-

Municipals saw little activity on Monday as the market prepped for the bulk of the week's $7B primary calendar arriving Tuesday and Wednesday.

May 24 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

May 3 -

Municipal triple-A benchmarks held steady as the focus was on the primary in which large new issues repriced to lower yields while secondary trading was light.

April 20 -

The markets and the Fed are not on the same page about the future of inflation. Luke Tilley Senior Vice President and Chief Economist at Wilmington Trust will discuss the economy and inflation.

-

Jack Janasiewicz, senior vice president, portfolio manager and portfolio strategist at Natixis Investment Managers Solutions, discusses inflation and why there is disagreement on whether it will become an issue this year. He talks about how stimulus money and the employment situation factor in. Gary Siegel hosts. (Taped March 9 / 30 minutes).

April 6 -

Both personal income and expenditures dropped in February, while personal consumption expenditures also came in weaker than expected, meaning inflation remains in check for now.

March 26 -

The primary led the secondary to lower yields as UST 10-year fell to lows last seen a week ago. Regional service sector surveys released Tuesday showed improvement, which feeds into the belief that inflation will rise in the near term.

March 23 -

Exactly one year after record billions were pulled from municipal bond mutual funds and the market was in free fall, municipals followed U.S. Treasuries this week as the markets continued to dismiss the Fed's outlook on inflation and rates.

March 19 -

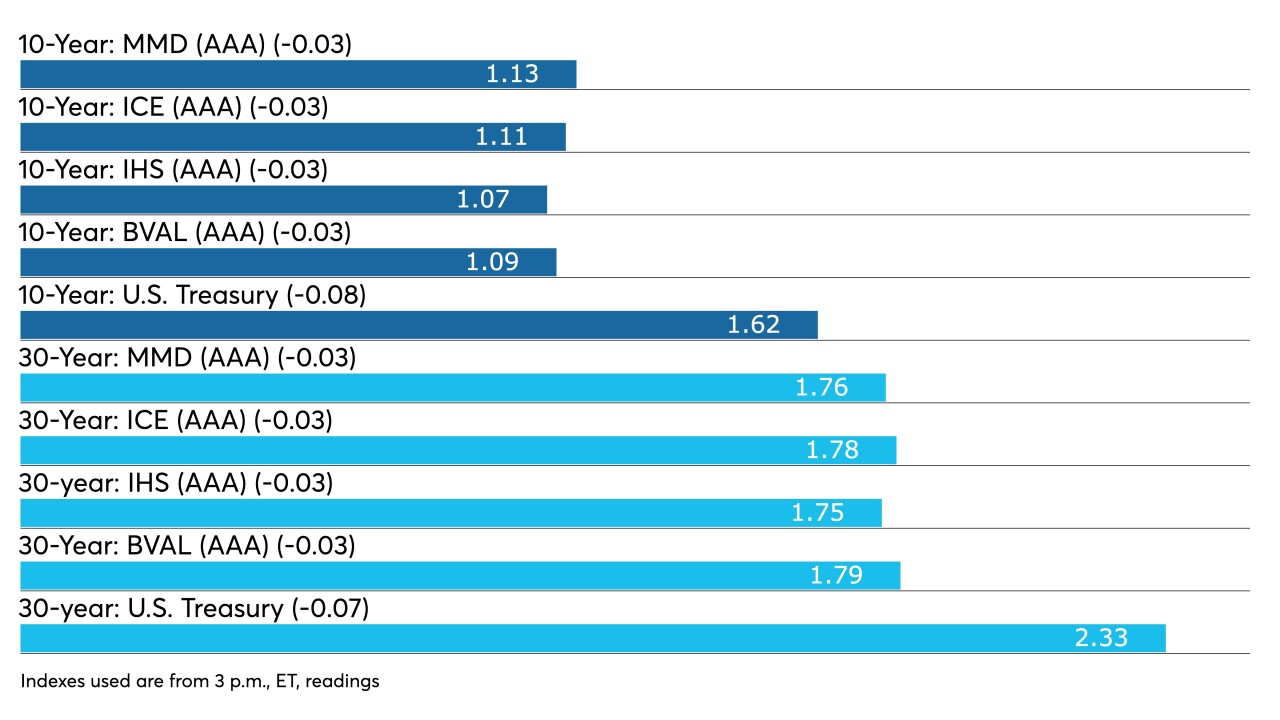

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

March 18 -

Municipals largely ignored the moves to higher yields in U.S. Treasuries as participants await the largest new-issue calendar of 2021 and big-name deals out of New York and Illinois.

March 12