-

The commission approved $73 million of limited obligation bonds for Rowan County schools.

September 12 -

Issuance as of Wednesday is at $345.327 billion, a 32.7% increase over 2023. The Bond Buyer 30-day visible calendar on Monday was at $20.02 billion, the largest in nearly four years.

September 11 -

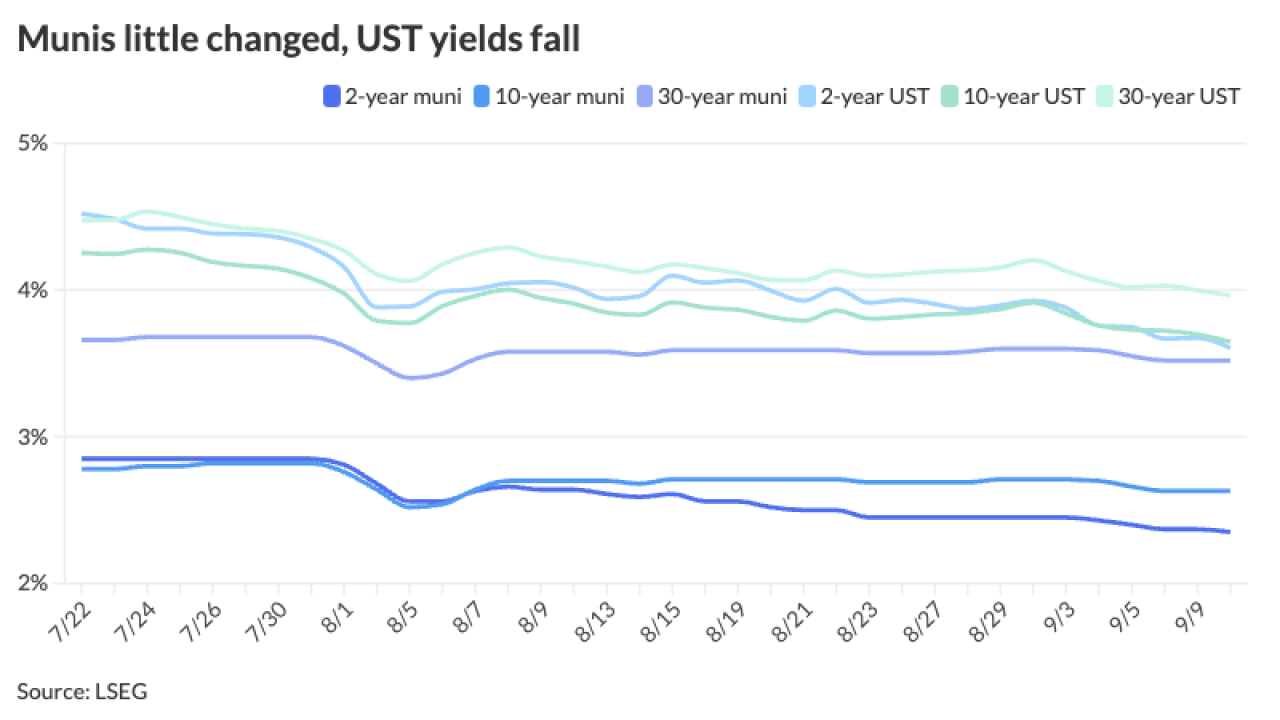

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

September 3 -

Investors will see more than $7.8 billion of supply to start off September, following a record issuance month in August. The calendar is led by the North Texas Tollway Authority's $1.126 billion of system revenue refunding bonds while high-grade Massachusetts leads the competitive slate with $850 million of exempt and taxable general obligation bonds.

August 30 -

The sale follows the utility's successful initiation of two nuclear power units in the last 13 months.

August 29 -

ICE's and MarketAxess's networks are "complementary," said Peter Borstelmann, president of ICE Bonds, as the former is "deep and rich" in the retail wealth segment, while the latter is "deep and rich" in the institutional space.

August 28 -

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

In this episode, Howard Cure, Director of Municipal Bond Research at Evercore Wealth Management, discusses the improving state of public pensions, the ongoing challenges faced by states like New Jersey and Illinois, and the risks associated with pension obligation bonds.

August 20 -

At $1.8 billion, the tax-exempt and taxable deal is the largest on the calendar this week and it's the latest offering from the city since a $1.2 billion refunding issuance in July.

August 20 -

As investors contemplate rate policy for the remainder of 2024, "there have been a few strategies from which to choose to boost yield — short positioning, curve extension and credit quality," noted Kim Olsan, senior fixed-income portfolio manager at NewSquare Capital.

August 19 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

August 15 -

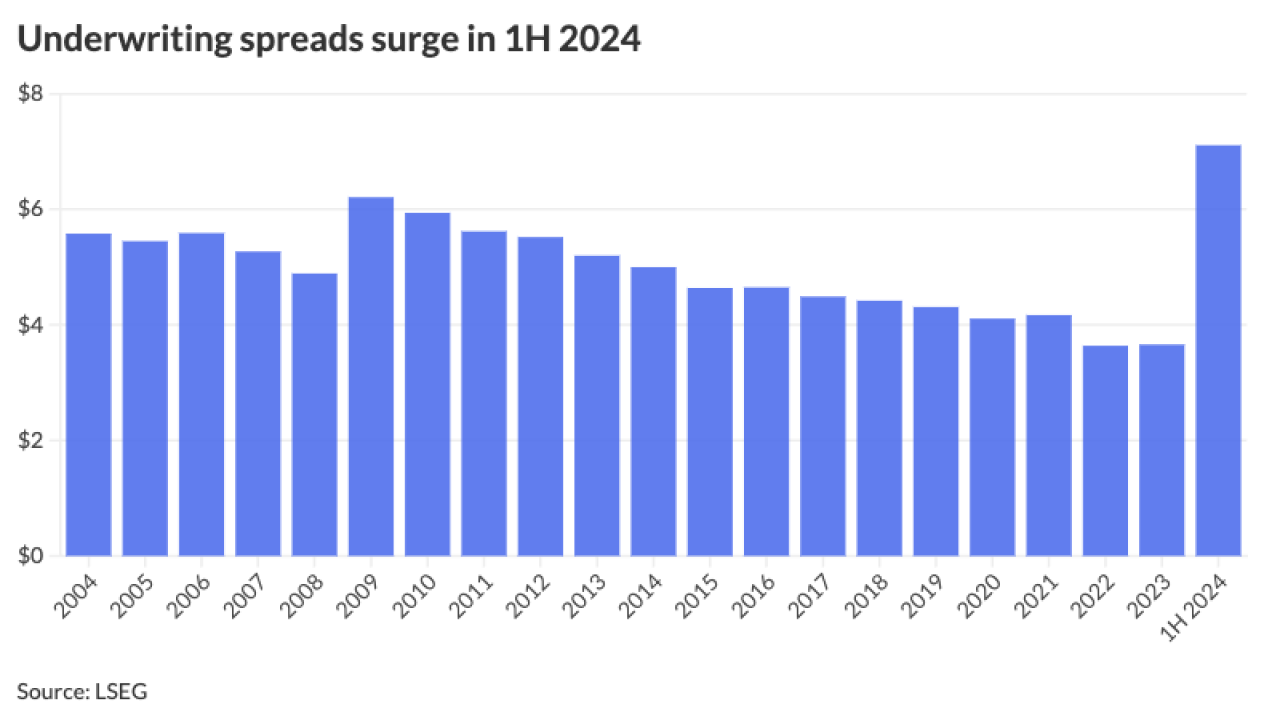

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

August 14 -

"There's an important 'date certain' the market may overreact to, but by and large, [this] week is looking positive given a lighter new- issue calendar," said AllianceBernstein strategists.

August 13 -

A new classification scheme would allow market participants, both on the buy and sell sides, to correctly identify the source and nature of credit risk in their holdings and to aggregate such risk into meaningful sectors that share common risk drivers.

August 13 DPC Data

DPC Data -

"After a long-period of muni yields not being that attractive relative to corporates, that's starting to shift," Charles Schwab's Cooper Howard said.

August 12 -

Muni returns so far in August are in the black, with the Bloomberg Municipal Index at 0.53% this month and 1.04% year to date. High-yield continues to outperform with returns at 0.68% in August and 5.99% in 2024.

August 9 -

In an environment characterized by dwindling enrollment, slowing revenues, and the end of COVID-19 federal aid, small private universities are struggling to remain afloat.

August 9