-

In the week ended Dec. 1, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose 12 basis points to 4.35% from 4.23% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

December 1 -

Catholic Health Initiatives, one of the nations largest nonprofit health care providers, is in danger of a downgrade from S&P Global Ratings after analysts placed its A-minus rating on its negative watch list.

November 30 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose four basis points to 4.23% in the week ended Nov. 22 from 4.19% in the previous week.

November 22 -

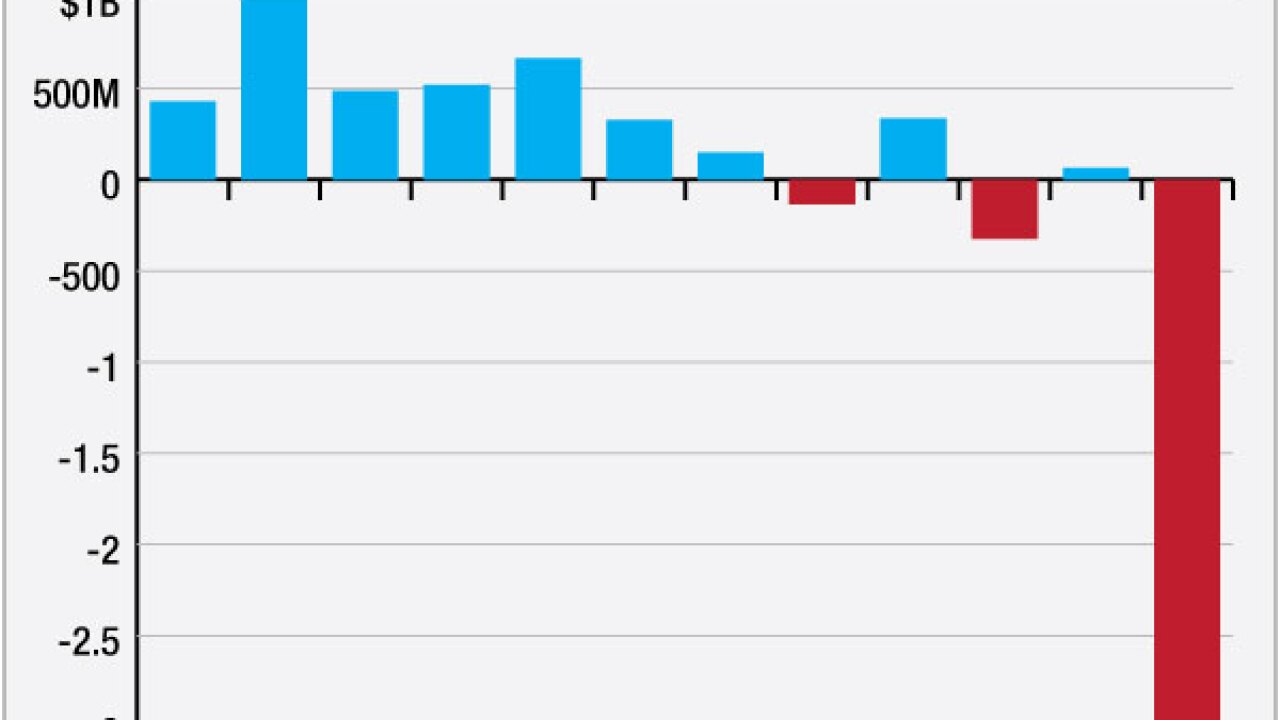

Municipal bond fund flows reversed course as investors pulled cash out at the fastest pace in more than three years, according to weekly Lipper data released late Thursday.

November 18 -

In the week ended Nov. 17, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose 22 basis points to 4.19% from 3.97% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

November 17 -

The Federal Trade Commissions heightened scrutiny and challenge of not-for-profit healthcare mergers may not change much under a Trump administration, law firm Holland & Knight says a report.

November 17 -

As Rep. Devin Nunes joins the executive committee of Trumps transition team, some state and local officials worry he will gain support for his controversial pension bill next year.

November 16 -

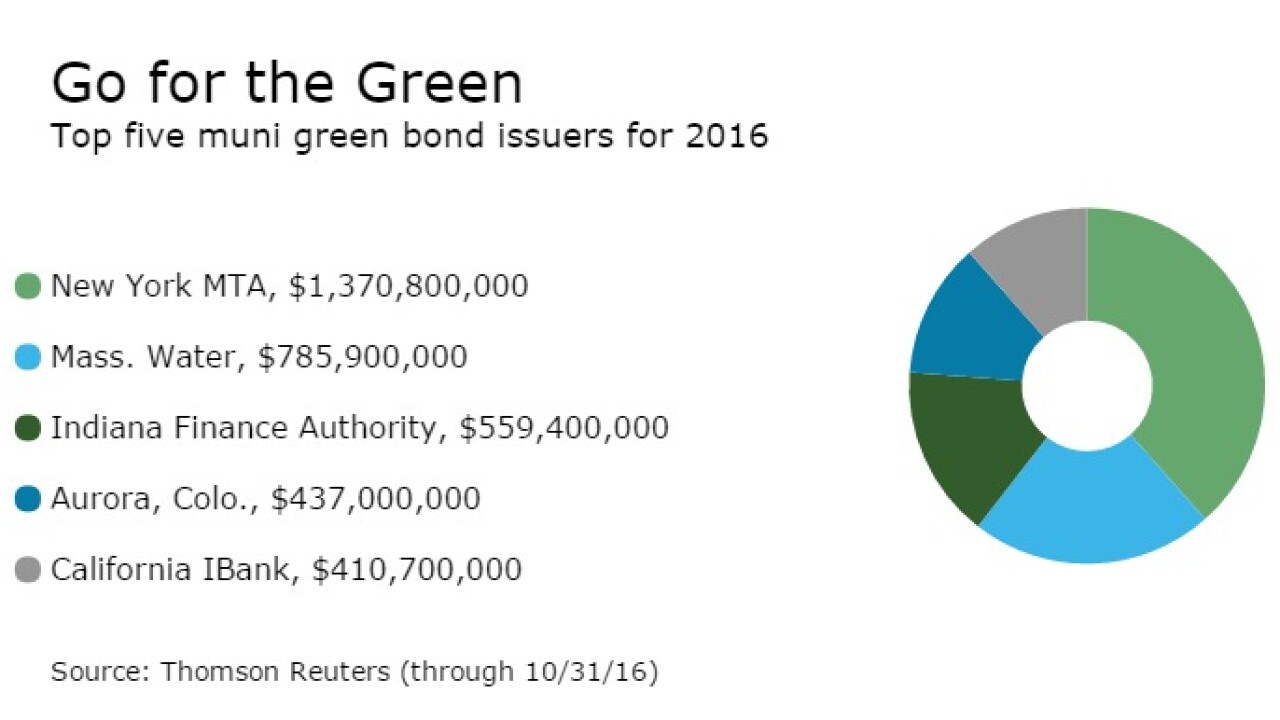

The heightened focus on disclosure in green bonds could inspire better disclosure practices in the larger municipal bond market, S&P Global Ratings said in a report this week.

November 15 -

California's $2 per pack increase on cigarettes is credit negative for tobacco bonds, nationally.

November 14 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose three basis points to 3.97% in the week ended Nov. 10 from 3.94% in the previous week.

November 10 -

While backers tout the benefits of green bond certification, municipal issuers must examine whether it's the best fit. Concerns include costs, procedural burdens and redundancies.

November 10 -

Standard & Poors is reassessing some existing ratings and deferring some new ones in certain sectors because of errors in its credit scoring models.

November 7 -

More than half of the top 50 local governments ranked by outstanding debt by Moodys now have higher pension liabilities than debt, the rating agency said Friday.

November 4 -

Providence, R.I., Mayor Jorge Elorza said his city's three-notch upgrade from Fitch Ratings, to A-minus from BBB-minus, reflects a move in the right direction.

November 4 -

In the week ended Nov. 3, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell one basis point to 3.94% from 3.95% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

November 3 -

With the presidential election just days away, the potential impact on the municipal tax exemption, demand for public debt, and tax reform are among unresolved concerns for buy-side market participants.

November 2 -

Clarity Bidrate Alternative Trading System, a division of Arbor Research & Trading LLC that aims to rejuvenate the variable rate municipal market, has won its first new bond issue.

October 28 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose one basis point to 3.95% in the week ended Oct. 27 from 3.94% in the previous week.

October 27 -

The not-for-profit healthcare sector is holding steady but may have peaked as persistent long-term challenges threaten to undercut gains that have bolstered margins, says S&P Global Ratings health care analyst J. Kevin Holloran.

October 27 -

A large drop in foreclosures through the first half of this year means lower loan losses for state housing finance agencies bond programs, according to a report by Moodys Investors Service.

October 25