-

April finished with $23.7 billion of issuance, a 15% decline from the $27.9 billion in April 2019. Volatility from the pandemic has caused erratic swings in benchmark yields, resulting in the lowest muni volume total in the month since 2011.

April 30 -

Municipal bond issuance was $67.88 billion after the first two months of 2020 and was on pace to easily eclipse the $400 billion mark — then COVID-19 completely turned the market upside down.

March 31 -

Taxable bonds and COVID-19 are two of the main catalysts that helped February municipal bond volume ascend to its highest level since at least 1986.

February 28 -

Issuers in the Far West sold $85 billion of municipal bonds in 2019, a 23% increase from 2018.

February 27 -

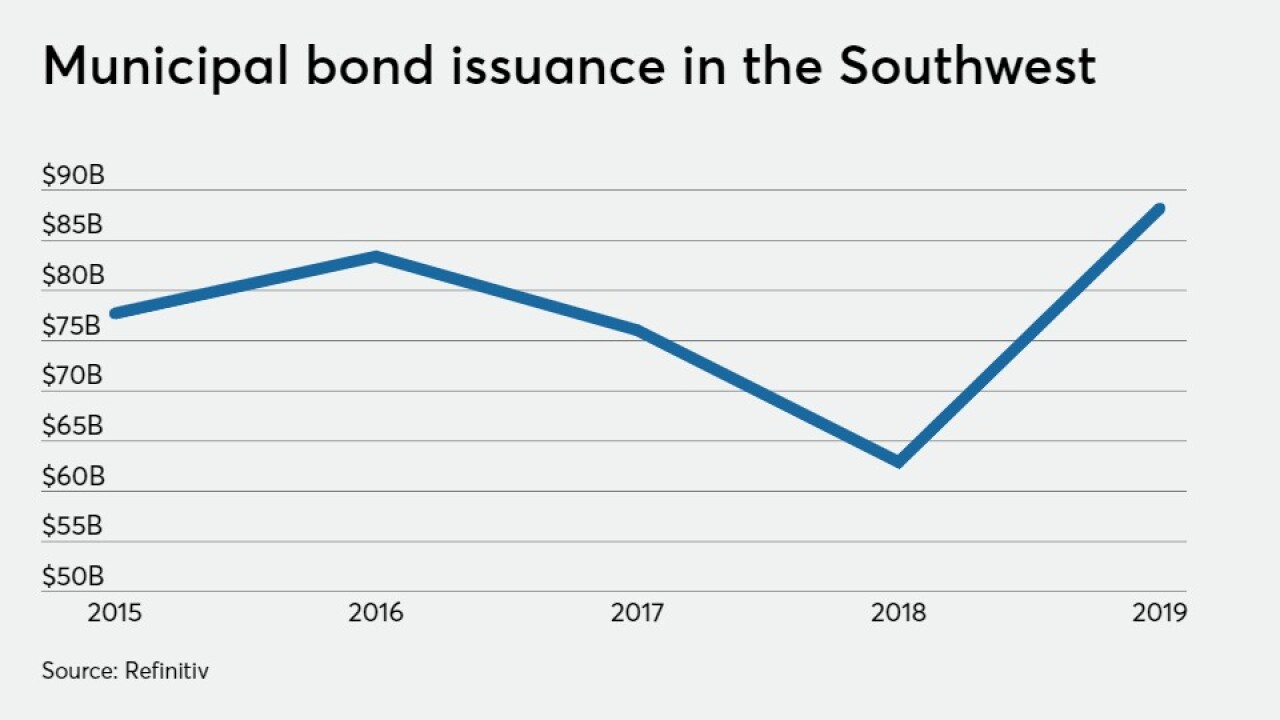

Refundings and taxable deals were also up substantially, driving the region to $75 billion of municipal bond volume, up 32.6% from 2018.

February 26 -

Taxable refundings caught on in the Midwest as they did elsewhere in the nation, helping the region post a 19% volume gain.

February 25 -

Issuers in the region sold $78.2 billion of bonds in 2019, a 24% year-over-year gain driven by growth in Texas and Colorado.

February 24 -

For the third time in four years, long-term municipal bond volume has surpassed the $400 billion mark — this time thanks to a second half surge in taxable issuance that took the market by storm.

February 24 -

While these were the percentage growth leaders, education and transportation had the biggest dollar growth.

February 24 -

The region's bond issuers sold $113.3 billion of debt in 2019, a 16.8% increase from 2018 fueled largely by a spike in taxable deals.

February 21 -

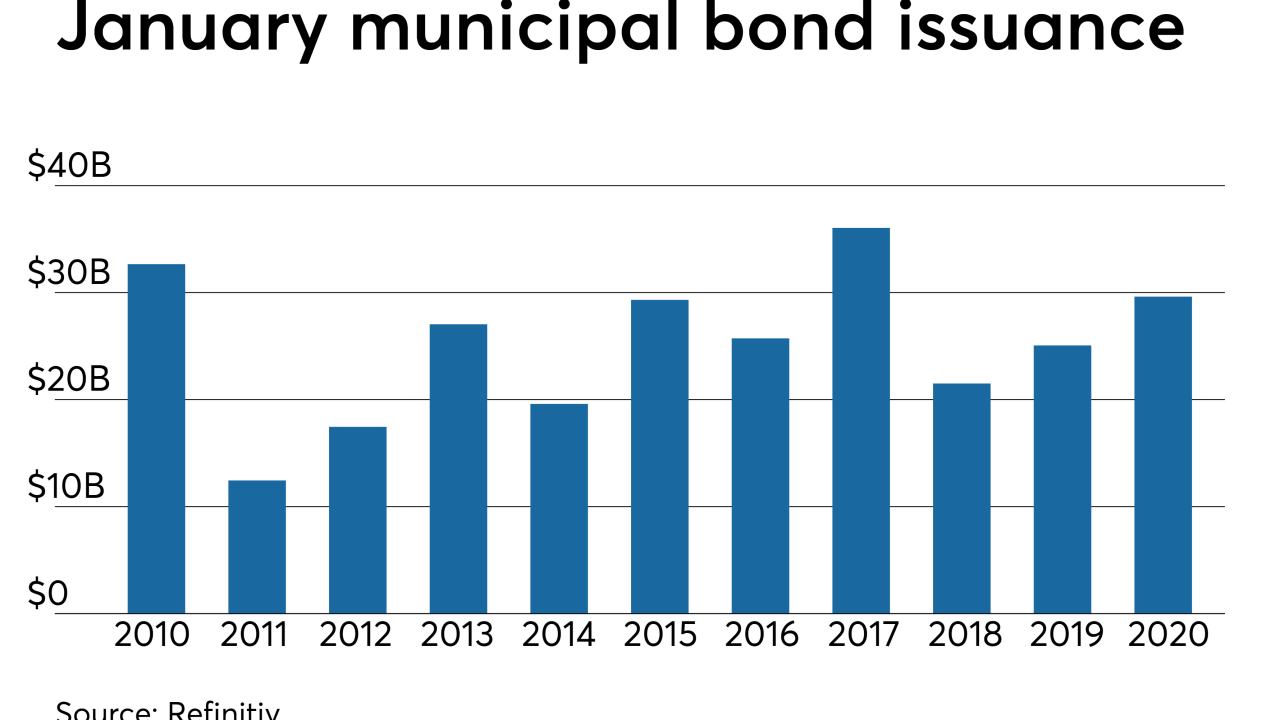

Thanks to the taxable tear, the municipal market saw the third highest volume for the month of January in the past 10 years.

January 31 -

The municipal bond market eclipsed the $400 billion mark for the fourth time since 2010, thanks to taxable trend that led to a vault in fourth quarter volume.

December 31 -

State government issuers are expected to sell $4.68 billion of new money bonds in fiscal 2020, a 6.5% increase, according to the Texas Bond Review Board.

December 30 -

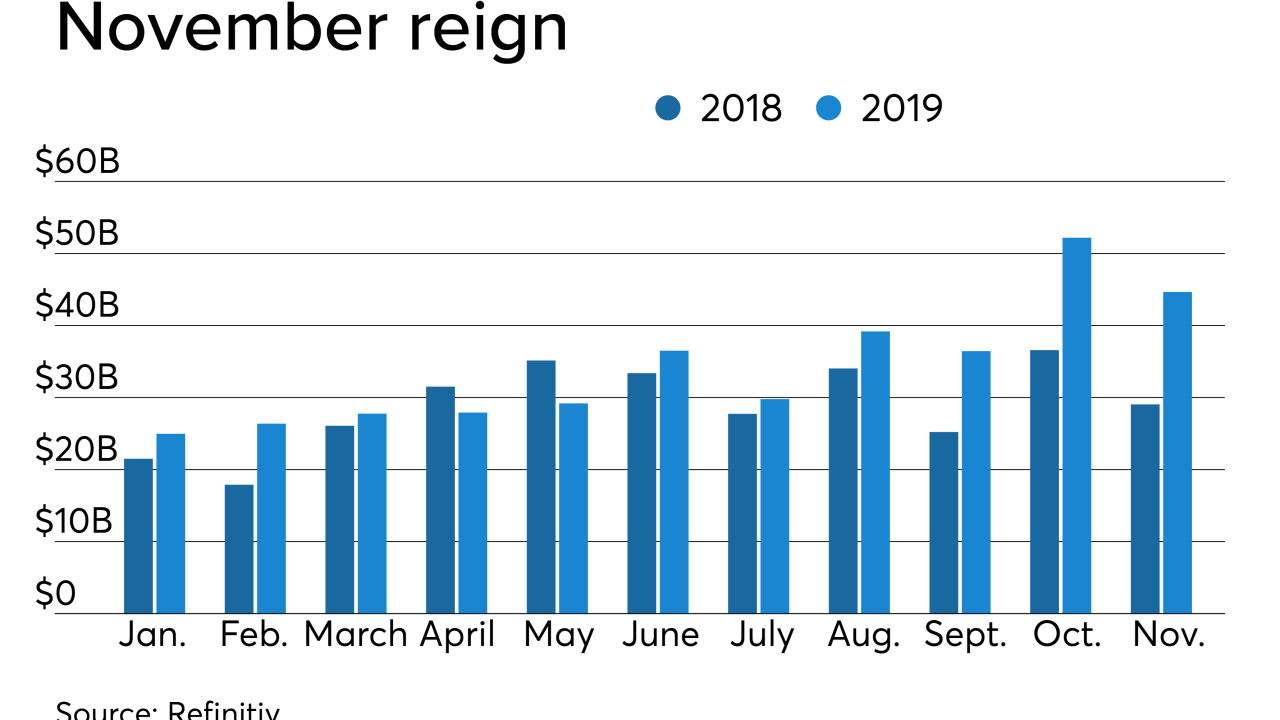

Continued gains attributed to increase in taxable refunding issuance.

November 27 -

The volume boom accelerated in October, with taxables accounting for about a quarter of the supply.

October 31 -

Municipal bond volume continues to accelerate, closing out the month of September 39.1% higher and the quarter 17.8% higher than a year earlier, as issuers flocked to market with taxable deals.

September 30 -

Volume bounced back from second lowest monthly total of the year in July as yields plunged to historic lows and issuers came out in droves.

August 30 -

Two Virgin Trains USA deals from Florida helped push the region's volume up 9.8% over last year, making it one of only two regions to sell more bonds.

August 21 -

Municipal bond issuers in the Midwest recorded a healthy year-over-year volume gain, in contrast to flat nationwide numbers.

August 20 -

Refundings rebounded in the first half of 2019, but total bond volume across the Southwest fell to a six-year low.

August 19