-

The three new hires, two from Nuveen and one from Lord Abbett, will report directly to the fund's manager John Miller.

September 23 -

"Active ETFs are becoming an integral part of investor portfolios around the world, with financial advisors increasingly incorporating them into their models-based practice," a BlackRock spokesperson said.

September 23 -

"Should September's positive returns hold as we expect, it would mark the fourth consecutive month of positive total returns — the first such period since the five-month period spanning from March through July 2021," BofA strategists Yingchen Li and Ian Rogow said.

September 20 -

Nuveen LLC reached an agreement to sell its 11% equity stake in Vistra Vision to Vistra Corp., that started as municipal bonds ensnared in a bankruptcy.

September 20 -

The record pace of municipal bond supply this year is driven in part by cities and states realizing projects won't get any cheaper if they wait.

September 19 -

"Given increasing student demand for charter schools, we anticipate continued strong supply issued into the municipal market," according to Nuveen.

September 17 -

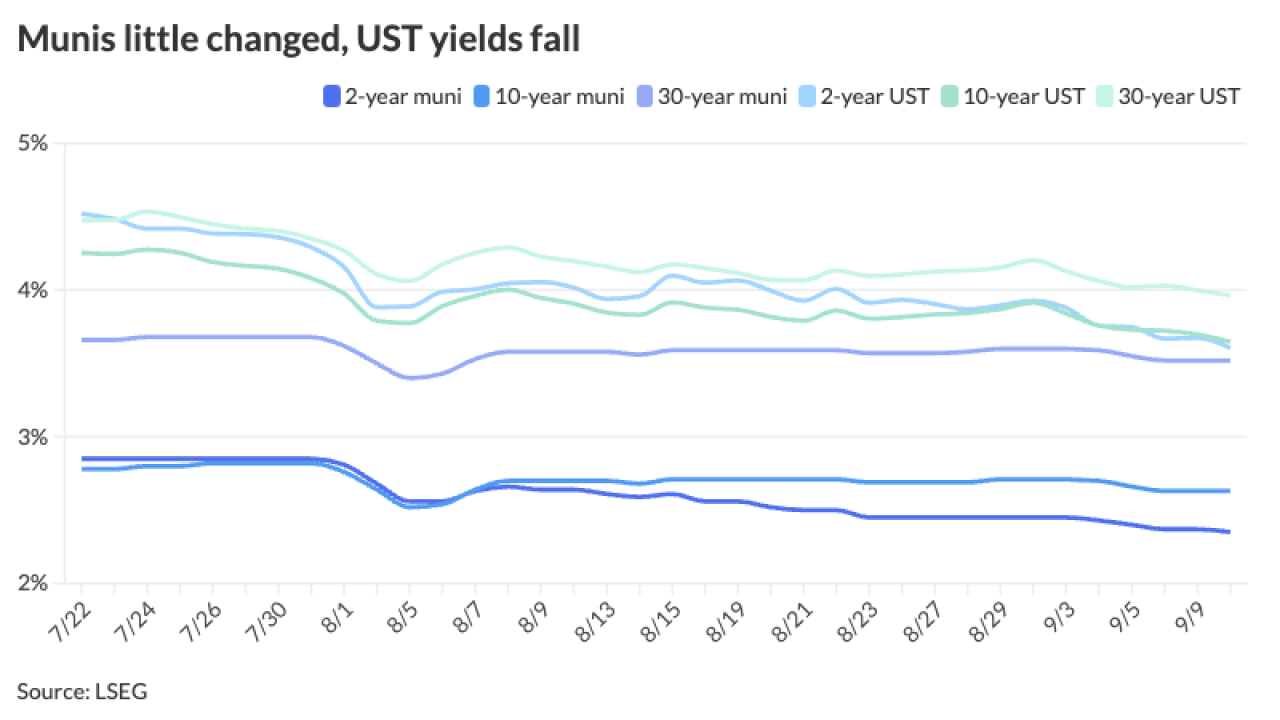

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Household ownership of individual bonds was the largest category of muni ownership at 44.6%, mutual funds at 19.2%, exchange-traded funds at 3.1% and U.S. banks at 12.4%. While not detailed in the Federal Reserve data, SMAs may hold up to $1.6 trillion currently.

September 13 -

California's state government typically pushes out billions of dollars of debt from August to November. This year there may be a shift in buy side sentiment.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

The commission approved $73 million of limited obligation bonds for Rowan County schools.

September 12 -

Issuance as of Wednesday is at $345.327 billion, a 32.7% increase over 2023. The Bond Buyer 30-day visible calendar on Monday was at $20.02 billion, the largest in nearly four years.

September 11 -

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

September 3 -

Investors will see more than $7.8 billion of supply to start off September, following a record issuance month in August. The calendar is led by the North Texas Tollway Authority's $1.126 billion of system revenue refunding bonds while high-grade Massachusetts leads the competitive slate with $850 million of exempt and taxable general obligation bonds.

August 30 -

The sale follows the utility's successful initiation of two nuclear power units in the last 13 months.

August 29 -

ICE's and MarketAxess's networks are "complementary," said Peter Borstelmann, president of ICE Bonds, as the former is "deep and rich" in the retail wealth segment, while the latter is "deep and rich" in the institutional space.

August 28 -

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

In this episode, Howard Cure, Director of Municipal Bond Research at Evercore Wealth Management, discusses the improving state of public pensions, the ongoing challenges faced by states like New Jersey and Illinois, and the risks associated with pension obligation bonds.

August 20