-

Supply ramps up this week to an estimated $13.361 billion, with several billion-dollar pricings on tap.

October 15 -

Florida will use its own cash, not from a refunding bond, to buy up to $500 million of bonds tendered.

October 15 -

Pension analysts are calling for higher contributions even as financial conditions improve.

October 15 -

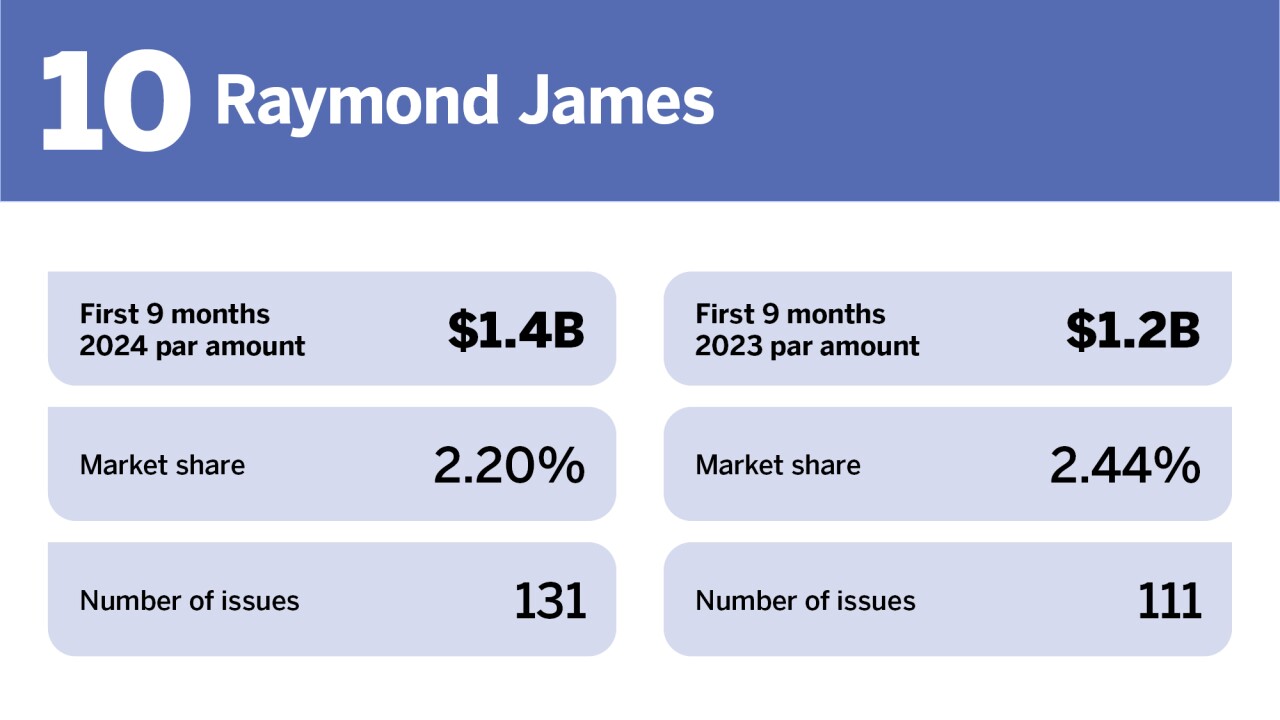

As the underwriter landscape changes, so does the competitive market.

October 15 -

Fitch revised upward its outlook for Marin General Hospital and affirmed its revenue bonds at BBB, and general obligation bonds at AA-minus.

October 9 -

The rating is a new milestone in the state's long road out of legislative dysfunction.

October 8 -

City Comptroller Brad Lander said he's optimistic about the deal, congestion pricing lawsuits and his mayoral campaign.

October 7 -

Enright's passion for infrastructure and complicated deals led him to the cutting edge of municipal financing strategies.

October 4 -

As managing director at Crews & Associates, Susan Reed aims to bring creative ideas and a deep well of experience to bear on challenges facing Indiana issuers.

October 1 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1