-

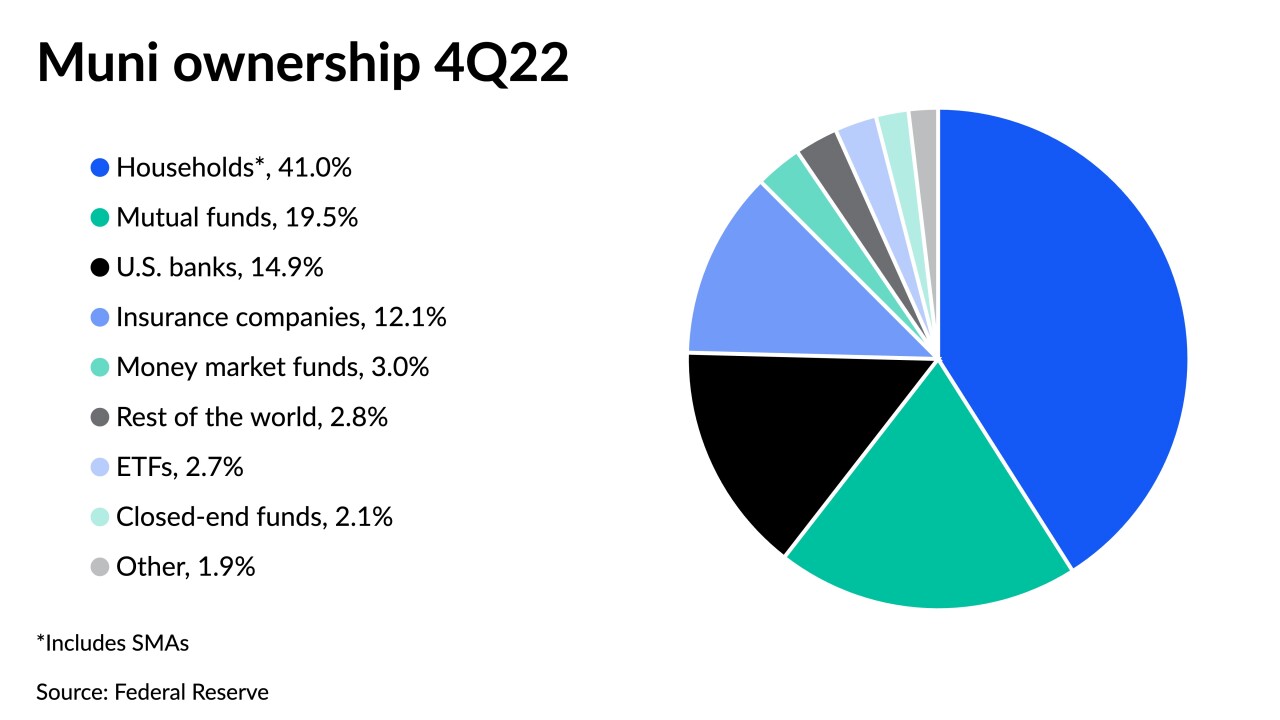

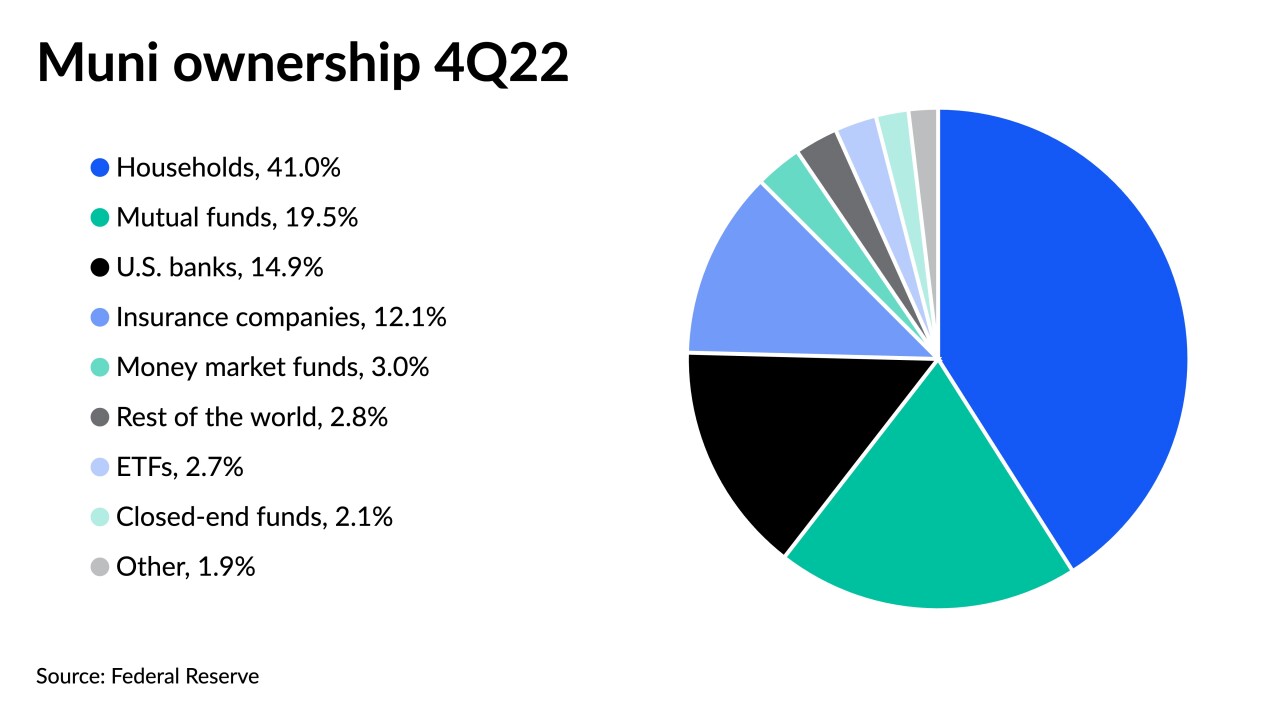

Some participants on the Street estimate that SMAs hold as much as $1.5 trillion of munis while others peg it closer to $1 trillion to $1.3 trillion.

February 8 -

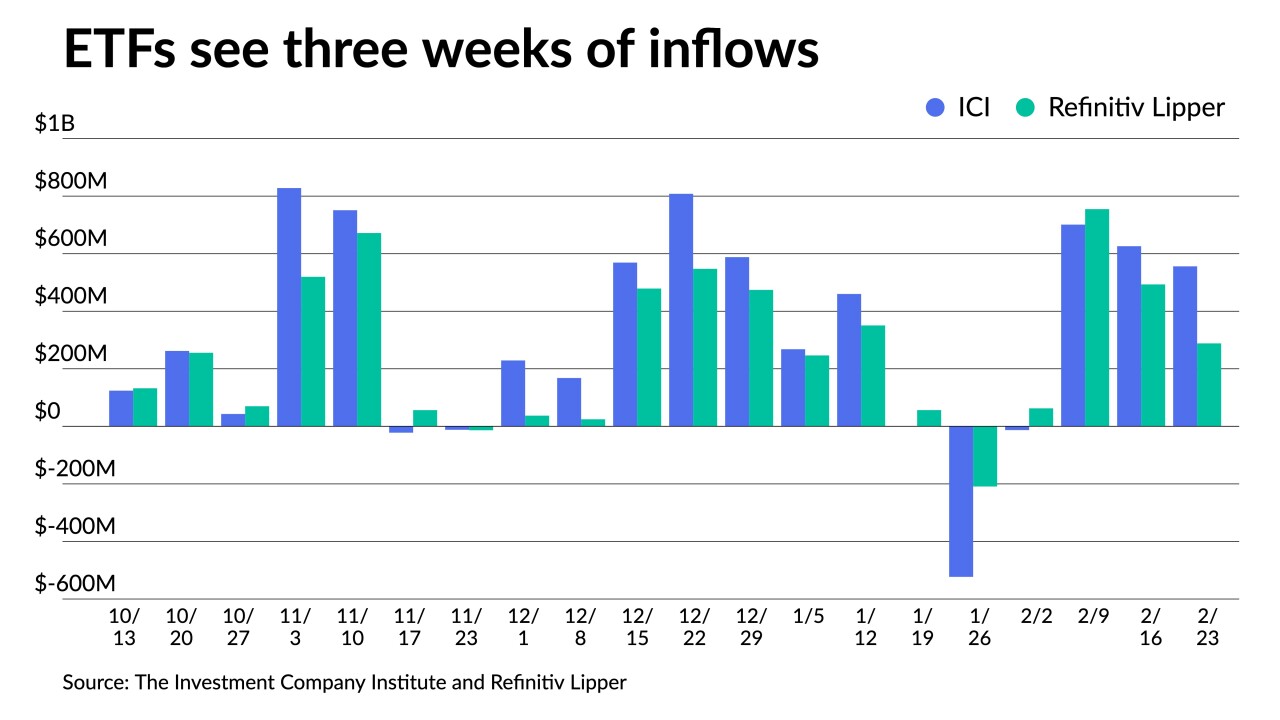

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

Late-month volumes are "waning as it appears the year's tax-loss harvesting was accomplished leading up to the holiday period," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 27 -

Data for the second quarter show the face amount of munis outstanding rose 0.4% quarter-over-quarter, or $15.5 billion, to $4.043 trillion.

September 26 -

"We're in a market right now where there's heightened volatility in prices, inconsistent pace of supply, and for investors who need to put money to work, muni ETFs continued to play that role," CreditSights' Pat Luby said.

April 26 -

Household and U.S. bank ownership of individual bonds fell and the total face amount of munis outstanding was down 0.6% quarter-over-quarter and down 1.4% year-over-year, Fed data shows.

April 10 -

The company has been working on this ETF for the past year and a half.

March 13 -

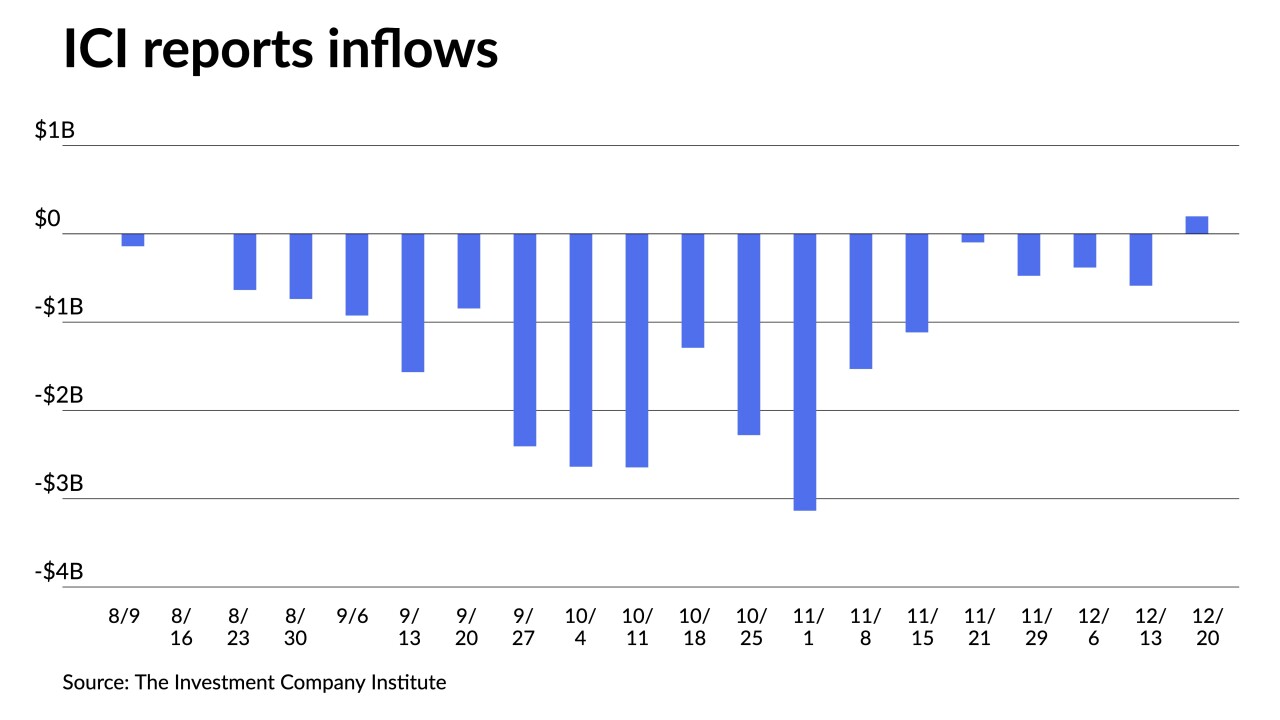

The market has seen outflows for 13 straight weeks, per Refinitiv Lipper, but Nuveen strategists Anders S. Persson and John V. Miller said "selling is due primarily to investors harvesting tax losses."

November 8 -

Join Peter O'Neill, Director and Senior Fixed Income Portfolio Manager, at Bank of America, and Blake Lynch, Head of Business Development, IMTC, as they discuss the role of separately managed accounts in the muni market with The Bond Buyer's Lynne Funk.

-

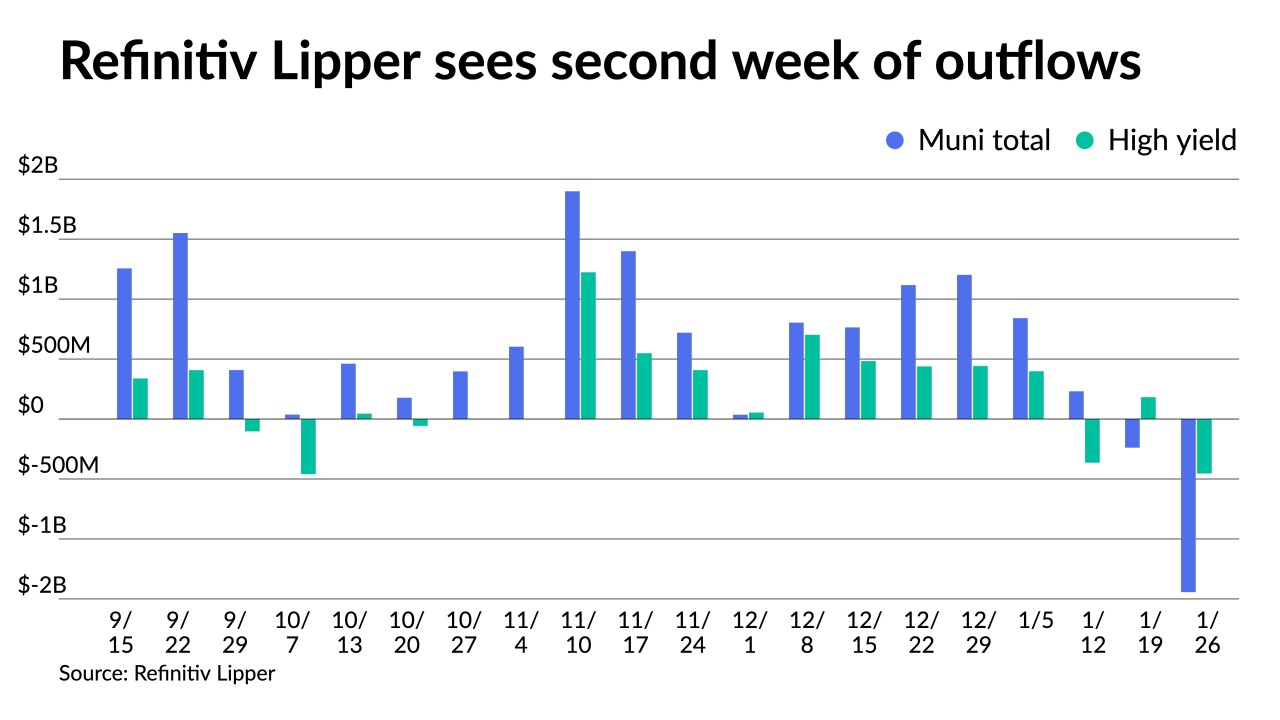

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

The Investment Company Institute reported investors added $543 million to muni bond mutual funds in the week ending July 13 compared to the $1.061 billion of outflows in the previous week.

July 20 -

The Investment Company Institute reported investors pulled $4.590 billion from muni bond mutual funds in the week ending June 22, down from $6.243 billion of outflows in the previous week.

June 29 -

Largely attributable to Fed interest rate increase-led volatility, outstanding municipal bonds lost $300 billion of market value in the first quart of 2022, a Municipal Securities Rulemaking Board report said.

June 29 -

As ETFs take a larger bite of the market, VanEck discusses how sustainable investing will contribute to the muni space.

-

The second quarter should bring more opportunity and less volatility following the worst quarter in four decades, analysts said.

April 14 -

At least 80% of the fund has to be “ESG leaders,” or issuers that have shown leadership in terms of environmental and social stewardship within their communities relative to their peers and that sector.

April 6 -

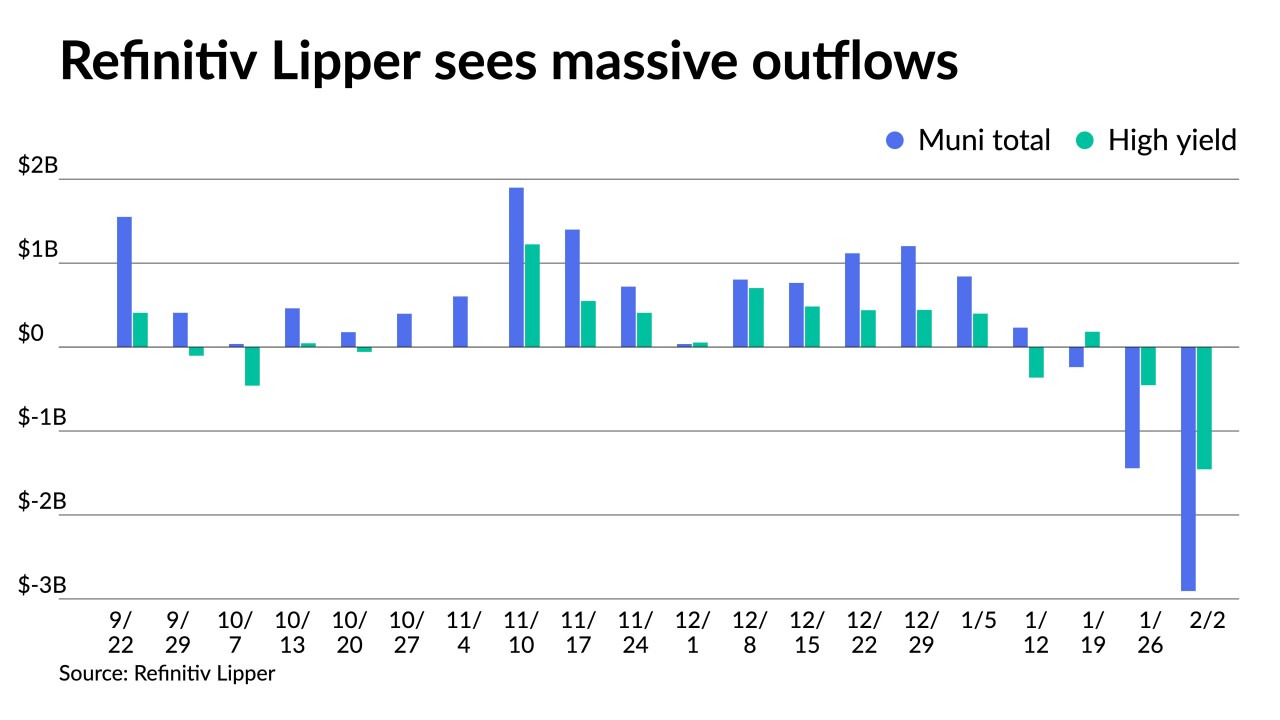

ETFs pulled in just more than $2 billion in February while muni mutual funds saw $8.5 billion of outflows.

March 4 -

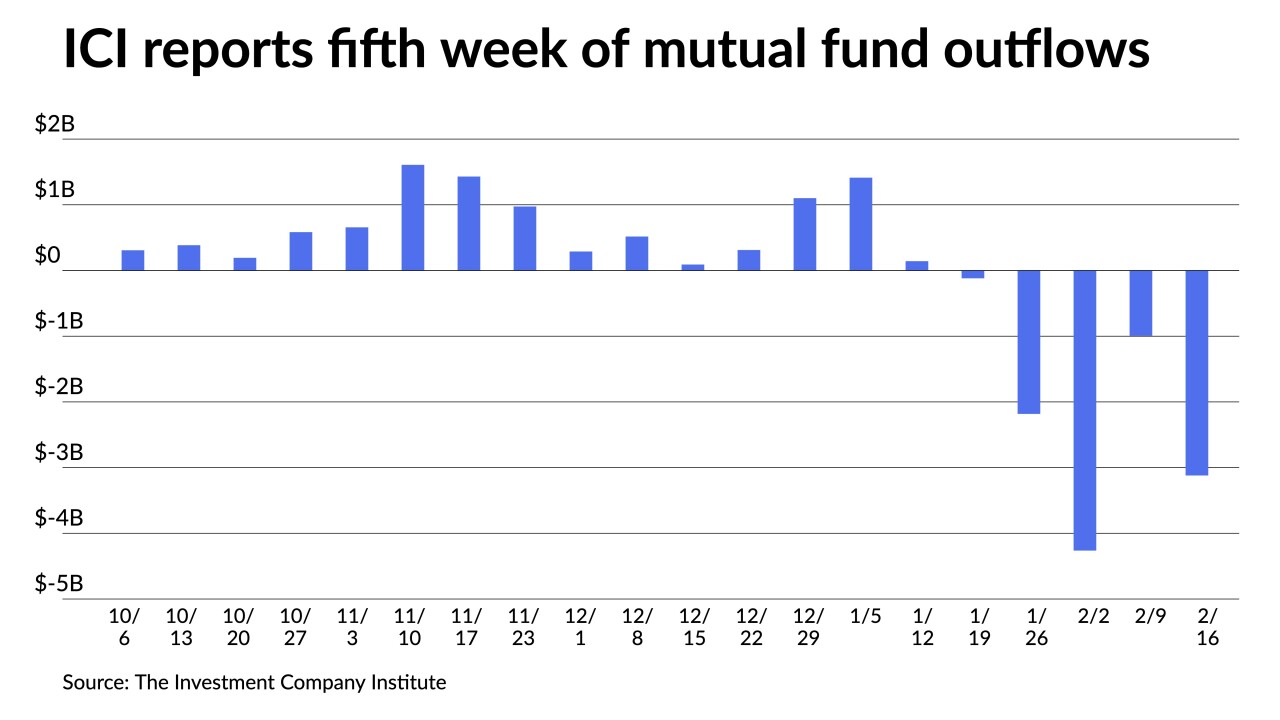

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

Municipals were stronger again on the day, though, and new-issues were repriced to lower yields.

February 3 -

Returns are deep in the red with the Bloomberg Municipal Index at negative 1.85%, while high-yield sits at negative 1.81%.

January 27