-

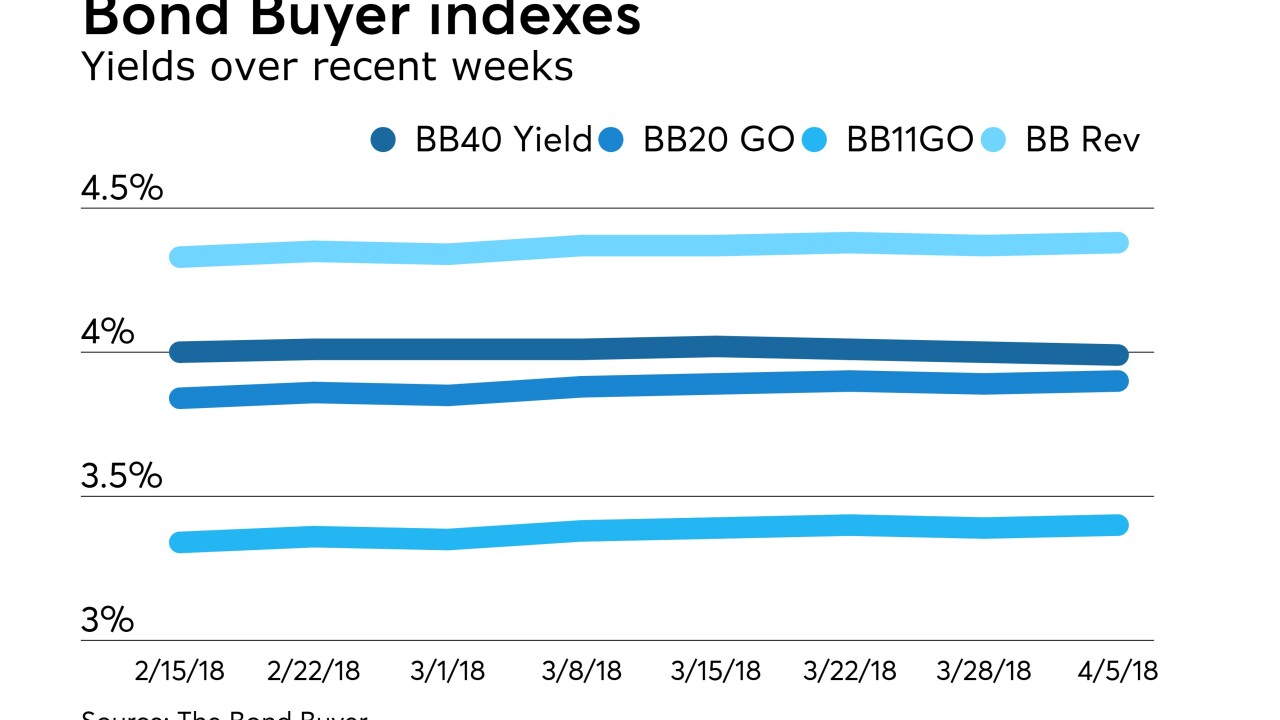

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dipped to 3.99% from 4.00% last week.

April 5 -

After a quarter marked by increased interest in taxable issuance, strengthened state support for local credits, and rising demand from investors seeking shelter from volatility, the municipal market is adapting to its new tax law realities.

March 29John Hallacy Consulting LLC -

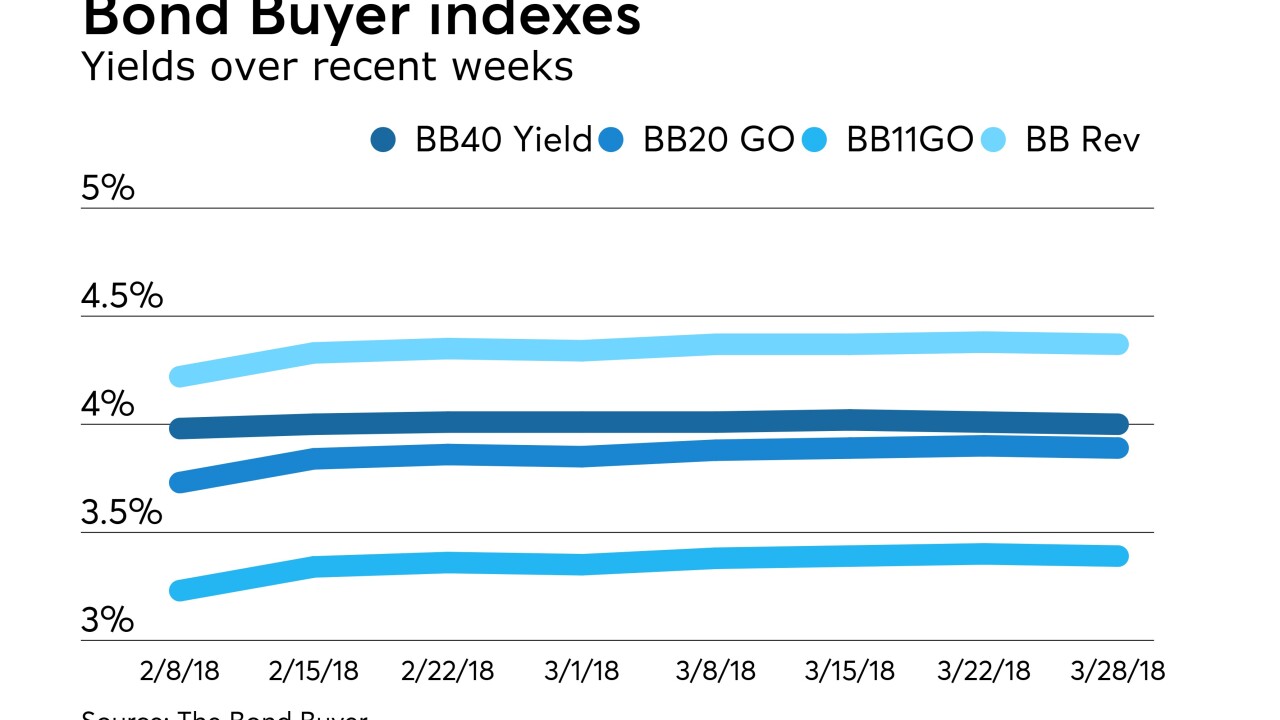

In the week ended March 28, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell to 4.00% from 4.01% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

March 28 -

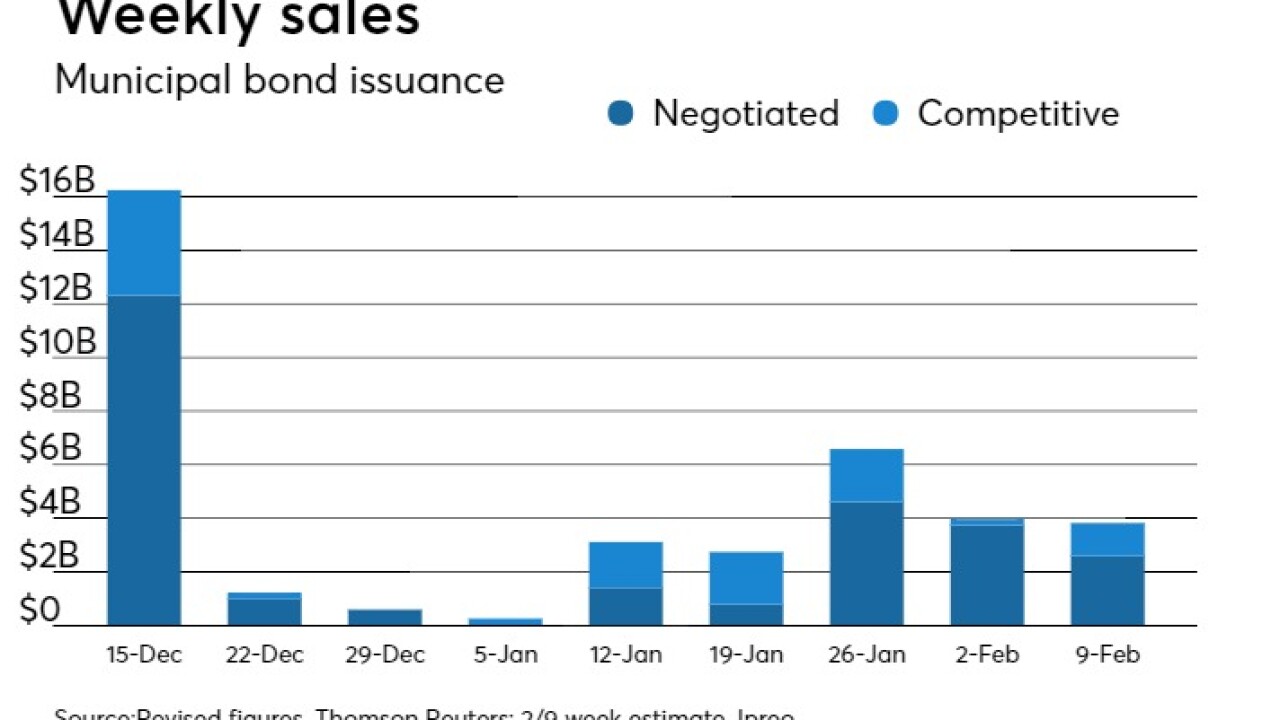

This week's miniature muni slate of under $3 billion means deals should have little trouble attracting investors.

March 19 -

In the week ended March 15, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 4.02% from 4.01% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

March 15 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged for the second week in a row at 4.01%.

March 8 -

Inaction, significant new debt and failure to control labor costs and other cost drivers could pose major bondholder risks, says a Gurtin report.

February 20 -

“Given the recent market volatility, it’s imperative that you stress test potential purchases under various rate scenarios,” says Jonathan Law at Advisors Asset Management.

February 16 -

Analysts say states' and cities' unfunded infrastructure should be viewed as a liability, along with debt, pensions and other post-employment benefits.

February 14 -

Wisconsin is conducting a request for qualifications to establish senior- and co-manager underwriting pools.

February 6 -

Although market conditions are not pristine, with rising yields and little primary action, market participants expressed reason to believe the first week of February will be a positive one.

February 2 -

Ronald Schwartz of Seix Investment Advisors resolves to upgrade credit, keep duration neutral to shorter, and remain selective about investments.

February 2 -

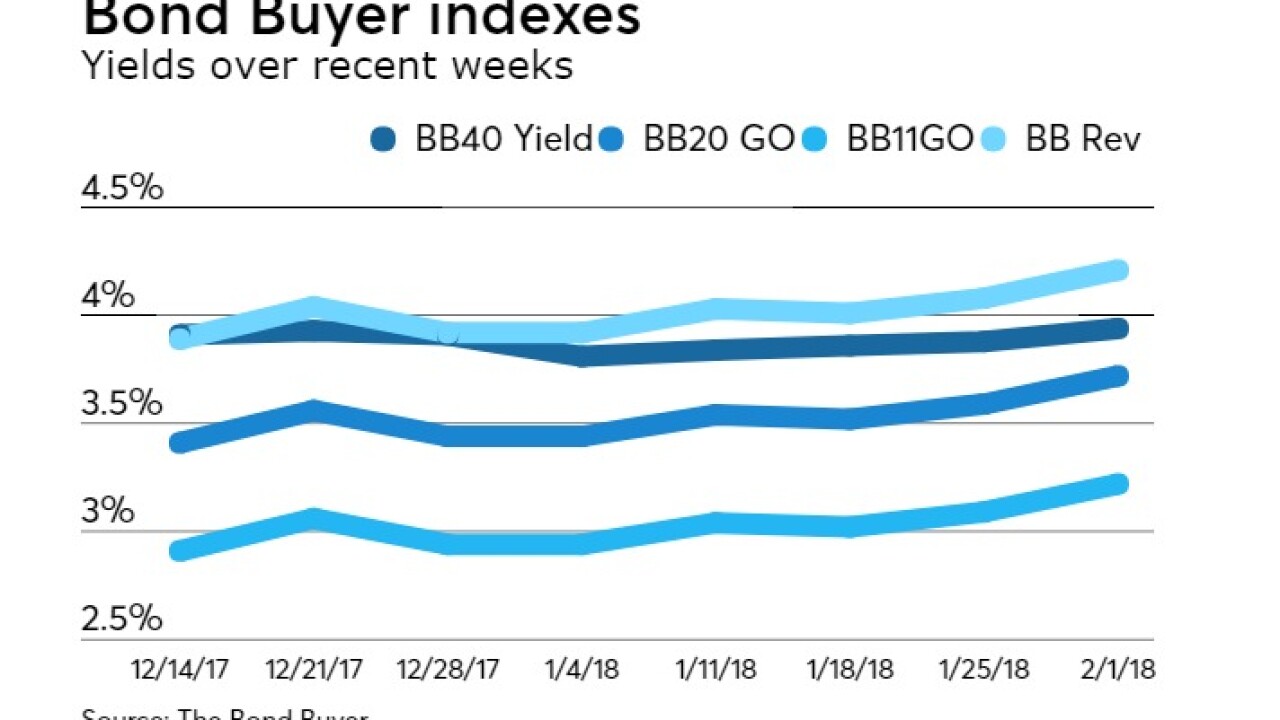

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.94% from 3.88% last week.

February 1 -

It will take some time to see how both tax reform and infrastructure makes an impression on the muni market, said panelists at The Bond Buyer's National Outlook 2018 Conference.

January 31 -

In the week ended Jan. 25, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.88% from 3.86% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 25 -

The cloud-based application is designed to help smaller firms access data on a broader universe of bonds.

January 23 -

The index's yield to maturity ticked up two basis points to 3.86%, while the 11-bond, 20-bond, and revenue bond indexes dipped a pair.

January 18 -

In the week ended Jan. 11, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.84% from 3.81% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 11 -

Dawn Mangerson, senior portfolio manager at McDonnell Investment Management talks about the ramifications of the new tax legislation and articulates her concerns for municipals in 2018. Aaron Weitzman and Chip Barnett co-host.

January 11 -

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell 10 basis points to 3.81% in the week ended Jan. 4, from 3.81% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 5