-

The SEC announced the settlement with former UBS broker Chris Rosenthal, the biggest yet from its ongoing flipping investigation.

December 21 -

Richard Gounaud, accused by the SEC of participation in a muni bond "flipping" scheme, claimed the use of the slang term created unfair bias.

December 11 -

A federal court imposed an unusually stiff financial penalty and a lifetime ban against the already-jailed Christopher St. Lawrence.

November 15 -

Examiners found that Mark Stewart Saunders was improperly relying on permission from a customer's daughter.

November 13 -

Todd Barker appears prepared to have negotiated a monetary settlement with the SEC, while Dwayne Edwards plans to contest the SEC's motion in court.

November 8 -

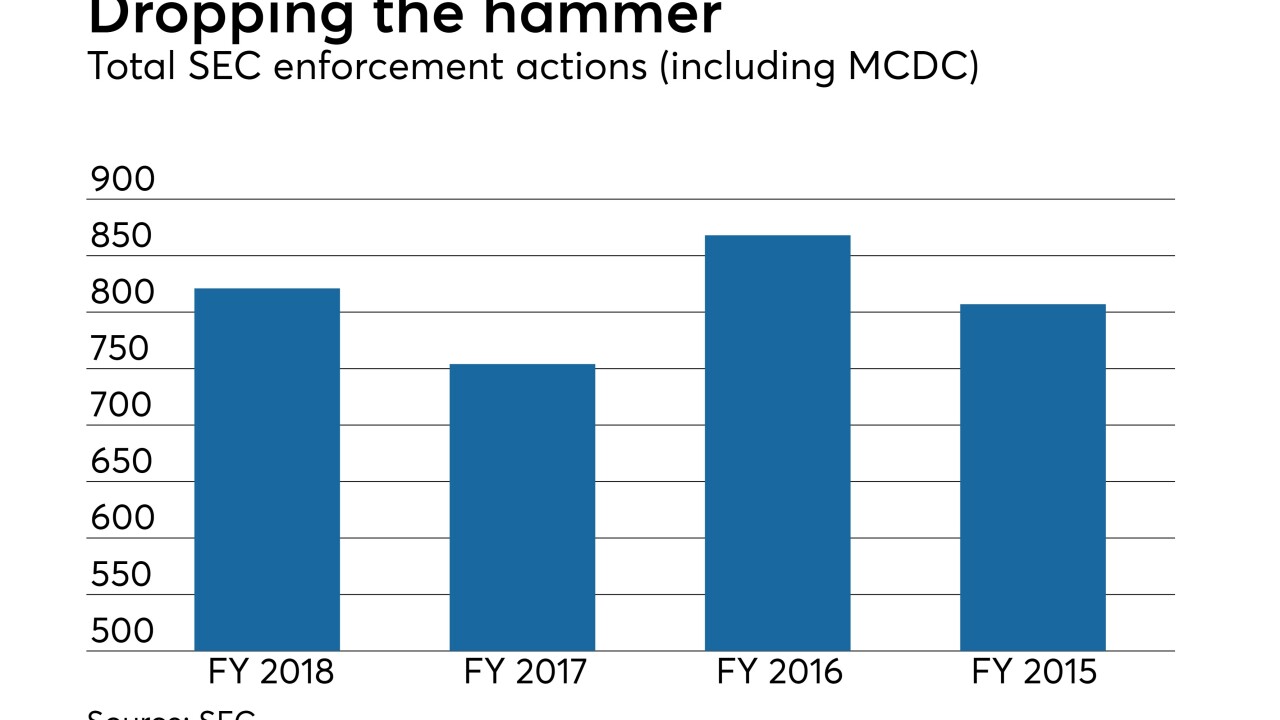

Public finance cases represented 3% of the SEC's enforcement actions the past fiscal year.

November 2 -

FINRA found, and the SEC upheld, muni and other rule that violations Thaddeus North failed to prevent as chief compliance officer.

October 31 -

The defense team accused the SEC of a "gross abuse of power."

October 30 -

The pilot program began in May, but was not officially announced by the IRS until last week.

October 29 -

Key SEC officials responsible for muni rulemaking and enforcement said they don't feel disclosure has been adversely impacted due to fears stoked by the Municipalities Continuing Disclosure Initiative.

October 4 -

A Carlsbad, Calif.-based San Diego-based firm, Eric Hall & Associates, is accused of being unregistered when it served as municipal advisor to a school district.

September 20 -

The fallout from a 2017 federal fraud case is continuing to impact bond investors with the latest development involving the loss of tax-exempt status for bonds that were issued for two assisted living facilities in Georgia.

September 14 -

The now-defunct unregistered broker-dealer Core Performance Management, LLC, and four of its former employees settled fraud and MSRB rule violations with the SEC for engaging in municipal bond flipping and kickback scheme.

August 23 -

The Financial Industry Regulatory Authority has already barred Jose Ramirez from the securities industry, his lawyer said.

July 10 -

Jose Ramírez has yet to acknowledge wrongdoing in misleading investors about Puerto Rico debt and may pose a continued threat to investors, SEC lawyers told a federal judge.

June 25 -

Early returns indicate there have been some problems but firms seem to be working through them in complying with the new markup rules, regulators and industry officials said Tuesday.

May 22 -

FINRA found that Gates Capital and three of its employees breached several MSRB rules, some related to role-switching from advisor to underwriter on the same transaction.

May 10 -

S&P Global Ratings lifted Moberly, Missouri, out of speculative grade with a four-notch upgrade.

April 25 -

Lombard Securities and McDonald Partners agreed to pay fines after FINRA examiners found various violations of MSRB rules, including supervisory failures and trade reporting deficiencies.

April 17 -

The SEC wants a quick end to its case against former Ramapo, N.Y. town supervisor Christopher St. Lawrence, but St. Lawrence's lawyer wants a federal judge to proceed to trial.

April 3