-

The last day of the month brings a host of economic indicators, which showed much good news for housing and labor, strong consumer confidence, but mostly softer manufacturing conditions.

April 30 -

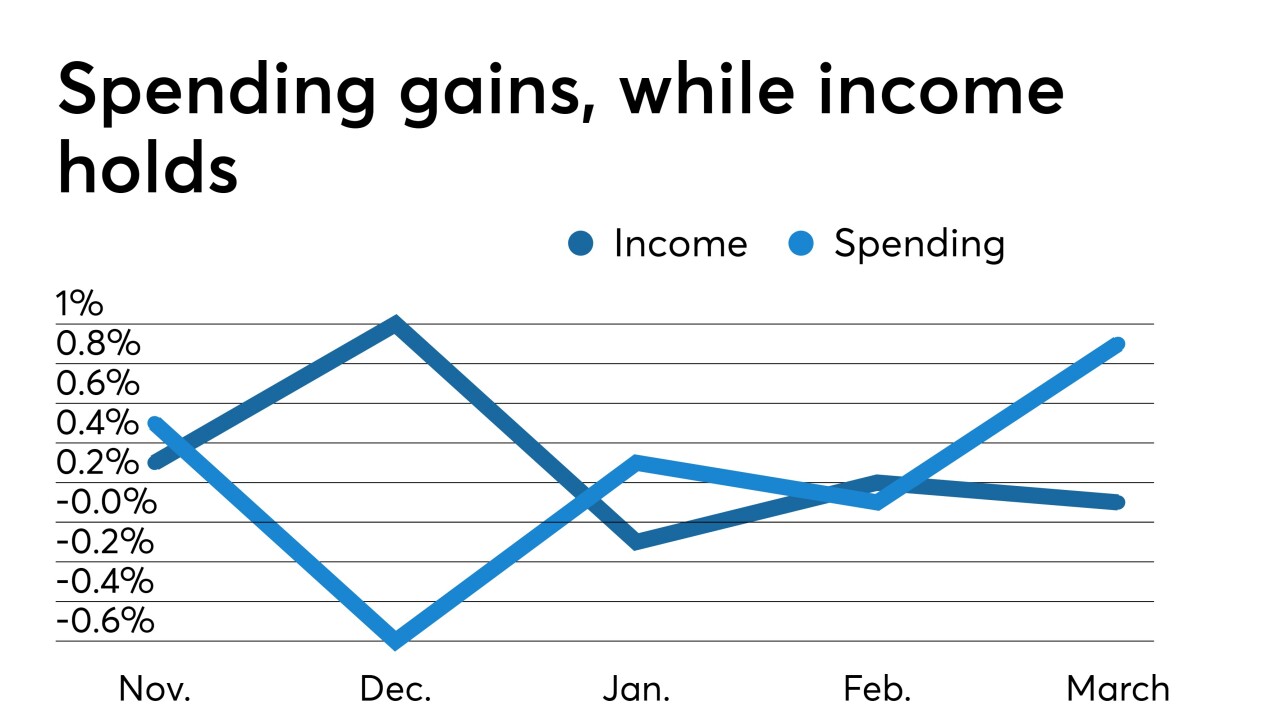

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29 -

U.S. consumer sentiment fell less than initially reported in April.

April 26 -

Gross domestic product expanded at a 3.2% annualized rate in the January-March period, according to the Commerce Department.

April 26 -

Manufacturing activity grew more modestly in April, the Federal Reserve Bank of Kansas City announced on Thursday.

April 25 -

March durable goods orders data were well above expectations for an aircraft-led gain, with the headline number rising by 2.7%.

April 25 -

Jobless claims rose 37,000 to 230,000 in the week ended April 20, according to the Labor Department.

April 25 -

Manufacturing growth in the central Atlantic region was weaker than in March, while “service sector activity was robust in April.”

April 23 -

Sales of new U.S. homes unexpectedly rose in March, climbing to a 16-month high.

April 23 -

The region's services sector “continued to expand” at nearly the same pace as the previous month.

April 23