Craig Brothers is a patient man.

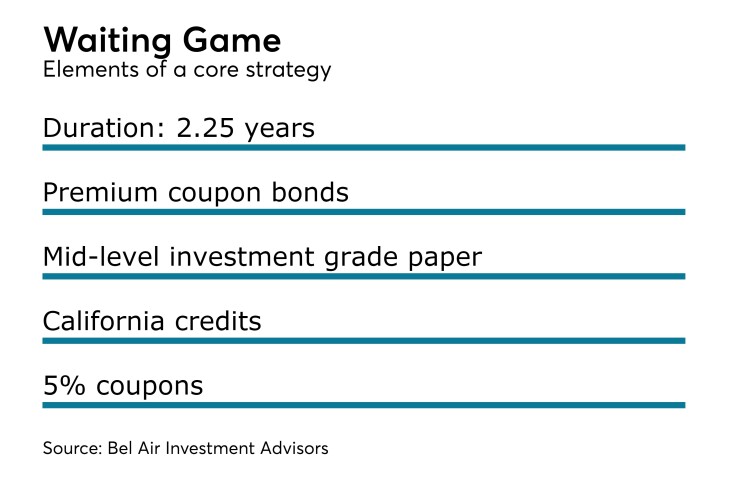

As he awaits the next Federal Reserve interest rate increase, the managing director and senior portfolio manager at Bel Air Investment Advisors continues to shorten duration and boost defensiveness, part of a core strategy to maintain a conservative stance and reduce maturity risk for his high net worth clients.

His strategy also favors premium coupons bonds for their protection against rising rates, buying mid-level investment-grade paper that has a yield kick of up to 40 basis points.

Brothers oversees separately-managed accounts that follow one of three strategies. The core strategy is the most commonly-used among conservative clients, as it is comprised of investment-grade credits and maintains a shorter, defensive duration.

The Los Angeles-based firm overseas the management of $3 billion in its fixed income strategy, nearly all of which consists of municipal assets, according to Brothers.

With the second quarter officially under way, he chose to continue his shorter duration strategy as the market awaits the Federal Reserve Board’s June decision on rates. This has proved to be a prudent way to protect his clients from the volatility in the municipal market ever since the latter half of 2016.

“It paid off when the fourth quarter was a blood bath with yields rising dramatically,” he said in an interview last week.

There is a 63% likelihood that the Fed will raise rates in June, Brothers said, adding that the market begins to price in a rate increase once that expectation rises to north of 70%.

The duration of his core strategy is now at 2.25 years, reduced from 3.2 years in the third quarter, he said.

Brothers is among those managers using or recommending a short duration strategy in a rising rate environment.

“Risk-averse investors, or those concerned about wide fluctuations in the principal value of their bond holdings, should consider a bond strategy with a very short duration,” according to a report on duration by global investment management firm Pimco.

The shorter a bond’s duration, the less volatile it is likely to be, the firm said.

For example, a bond with a one-year duration would only lose 1% in value if rates were to rise by 1%, the report said. In contrast, a bond with a duration of 10 years would lose 10% if rates were to rise by that same 1%.

Pimco said duration can be a useful tool for building bond portfolios and managing risk – and can change depending on a manager’s interest rate outlook.

“If a manager’s outlook indicates that interest rates will be increasing, he or she could shorten the portfolio’s average duration, moving it closer to zero, to minimize the negative effect on values,” Pimco said.

Brothers, who has more than 30 years of experience in the industry, said the duration of the core strategy is going to shorten as he waits for higher rates.

“We are intent to stay where we are – we don’t want to have an all-in bet to remove all our duration,” he said.

He currently aims to protect his core strategy clients from unnecessary interest rate risk by remaining on the ultra-short end of the municipal yield curve between one and five years, after previously favoring the one to 15-year range.

“We sold some of the bonds in the five to 15-year range and moved that money into shorter maturities,” he said, adding that he is also investing new cash and redeploying maturing assets to the short end.

“People who were skewing their portfolios longer were hurt by the fourth quarter,” he added.

The strategy “allowed us to outperform for 2016,” so it made sense to stick with it in 2017 – even though a shorter duration resulted in some underperformance year to date compared with the Merrill Lynch 1 to 7 Year Benchmark that his core strategy follows.

The duration of the core strategy is a little more than six months shy of Merrill’s 2.95 year benchmark duration, according to Brothers.

“We are underperforming because rates have been flat to slightly lower to start the year and our benchmark is longer than us,” he explained. “But we are still being patient while we wait for rates to move up.”

The Fed’s March 15 quarter-point increase of its fed funds target rate to a range of 0.75% to 1% came on the heels of a 25 basis points increase in mid-December to between 0.50% and 0.75%.

The cost of borrowing for mortgages and most other loans for businesses and consumers are tied to the benchmark rate.

His rate expectations are for Treasuries to rise to a target of 2 7/8% -- possibly 3% later this year.

As long as the Fed tightens between 25 and 50 basis points as the market anticipates, he expects his clients to be well positioned going forward.

“The price movement in the fourth quarter is indicative of what we think we will see in the second half of 2017,” Brothers said.

Brothers said two hikes by the Fed could be in store given the likelihood of stronger employment and wage numbers.

He said his core strategy will remain in place barring any significant slowdown in the economy that would cause him to “rethink our stance and add duration,” he said.

Brothers is looking to add the best value by purchasing a wide range of investment-grade California credits from large, frequent state issuers, such as the state of California and Los Angeles.

“There isn’t one credit we focus on – we buy all credits. We have a large number of clients in California so our focus on California is driven by clients here,” he said.

He currently prefers premium coupon bonds – mostly 5% coupons – that offer protection from rising rates and are in demand by a larger universe of buyers, such as institutional accounts and SMAs, compared with retail investors who typically prefer par bonds.

“If you get a big move up in rates the de minimus rule won’t hurt your bonds,” he said.

Besides higher coupons, he also favors an average rating of single A – and those in the mid-level investment-grade range, including A-minus and triple-B rated securities.

Like the premium paper, these bonds are in less demand by true mom and pop retail investors, so “it allows us to find a portion of the rating spectrum that is less followed and generally has more yield,” Brothers said.

By using this structure and credit quality, he said he is currently identifying yield opportunities that provide between 30 and 40 basis points of yield spreads on long paper compared with MMD’s 30-year generic triple-A scale.

Triple-A rated 10 and 30 year bonds yielded 2.13% and 2.94% respectively, as of April 11, according to the GO scale tracked by Municipal Market Data.

Brothers said the spread has narrowed after being as wide as 60 basis points in the fourth quarter, when the market was under pressure following the November election.

He said the spread is narrower in the one to five-year slope that he prefers for the core strategy to maintain a shorter duration ahead of rising rates.

Brothers is active in the municipal market, but he noted that the seasonal slowdown due to the arrival of income tax season in April is often characterized by less new issues in the primary market, thin secondary market supply, and fewer bid lists.

“The market is very slow right now,” he said. “There is not good buying interest and the selling is fairly well contained.”

He anticipated a pick up between May and July – a heavy reinvestment season due to June 1 and July 1 calls, redemptions, and maturing paper – ahead of the typical summer doldrums.

“There’s a period of six week or so three or four times a year where the market is very slow – and I don’t think this year will be any different,” he said.