-

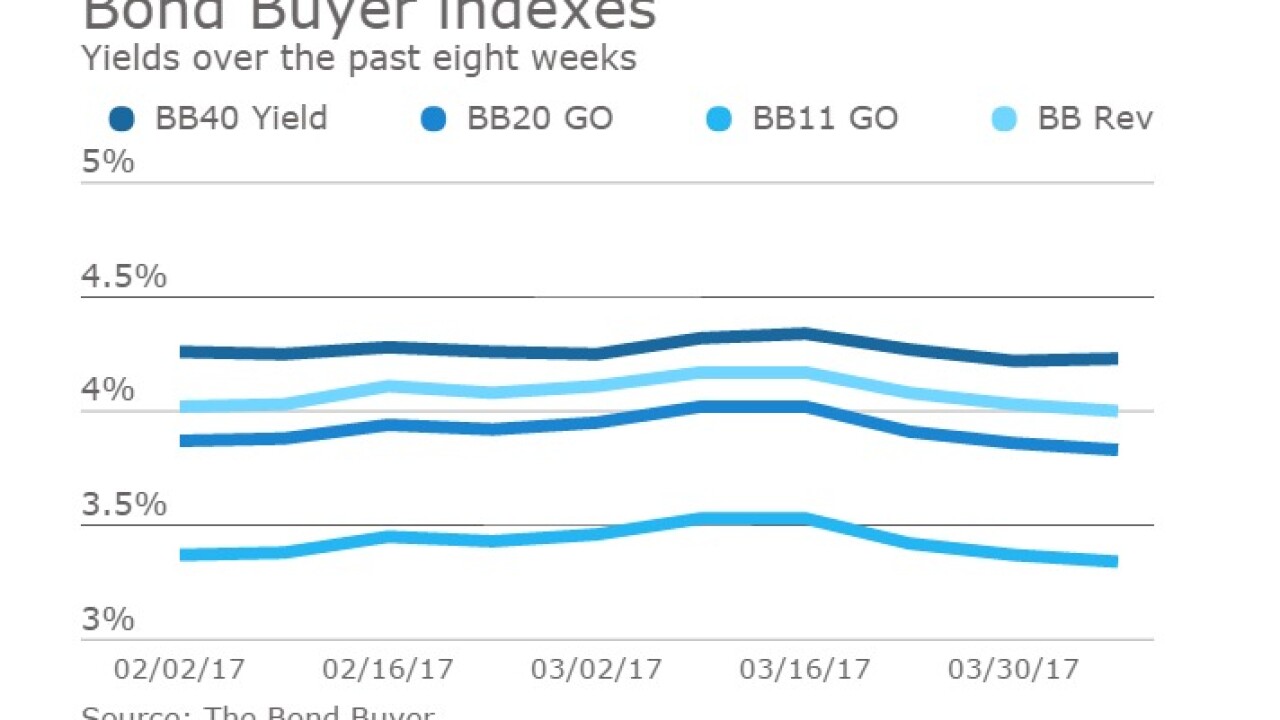

In the week ended April 27, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose four basis points to 4.19% from 4.15% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

April 27 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell three basis points to 4.15% from the previous week's 4.18%.

April 20 -

Are the markets are too focused on legislation being proposed by President Donald Trump and not enough on the strengthening U.S. Economy? Ronald Temple from Lazard Asset Management makes the case, as well as discusses the situation in China and Europe, and the coming cycle of rising inflation and interest rates. Hosted by Chip Barnett.

April 20 -

An emerging network technology that has begun to trickle into the securities industry has potential in the muni market.

April 18 -

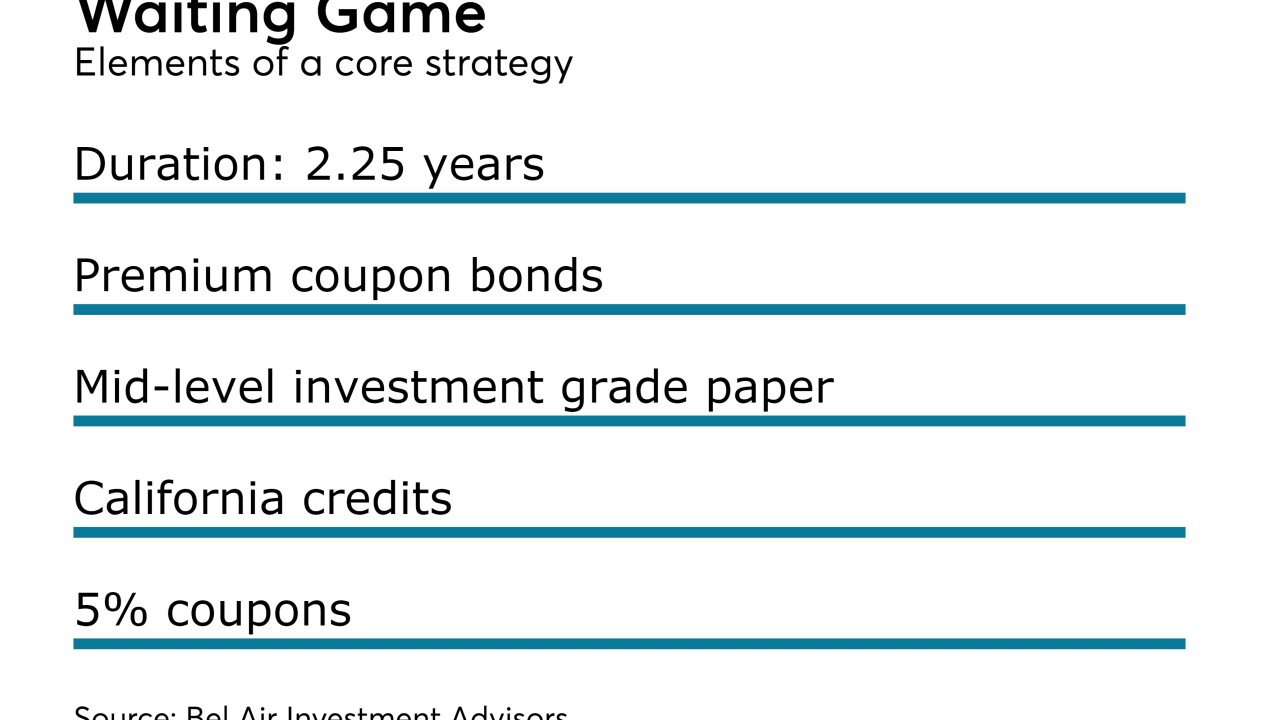

Craig Brothers is among fund managers who are sticking with a shorter duration core strategy as the market awaits the Federal Reserve Board’s June decision on rates.

April 17 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose one basis point to 4.23% from the previous week's 4.22%.

April 6 -

KeyBanc Capital Markets added to its fixed income team with the addition of Chris O’Neil and Jeffrey Tucker to the securitized products sale team.

April 6 -

Construction continues on new nuclear power plants in Georgia and South Carolina after the Westinghouse bankruptcy, but the Chapter 11 filing raises concerns for investors in the units, including public power utilities who issued billions in municipal debt.

March 30 -

In the week ended March 30, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell five basis points to 4.22% from 4.27% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

March 30 -

Now that health care is taking a back seat to tax reform in the Trump administration, municipal portfolio managers are maintaining their investment strategies while bracing for changes on overall market demand and other technicals.

March 30 -

Westinghouse Electric filed for Chapter 11 bankruptcy, raising more questions about the prospects of two under construction nuclear units in the southeast that were partly financed with municipal bonds.

March 29 -

Moody's Investors Service is asking market participants to comment on a proposal to publish certain internal issuer ratings.

March 28 -

Chicago expects the veto-proof passage in early April of an identical bill to the one vetoed Friday that saves its municipal and laborers' pension funds from insolvency, the city's finance chief told investors Monday.

March 27 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell seven basis points to 4.27% in the latest week from 4.34% in the previous week.

March 23 -

The 12-month investment gains of Rhode Island's pension fund topped $1 billion, state General Treasurer Seth Magaziner announced.

March 23 -

Heightened concern about a potential Westinghouse bankruptcy filing resulted in negative outlooks on municipal bonds issued for new nuclear units the company is building in Georgia and South Carolina.

March 22 -

Moodys Investors Service retained a negative outlook on Catholic Health Initiatives $5.7 billion of rated debt after lowering the healthcare giant to Baa1 from A3. The downgrade comes less than a month after a similar move by S&P Global Ratings.

March 22 -

A pension reform group took issue with a University of California report that argues that fully funding pensions may be a "misguided" goal.

March 21 -

Foreign investors increased holdings of municipal bonds by 16% last year, according to report released by Van Eck on Tuesday.

March 21 -

The National Collegiate Athletic Associations 8-year extension of its lucrative broadcast agreement with two major broadcasting networks wasnt enough to stave off a downgrade.

March 17