-

Transportation fare and tax revenues lost to the coronavirus can be countered with federal relief funding, says the Illinois Economic Policy Institute.

March 30 -

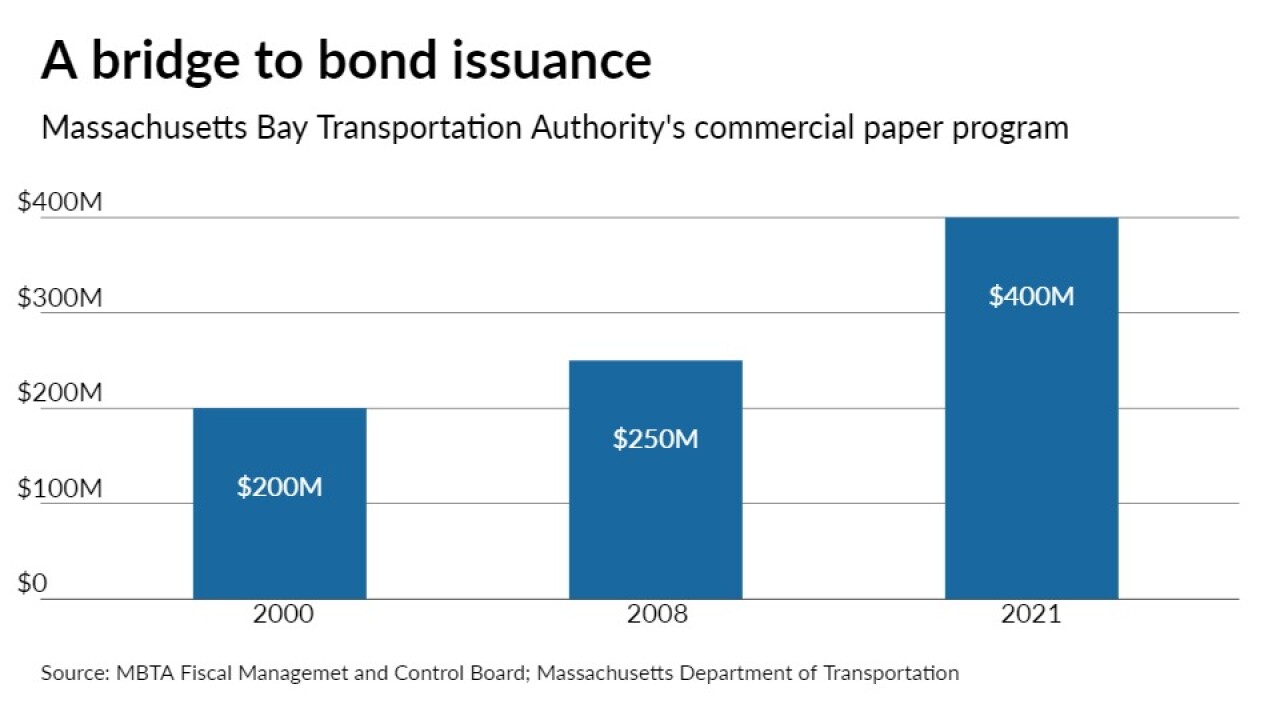

Officials cited borrowing flexibility before a joint meeting of the transit authority's oversight board and the Massachusetts Department of Transportation.

March 30 -

With some light at the end of the pandemic tunnel, the University of Arkansas for Medical Sciences fund growth with $139 million of revenue bonds.

March 29 -

Moody’s followed S&P in lifting Illinois’ outlook to stable, where it stood before the COVID-19 pandemic, but a lot more needs to happen for an upgrade.

March 26 -

The nonprofit hospital sector gets a fiscal shot in the arm from federal actions but margins are likely to remain depressed this year.

March 25 -

A formula revision will boost funding for local governments most in need under the state's payment in lieu of taxes program.

March 25 -

Veneta Dimitrova, senior U.S. economist at Ned Davis Research, says the COVID pandemic showed us the government has more fiscal space than thought. She also discusses inflation, housing, the manufacturing sector, global supply chain challenges and the Fed’s balance sheet. Hosted by Gary Siegel. Taped Feb. 24. (32 minutes)

March 25 -

Under the Transit Tech Lab accelerator program, companies can pilot their technologies with several New York region transportation agencies.

March 24 -

The agency that provides oversight of Chicago and suburban transit boards reports healthier sales tax collections that along with December’s federal relief package nearly wipe out 2021 deficits.

March 23 -

How the industry weathered the worst public health crisis in over 100 years to bring to market the amount of bonds it did, and to recover as it did, is a testament to its resiliency and its necessity for the state and local governments it serves. Join us for perspectives from industry experts on March 31.

March 22 -

The bond insurer adds a second office in the Lone Star State, where it does a large volume of business.

March 19 -

Dynamics at play in New Jersey include the pandemic, an election year, massive borrowing, significant federal aid and a major pension liability problem.

March 19 -

Highlights of that aid include $3 billion for K through 12 schools, $308 million for childcare, and $370 million for rental, mortgage, and homeless assistance.

March 17 -

Advocates for state and budget officials say there is enough ambiguity in the legislation to warrant guidance from the Treasury Department.

March 16 -

A bill backed by the Municipal Employees’ Annuity and Benefit Fund underscores the fiscal strains created by Chicago's pension underfunding.

March 16 -

Denver is selling $274 million of dedicated tax bonds in a deal to fund projects at the National Western Stock Show complex and Colorado Convention Center.

March 15 -

Planning will require favorable tax policies, sophisticated capital programing, bond financing, and pioneering public-private partnerships. It also requires a cohesive national, bipartisan infrastructure plan as a foundation to begin addressing this impending infrastructure crisis.

March 15 Siebert Williams Shank & Co. LLC

Siebert Williams Shank & Co. LLC -

Hank Smith, head of Investment Strategy at Haverford Trust, discusses the upcoming Federal Open Market Committee meeting, the coronavirus pandemic, inflation, and economic growth. He says, “at some point the Fed will have to acknowledge the economy may really take off.” Gary Siegel hosts. (Taped March 2. 26 minutes)

March 11 -

The House voted 220-211 to approve Senate-passed amendments midday Wednesday.

March 10 -

The next phase of pension risk analysis will be different and more challenging: Assessing the long-term impacts of individual jurisdictions’ choices in the context of their unique workforce demographics, benefits and salary structure, and pension funding status.

March 9 Build America Mutual

Build America Mutual