-

Developers say construction will continue on the 310-unit apartment complex in Gainesville, near the University of Florida, during the Chapter 11 process.

May 13 -

The Westin Lombard hotel and conference center in Chicago's suburbs dipped into debt reserves to cover operations after closing in response to the pandemic.

May 11 -

The court filings could directly impact about $6 billion of bonds and $15 billion more indirectly.

May 1 -

California's response to COVID-19 became a factor in Verity Health System's Chapter 11 proceedings.

April 30 -

The Center on Budget and Policy Priorities said bankruptcy "could significantly raise states' cost of issuing bonds to pay for major transportation projects and other investments that boost the economy."

April 24 -

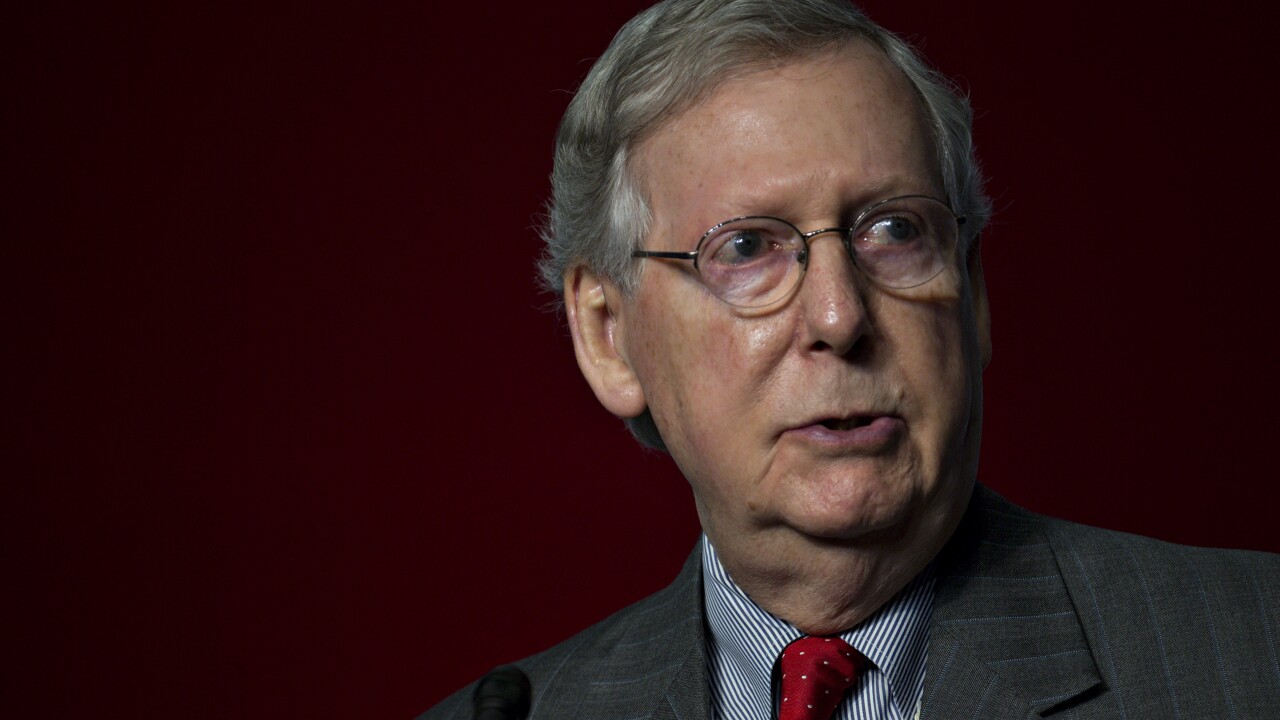

Senate Majority Leader Mitch McConnell said Wednesday he favors allowing states struggling with high public employee pension costs amid the burdens of the pandemic response to declare bankruptcy rather than giving them a federal bailout.

April 22 -

The Puerto Rico Oversight Board had asked for the postponement, citing the impact of COVID-19 and its possible financial impact on PREPA.

April 2 -

Smith, who headed the restructuring practice at Chicago-based McDermott Will & Emery, worked on nearly every major muni bankruptcy of the past 20 years.

March 26 -

Judges said the district court judge was reasonable in her treatment of the case differently from that of a corporate bankruptcy.

March 20 -

Puerto Rico Gov. Wanda Vázquez Garced issued an order for all residents except a few classes of essential employees to remain at home.

March 18 -

Vallejo, California, benefited from last week's record-low municipal market rates when it finally sold its water revenue bond refunding.

March 4 -

The National Museum of American Jewish History in Philadelphia filed for Chapter 11 this week, burdened by debt sold to construct its building.

March 3 -

Spiotto, considered the "dean of municipal restructuring," died suddenly on Thursday.

February 28 -

The Illinois attorney general's office is also believed to be looking into the foundation, which issued $170 million of tax-exempt bonds that have defaulted.

February 26 -

Bankruptcy hearings are underway for Lindan Properties, one of five troubled bond-financed Better Housing Foundation affordable housing portfolios in the area.

February 24 -

The state conduit that issued $170 million of defaulted Better Housing Foundation bonds is weighing in as S&P prepares housing bond criteria changes.

February 10 -

Recoveries would be from 65% to 77% for general obligation and Public Building Authority bondholders.

February 10 -

A proposed asset sale would resolve — with a loss for bond investors — one of five Better Housing Foundation-owned portfolios in default in the Chicago area.

February 5 -

Scott Wiener plans to introduce a bill later this week outlining a plan to take over the bankrupt investor-owned utility.

February 4 -

An Oversight Board lawyer said that an announcement might be made in the next 30 days.

January 29