-

During the Great Recession, interest rates hit zero lower bound, which caused the Fed to make unprecedented moves, or quantitative easing, to spur the economy.

May 17 -

Financial markets ignored surprisingly strong data and stayed focused on tariffs and developments in talks with China.

May 16 -

Worse-than-expected economic data released on Wednesday may signal softer growth — and greater demand for bonds.

May 15 -

While tariffs will certainly cause an uptick in inflation, the Federal Reserve can hold rates, according to Federal Reserve Bank of New York President John Williams.

May 14 -

While futures signaled traders' expectations, analysts said conditions aren't ripe for the Federal Reserve to ease credit.

May 13 -

Atlanta Fed President Rafael Bostic said he would do "whatever it takes" should tariffs cause consumers to cut back spending.

May 10 -

The April producer price index grew less than expected, suggesting inflationary pressure will remain weak.

May 9 -

The April employment report topped estimates for jobs created, while the jobless rate fell to a 49-year low; wage increases missed projections.

May 3 -

Federal Chair Jerome Powell doused market hopes for a rate cut, but it was not the result of a shift in Fed policy.

May 2 -

The Fed Chair said the FOMC is “comfortable with our current policy stance,” which he termed “appropriate.”

May 1 -

The last day of the month brings a host of economic indicators, which showed much good news for housing and labor, strong consumer confidence, but mostly softer manufacturing conditions.

April 30 -

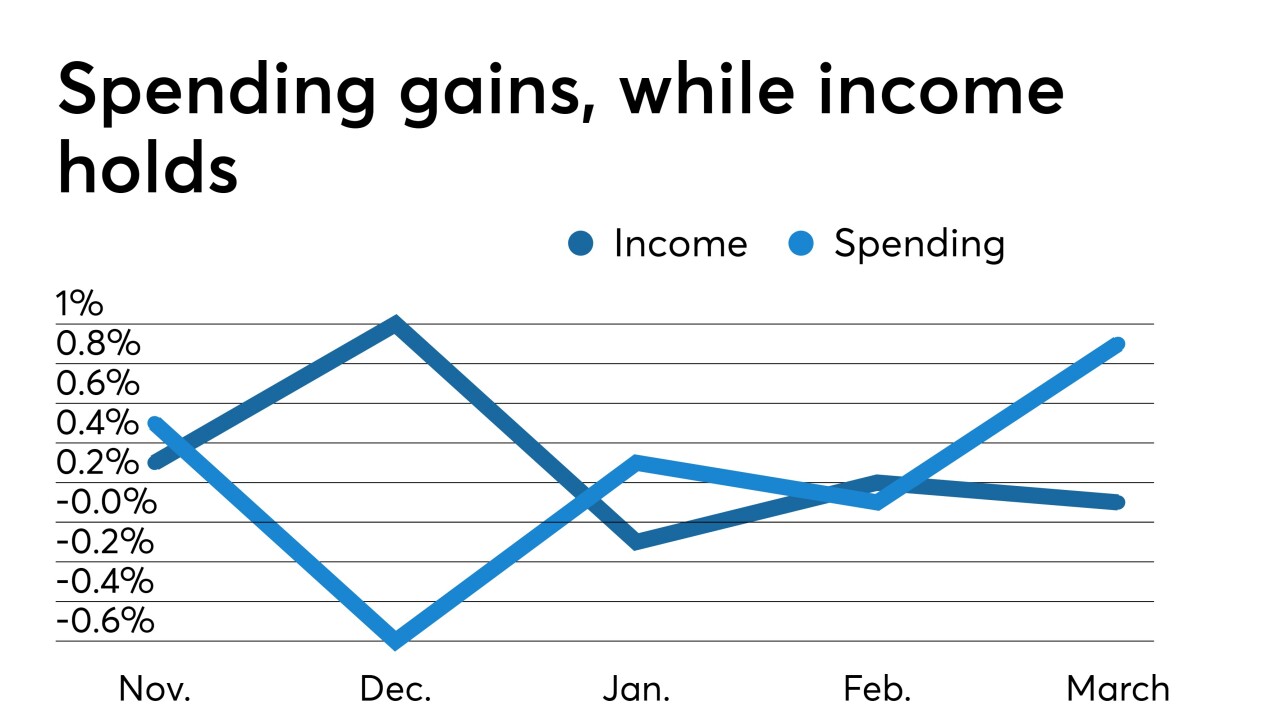

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29 -

U.S. consumer sentiment fell less than initially reported in April.

April 26 -

Gross domestic product expanded at a 3.2% annualized rate in the January-March period, according to the Commerce Department.

April 26 -

Manufacturing activity grew more modestly in April, the Federal Reserve Bank of Kansas City announced on Thursday.

April 25 -

March durable goods orders data were well above expectations for an aircraft-led gain, with the headline number rising by 2.7%.

April 25 -

Jobless claims rose 37,000 to 230,000 in the week ended April 20, according to the Labor Department.

April 25 -

Manufacturing growth in the central Atlantic region was weaker than in March, while “service sector activity was robust in April.”

April 23 -

Sales of new U.S. homes unexpectedly rose in March, climbing to a 16-month high.

April 23 -

The region's services sector “continued to expand” at nearly the same pace as the previous month.

April 23