-

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

Refinitiv Lipper reported the first inflows into municipal bond mutual funds at $216 million after three weeks of large outflows while high-yield saw small outflows. Exchange-traded funds reported $755 million of inflows.

February 10 -

Markets were somewhat comforted by Federal Reserve Bank of Atlanta President Raphael Bostic’s comments suggesting the Fed will not be as aggressive as the markets suspect.

February 9 -

Washington will bring $742 million of general obligation bonds in competitive sales Tuesday, providing guidance for triple-A benchmark yields.

February 7 -

The market consensus is that interest rates will rise by two to three percentage points over the next three years. What will that mean?

February 7 MaxMyInterest

MaxMyInterest -

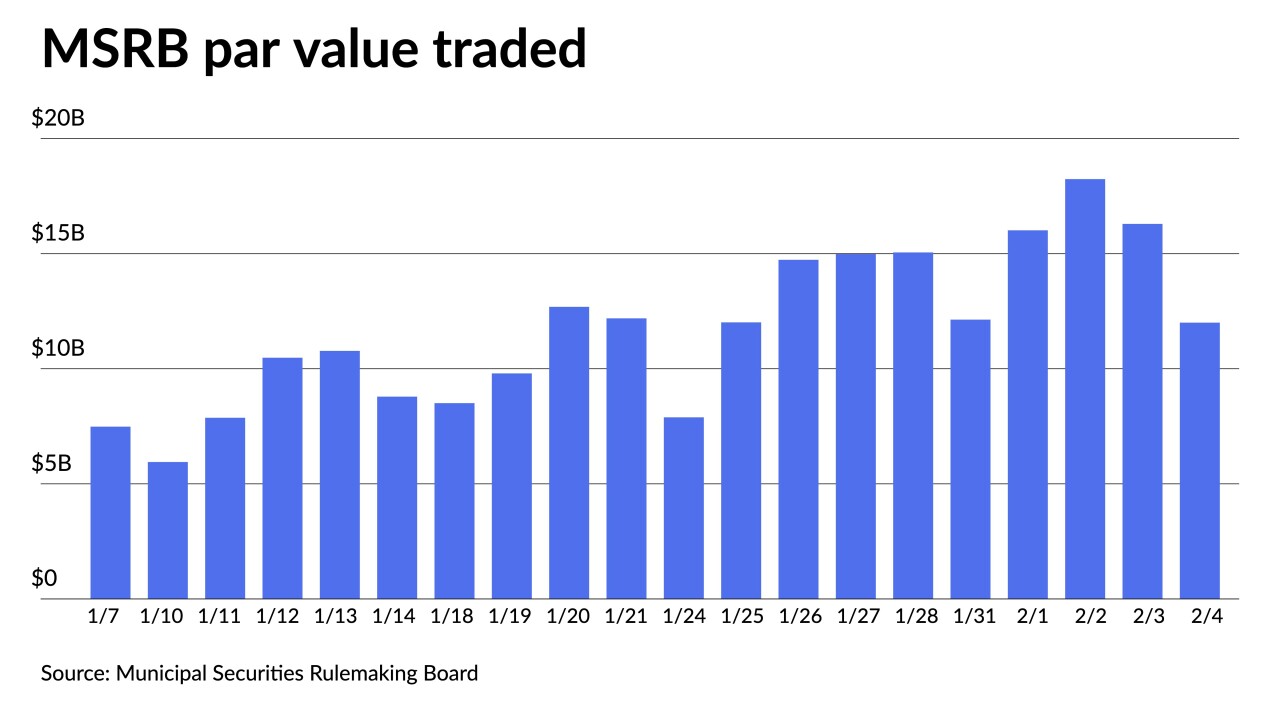

Buyers appeared to return to the market the past two sessions after the January correction moved yields and ratios higher. Secondary trading was up again on Wednesday and new deals were well-received.

February 2 -

John Hallacy of John Hallacy Consulting LLC sits down with Chip Barnett to talk about what the municipal bond market will face in 2022. He discusses inflation, new issuance volume, and the future of infrastructure this year amid the lingering effects of COVID and Omicron. (19 minutes)

January 25 -

In the near term, federal aid is sitting on balance sheets ready to be deployed if some of the downside economic risks become reality, experts say.

January 21 -

Refinitiv Lipper reported $238.926 million of outflows, but $182.035 million of inflows to high-yield, reversing last week's outflows. New-issues faced concessions.

January 20 -

The Investment Company Institute reported a large drop of inflows into municipal bond mutual funds at $142 million in the week ending Jan. 12, down from $1.413 billion in the previous week.

January 19