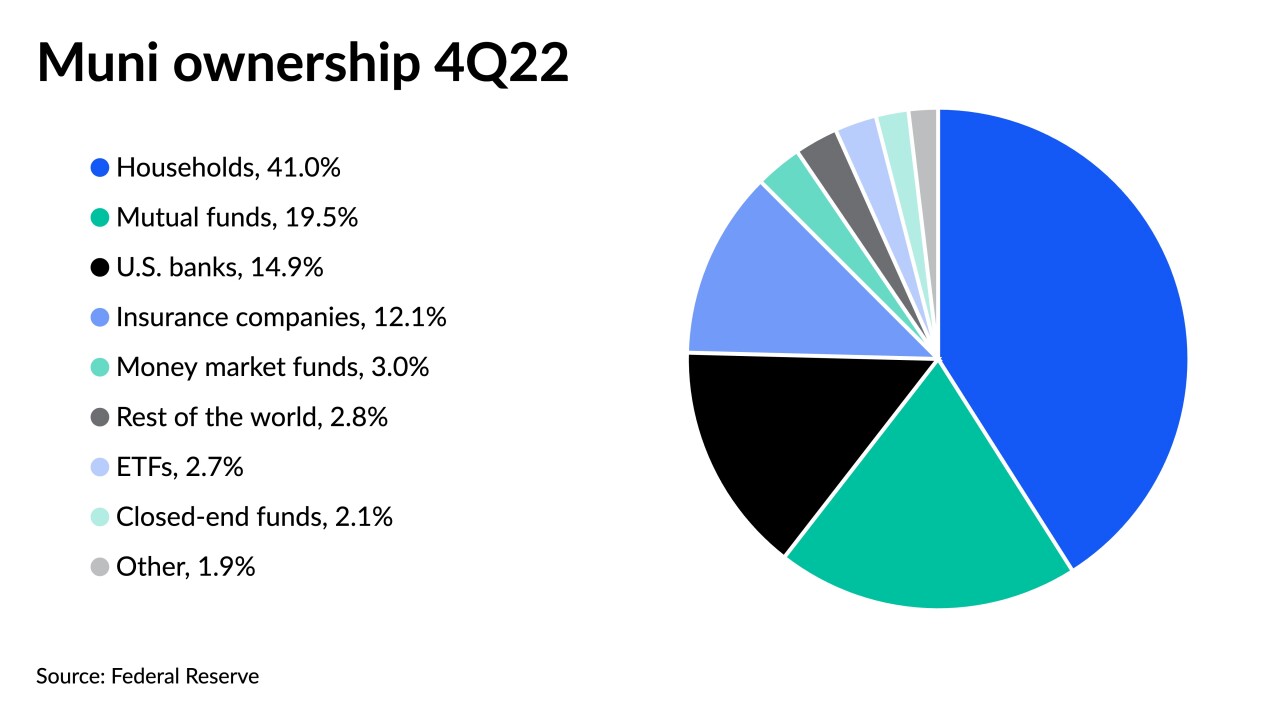

Household ownership of individual bonds was the largest category of muni ownership at 44.6%, mutual funds at 19.2%, exchange-traded funds at 3.1% and U.S. banks at 12.4%. While not detailed in the Federal Reserve data, SMAs may hold up to $1.6 trillion currently.

September 13 -

"Investor reception will remain the ultimate arbiter of muni performance and … the current state of the tax-exempt space to be well-positioned, even though munis are likely to continue to underperform USTs," said Jeff Lipton, a research analyst and market strategist.

August 20 -

Broker-dealer Millennium will provide clients with real-time pricing and trade execution capabilities by connecting directly to the Investortools Dealer Network, or IDN.

June 24 -

Household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts and SMAs — rose to $1.779 trillion, up 0.3% from Q4 2023 and from 5.6% in Q1 2023.

June 13 -

As the public finance landscape evolves with increased philanthropic interest and a focus on climate resilience and community health, it's time for traditional market participants to align their investments with impactful outcomes to drive systemic change and foster equitable growth.

June 7 16Rock

16Rock -

Despite losses, munis are "being set up nicely" as the summer season approaches, said Jeff Lipton, a research analyst and market strategist.

May 30 -

SMA growth has been "pretty staggering to see," said Matthew Schrager, managing director and co-head of TD Securities Automated Trading, noting the "interplay between SMA and electronic trading is a very symbiotic relationship."

May 29 -

Marty Mannion and Matt Schrager, managing directors and co-heads at TD Securities Automated trading division, discuss how automation and electronic trading are creating more opportunities and better outcomes for municipal market participants, including making muni bonds more accessible to a broader range of investors.

May 28 -

A state ban on bond underwriters that "boycott" or "discriminate" against the fossil fuel or firearms industries has resulted in fewer banks providing municipal financial products and services.

April 23 -

Barclays' Mikhail Foux talks shifting demand, BABs refundings, election effects and what it means for the asset class in a volatile market.

April 16 -

Investor demands and lower account minimums have grown separately managed accounts across fixed-income markets, particularly in munis. Russell Feldman, CEO and co-founder of IMTC, discusses this evolution and how technology has contributed to changing market dynamics.

March 5 -

What do investors want for their investment strategies, a look at the various demand components in the market, as well as the uptick of alternative financing products issuers are using and what they mean for the buy-side community.

February 16 -

Some participants on the Street estimate that SMAs hold as much as $1.5 trillion of munis while others peg it closer to $1 trillion to $1.3 trillion.

February 8 -

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

"BNP Paribas choosing Miami to open its newest office reinforces our community's status as a top financial market within the global economy," said Miami-Dade County Mayor Daniella Levine Cava.

December 7 -

"We're in a market right now where there's heightened volatility in prices, inconsistent pace of supply, and for investors who need to put money to work, muni ETFs continued to play that role," CreditSights' Pat Luby said.

April 26 -

Household and U.S. bank ownership of individual bonds fell and the total face amount of munis outstanding was down 0.6% quarter-over-quarter and down 1.4% year-over-year, Fed data shows.

April 10 -

The value of the municipal bond market decreased by 4.3% in the third quarter of 2022, said Pat Luby, a strategist at CreditSights.

December 30 -

Retail investors may be moving out of municipal bond mutual funds and into separately managed accounts, largely due to the headline shock of the massive outflows from the funds, participants say.

September 23