-

California and Oregon are experiencing yet another record-setting year of wildfires amid increasing uncertainty about FEMA and property insurance backstops.

August 9 -

The past several trading sessions have seen "crazy volatility," said Jennifer Johnston, director of research of municipal bonds at Franklin Templeton.

August 8 -

The company says merging Assured Guaranty Municipal Corp. into Assured Guaranty Inc. will reduce duplication and represents a better use of capital.

July 9 -

The New Terminal One project was able to flex its construction progress, which the P3 backers say may have encouraged investors in a deal upsized by $1 billion.

July 8 -

"The forces of municipal fundamental and technical measures are setting up a reconciliation against higher UST yields," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 3 -

July will see $35.2 billion of redemptions, down 13% month-over-month but still 35% higher than 2024's monthly average of $27 billion, said Pat Luby, head of municipal strategy at CreditSights.

July 3 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28 -

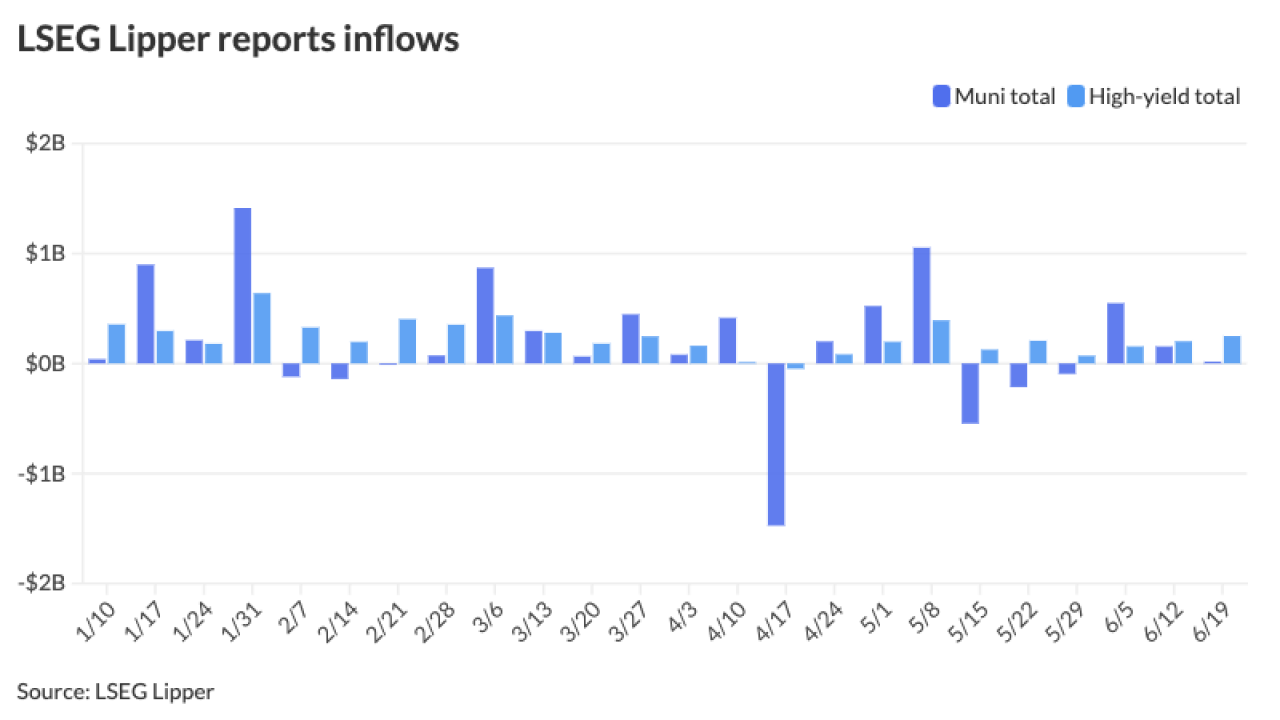

Municipal bond mutual funds saw outflows as investors pulled $498 million from funds after $16 million of inflows the week prior, according to LSEG Lipper. High-yield funds still saw inflows.

June 27 -

Finance officials for the city decided to be the first municipal issuer to use the distributed ledger technology for a $10 million deal, banking on cost savings, better liquidity and more access for retail investors to their bonds. Mayor Tom Koch, CFO Eric Mason and Strategic Asset Manager Rick Coscia say it should be the first of many deals for the industry.

June 25 -

Total volume currently stands at $224.13 billion, up 38.5% from $161.848 billion at this time last year. As the end of the first half approaches, several firms are revisiting their supply projections for the year, given the growth so far this year.

June 25 -

With the "pretty good run" month-to-date, it would not be unexpected to see "the market take a breather, and with a large calendar this coming week, it may again move sideways," said AllianceBernstein strategists in a weekly report.

June 24 -

Broker-dealer Millennium will provide clients with real-time pricing and trade execution capabilities by connecting directly to the Investortools Dealer Network, or IDN.

June 24 -

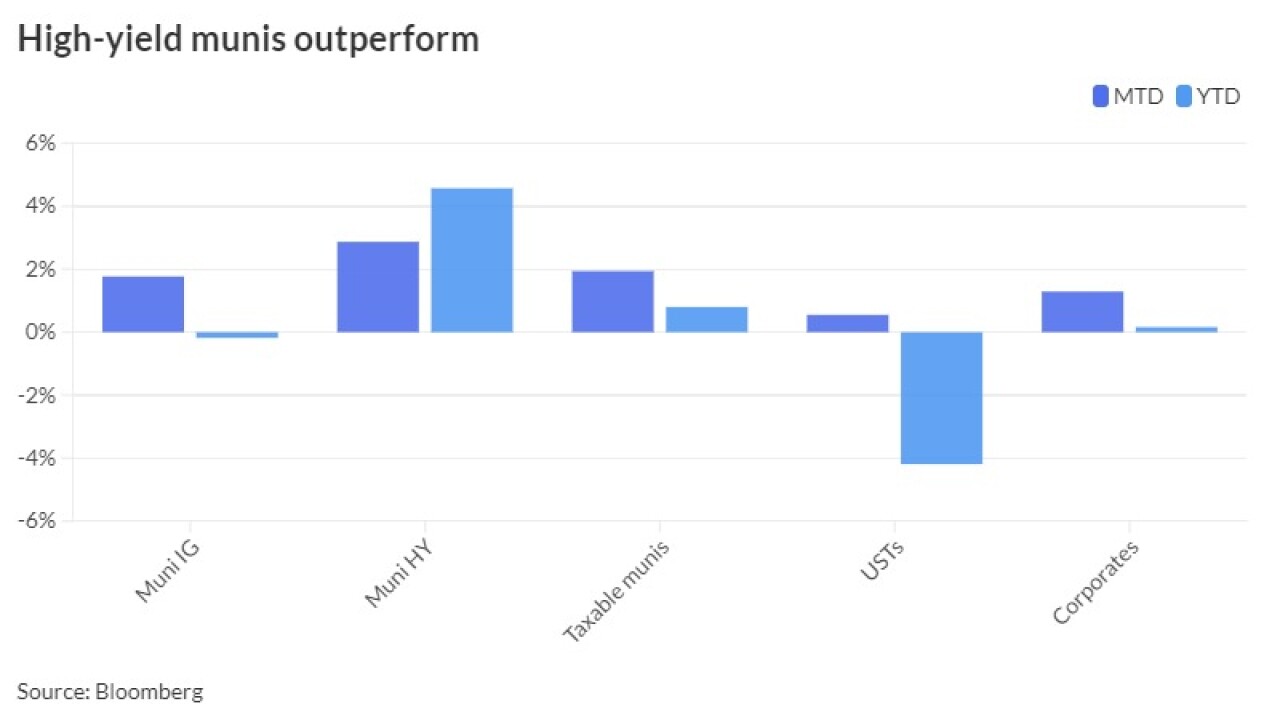

"It is hard to be overly excited about current valuations of tax-exempts relative to Treasuries; however, at tax-adjusted yields (using individual tax brackets), munis look quite attractive compared with other asset classes," noted Barclays PLC.

June 21 -

Municipal bond mutual funds saw small inflows as investors added $16.4 million to the funds after $154.4 million of inflows the week prior, according to LSEG Lipper.

June 20 -

Investors may want to consider non-disclosure of climate hazards as a symbol of non-resilient projects and limited planning.

June 18 -

Household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts and SMAs — rose to $1.779 trillion, up 0.3% from Q4 2023 and from 5.6% in Q1 2023.

June 13 -

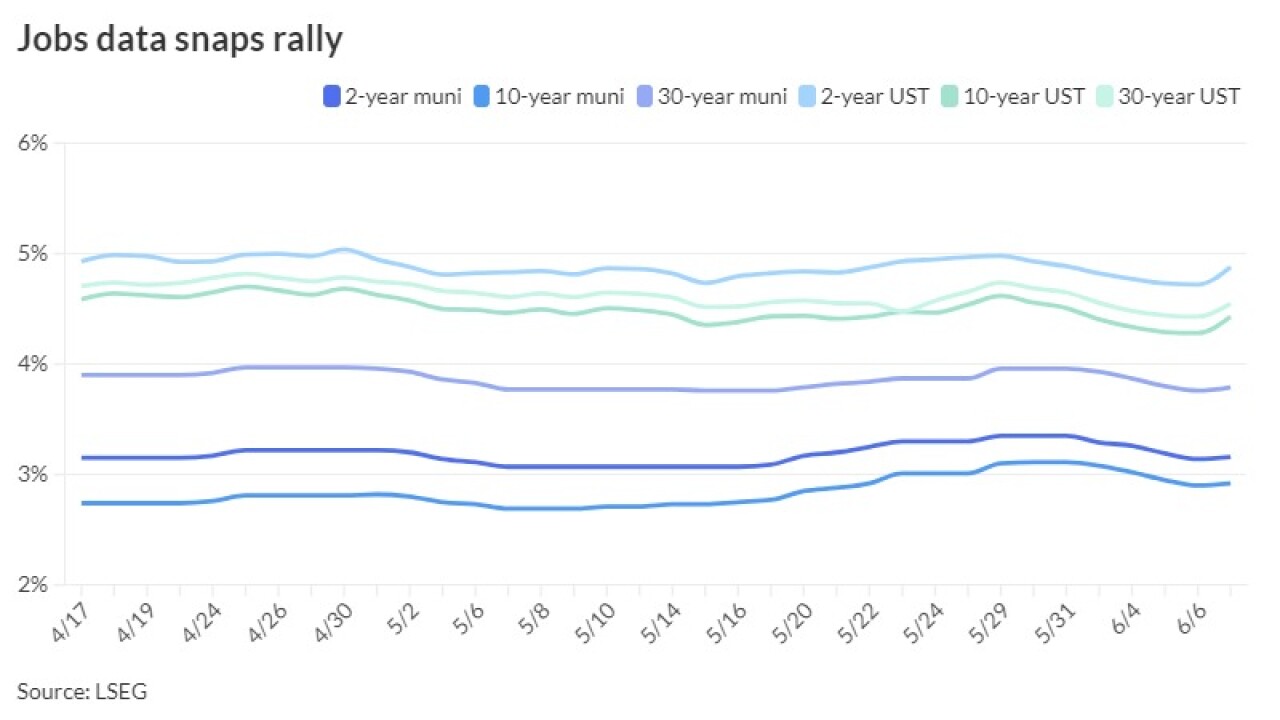

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

June 12 -

Driven by ongoing capital expenditure funding and current refunding opportunities, airport issuance is estimated at $21 billion in 2024, with a slew of from June through September and more planned in December, according to Ramirez.

June 12 -

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

As the public finance landscape evolves with increased philanthropic interest and a focus on climate resilience and community health, it's time for traditional market participants to align their investments with impactful outcomes to drive systemic change and foster equitable growth.

June 7 16Rock

16Rock