-

Nuveen LLC reached an agreement to sell its 11% equity stake in Vistra Vision to Vistra Corp., that started as municipal bonds ensnared in a bankruptcy.

September 20 -

The record pace of municipal bond supply this year is driven in part by cities and states realizing projects won't get any cheaper if they wait.

September 19 -

"Given increasing student demand for charter schools, we anticipate continued strong supply issued into the municipal market," according to Nuveen.

September 17 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Household ownership of individual bonds was the largest category of muni ownership at 44.6%, mutual funds at 19.2%, exchange-traded funds at 3.1% and U.S. banks at 12.4%. While not detailed in the Federal Reserve data, SMAs may hold up to $1.6 trillion currently.

September 13 -

California's state government typically pushes out billions of dollars of debt from August to November. This year there may be a shift in buy side sentiment.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

The commission approved $73 million of limited obligation bonds for Rowan County schools.

September 12 -

Issuance as of Wednesday is at $345.327 billion, a 32.7% increase over 2023. The Bond Buyer 30-day visible calendar on Monday was at $20.02 billion, the largest in nearly four years.

September 11 -

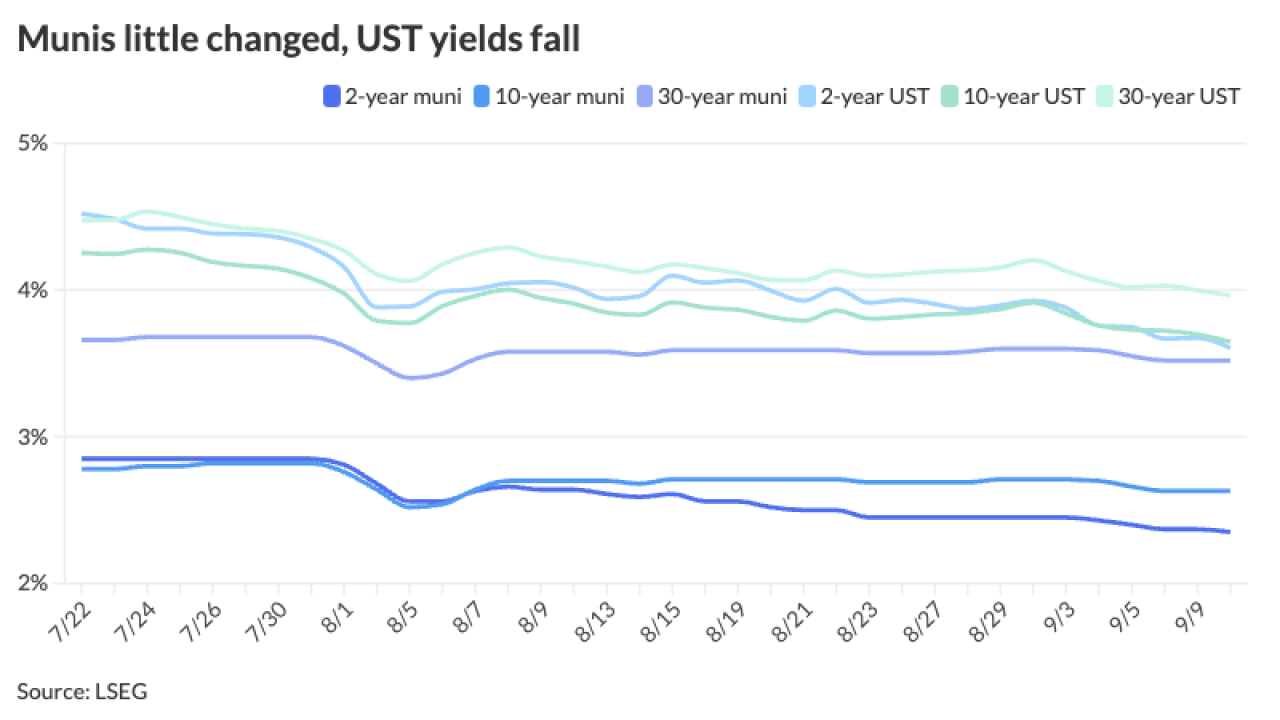

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10