-

A key measure of underlying U.S. inflation unexpectedly eased in February amid falling prices for autos and prescription drugs.

March 12 -

Consumers’ inflation expectations fell, according to the February Survey of Consumer Expectations, released by the Federal Reserve Bank of New York on Monday.

March 11 -

The value of business inventories in December was up 0.6% from November as expected.

March 11 -

The Conference Board's Employment Trends Index (ETI) climbed to 111.15 in February from a downwardly revised 109.34 in January.

March 11 -

U.S. retail sales stabilized in January after a plunge the prior month that was larger than first reported.

March 11 -

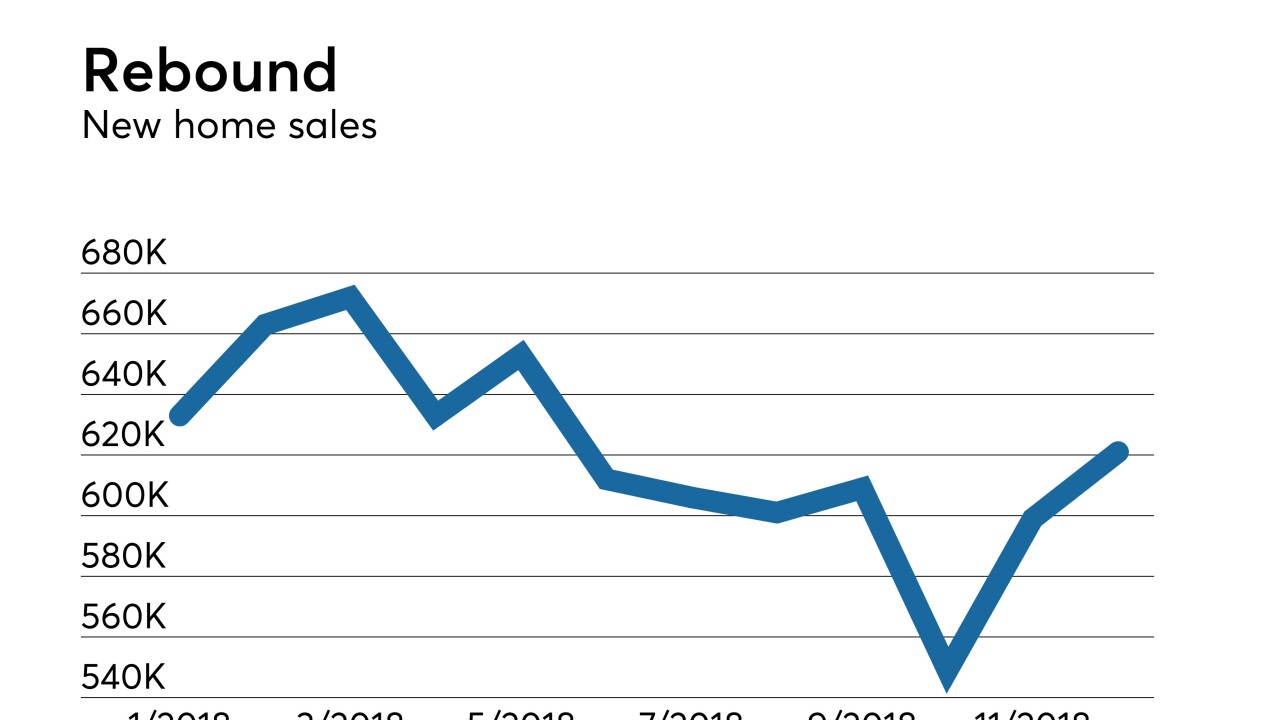

U.S. new-home construction rebounded by more than expected in January amid strength in single-family starts and a nine-month high for permits, signaling the market is stabilizing thanks to lower mortgage rates.

March 8 -

U.S. hiring was the weakest in more than a year while wage gains were the fastest of the expansion and the unemployment rate fell.

March 8 -

Consumer credit increased by $17.0 billion in January to $4.035 trillion.

March 7 -

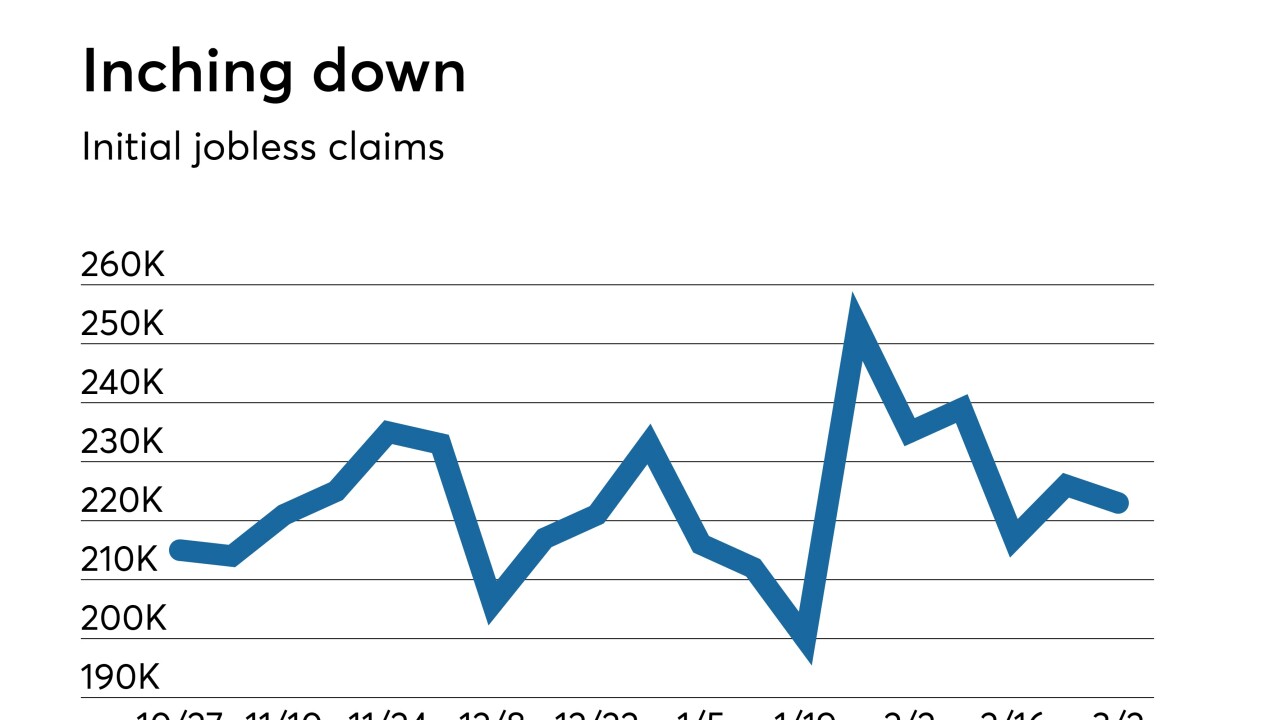

The level of initial claims fell by 3,000 to 223,000 in the March 2 week, just below expectations for a 225,000 reading, data released Thursday showed.

March 7 -

Productivity gains in the U.S. last quarter exceeded forecasts though were little changed from the prior reading as output and hours worked both cooled.

March 7 -

The U.S. international trade gap widened to $59.8 billion in December from $50.3 billion.

March 6 -

Private-sector employment increased by 183,000 in February, on a seasonally adjusted basis, ADP estimated Wednesday.

March 6 -

Lower mortgage rates and more-affordable properties offered some relief for buyers.

March 5 -

The U.S. services sector expanded at a faster pace in February as the non-manufacturing index climbed to 59.7.

March 5 -

The composite of the Leading Economic Index was revised to an unchanged level in January.

March 4 -

U.S. construction spending posted the smallest annual increase since 2011 as homebuilding slowed amid higher borrowing costs and a glut of apartments in some areas.

March 4 -

New York economic conditions slipped in February, with current conditions falling to their lowest level since June.

March 4 -

The University of Michigan's final February consumer sentiment index reading was 93.8.

March 1 -

The overall economy grew for the 118th straight time, the Institute for Supply Management reported Friday.

March 1 -

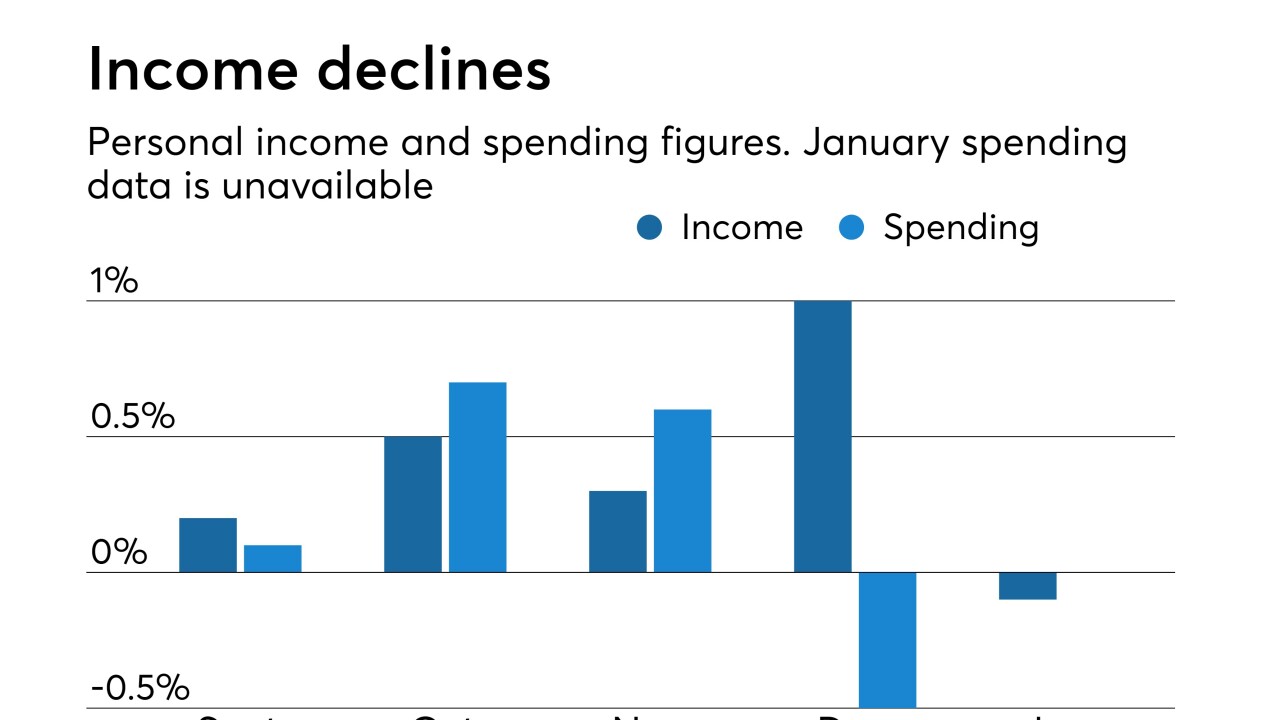

Americans' incomes unexpectedly fell in January, the first decline in about three years, following a surge in the prior month that reflected special dividends and farm subsidies.

March 1