-

Alexandra Lebenthal has sold a 49% stake in Lebenthal & Co., an iconic firm in in the municipal market, to South Street Securities.

March 7 - Texas

President Donald Trumps plan to rely on private prisons to house federal inmates and immigration detainees is reviving interest in the high-yield bonds that financed the lockups.

March 6 -

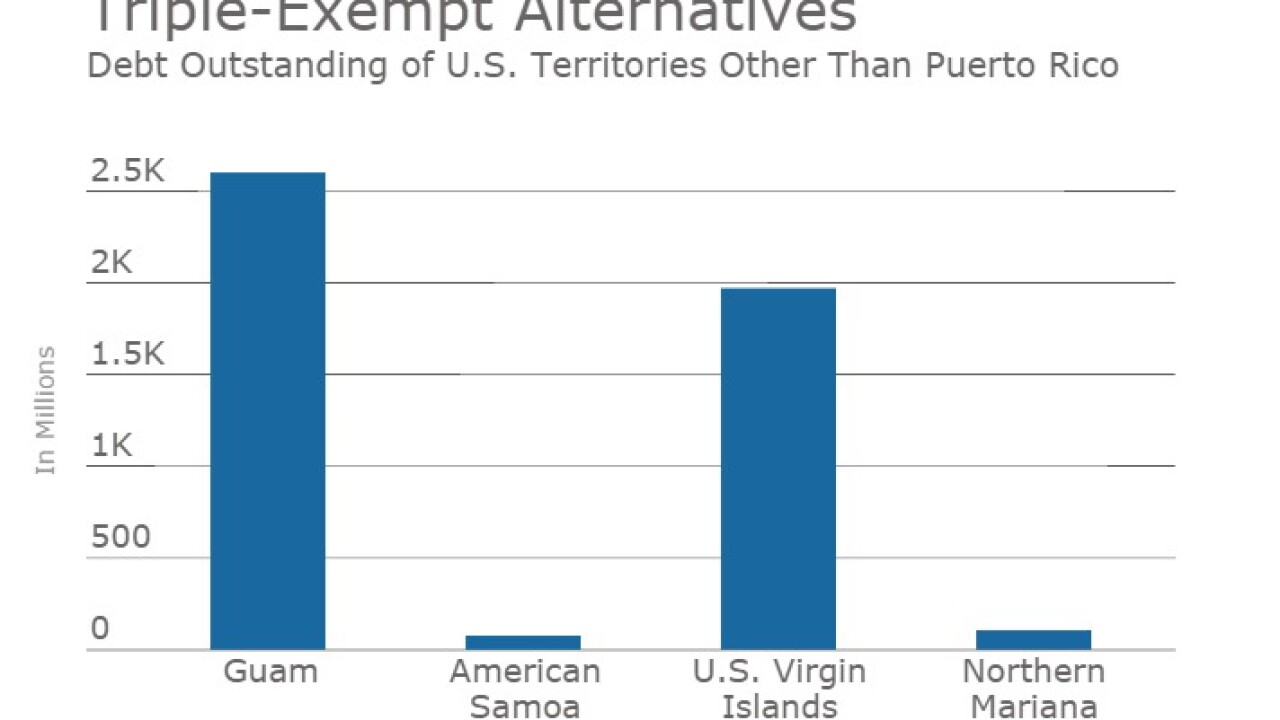

Investors are mindful of the lessons of Puerto Ricos financial distress as they chase higher yields and the benefits of interest payments that arent taxable by the federal government or by any U.S. state or municipality.

March 6 -

In the week ended March 2, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell one basis point to 4.25% from 4.26% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

March 2 -

Despite the U.S. Attorney Generals reversal of plans to end use of private, for-profit prisons, the bonds used to finance the facilities still bear the risk of abrupt policy changes, according to S&P Global Ratings.

February 27 -

Some analysts see an opportunity in hospital bonds, as the spreads in that sector have continued to widen even as the push to repeal the Affordable Care Act loses steam.

February 27 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell two basis points to 4.26% in the latest week from 4.28% in the previous week.

February 23 -

A change in the credit cycle may be in store for the municipal bond market as the combination of wider-than-average credit spreads and a rising-interest-rate climate threaten to restrain demand for high yield paper.

February 21 -

Public pension funds around the country are reducing their return assumptions.

February 17 -

An attempt by an issuer to introduce protective language into bond documents on a taxable municipal hospital deal backfired and was thwarted by bondholders, Adam Cohen, the founder of Covenant Review, told a meeting of the Fixed Income Analysts Society on Thursday night.

February 17 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose three basis points to 4.28% from 4.25% in the previous week.

February 16 -

Municipal investors at client meetings with BlackRock are expressing more concern about rising interest rates than about the potential impact of tax reform to the surprise of officials in the firms muni group.

February 15 -

Short-term note issuance slipped 1.5% in 2016 as continued austerity among state and local governments and attractive long-term interest rates kept the sector in a downward trend.

February 13 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell one basis point to 4.25% in the week ended Feb 10 from 4.26% in the previous week.

February 9 -

Tucked into the Illinois Senate's "Grand Bargain" budget legislation is a bill to authorize a new type of local government bond that would benefit Chicago and other home rule communities.

February 7 -

New language designed to protect investors appeared in the offering documents of a recent municipal bond deal.

February 7 -

Private placement bond deals helped push volume to record levels in 2016, even as some observers remain concerned about transparency and value in the deals.

February 6 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices was steady at 4.26% from the previous week.

February 2 -

Retail municipal investors who prefer discount bonds are becoming more aware of the tax implications of the de minimis rule as interest rates rise.

February 2 -

Fitch Ratings issued a report to criticize Moodys Investors Services recent assessment of Chicago Public Schools.

February 1