-

At $1.8 billion, the tax-exempt and taxable deal is the largest on the calendar this week and it's the latest offering from the city since a $1.2 billion refunding issuance in July.

August 20 -

As investors contemplate rate policy for the remainder of 2024, "there have been a few strategies from which to choose to boost yield — short positioning, curve extension and credit quality," noted Kim Olsan, senior fixed-income portfolio manager at NewSquare Capital.

August 19 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

August 15 -

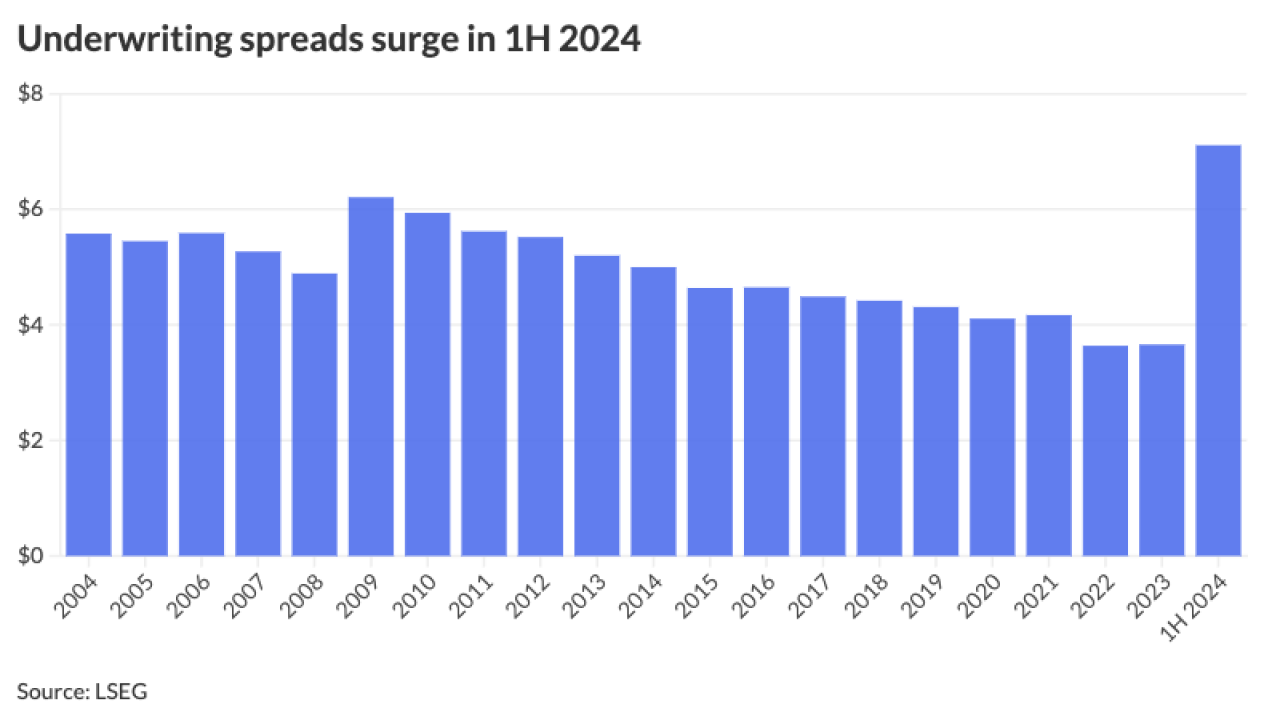

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

August 14 -

"There's an important 'date certain' the market may overreact to, but by and large, [this] week is looking positive given a lighter new- issue calendar," said AllianceBernstein strategists.

August 13 -

A new classification scheme would allow market participants, both on the buy and sell sides, to correctly identify the source and nature of credit risk in their holdings and to aggregate such risk into meaningful sectors that share common risk drivers.

August 13 DPC Data

DPC Data -

"After a long-period of muni yields not being that attractive relative to corporates, that's starting to shift," Charles Schwab's Cooper Howard said.

August 12 -

Muni returns so far in August are in the black, with the Bloomberg Municipal Index at 0.53% this month and 1.04% year to date. High-yield continues to outperform with returns at 0.68% in August and 5.99% in 2024.

August 9 -

In an environment characterized by dwindling enrollment, slowing revenues, and the end of COVID-19 federal aid, small private universities are struggling to remain afloat.

August 9 -

California and Oregon are experiencing yet another record-setting year of wildfires amid increasing uncertainty about FEMA and property insurance backstops.

August 9 -

The past several trading sessions have seen "crazy volatility," said Jennifer Johnston, director of research of municipal bonds at Franklin Templeton.

August 8 -

The company says merging Assured Guaranty Municipal Corp. into Assured Guaranty Inc. will reduce duplication and represents a better use of capital.

July 9 -

The New Terminal One project was able to flex its construction progress, which the P3 backers say may have encouraged investors in a deal upsized by $1 billion.

July 8 -

"The forces of municipal fundamental and technical measures are setting up a reconciliation against higher UST yields," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 3 -

July will see $35.2 billion of redemptions, down 13% month-over-month but still 35% higher than 2024's monthly average of $27 billion, said Pat Luby, head of municipal strategy at CreditSights.

July 3 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28 -

Municipal bond mutual funds saw outflows as investors pulled $498 million from funds after $16 million of inflows the week prior, according to LSEG Lipper. High-yield funds still saw inflows.

June 27 -

Finance officials for the city decided to be the first municipal issuer to use the distributed ledger technology for a $10 million deal, banking on cost savings, better liquidity and more access for retail investors to their bonds. Mayor Tom Koch, CFO Eric Mason and Strategic Asset Manager Rick Coscia say it should be the first of many deals for the industry.

June 25 -

Total volume currently stands at $224.13 billion, up 38.5% from $161.848 billion at this time last year. As the end of the first half approaches, several firms are revisiting their supply projections for the year, given the growth so far this year.

June 25