-

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

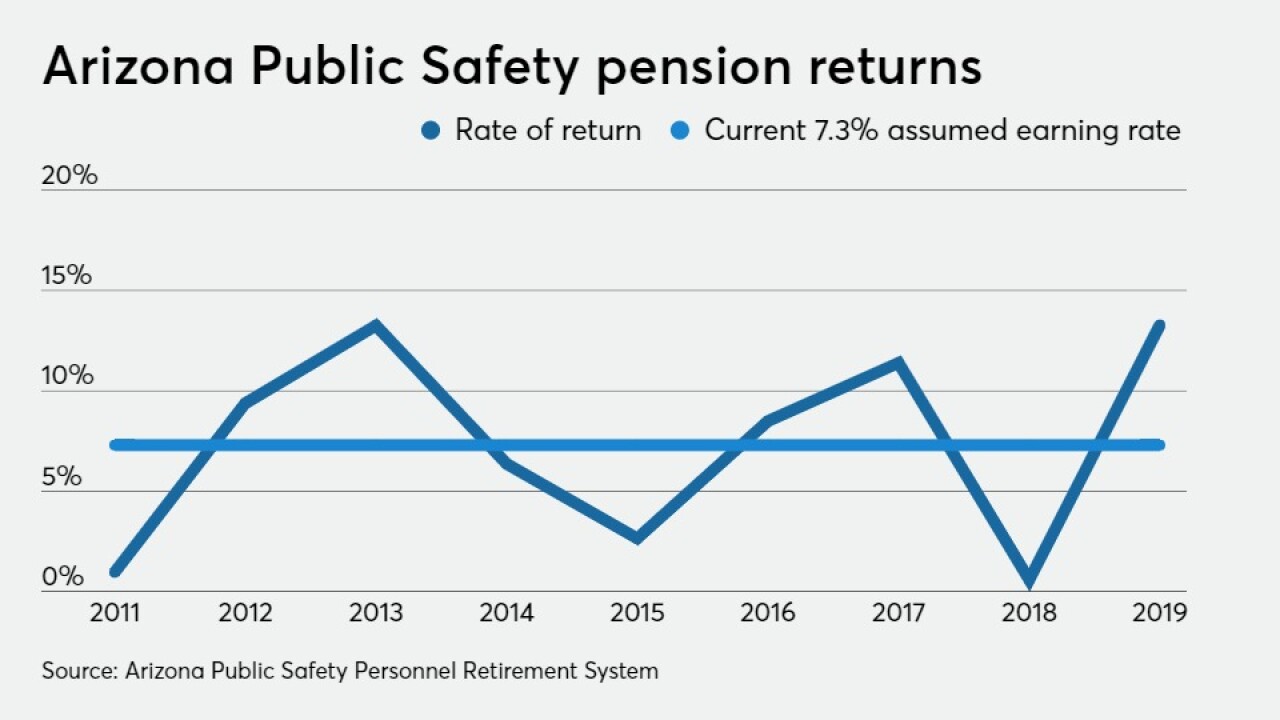

With interest rates at historic lows and stock market returns at record highs, Tucson sees a ripe opportunity to issue pension debt.

January 25 -

A 'perpetual calm' continues to fall over the municipal market as inflows into municipal funds, combined with the shortage of traditional tax-exempt supply, is directing most aspects of daily market activity.

January 22 -

The bonds are coming in three tranches, mixing tax-exempt new money and a taxable refunding.

January 15 -

Federal aid and budget cuts could erase Texas's nearly $1 billion revenue shortfall, state Comptroller Glenn Hegar says.

January 11 -

The $125 million deal from the Colorado Housing Finance Authority carries a third-party social bond opinion from Kestrel Verifiers.

January 4 -

In a year in which 16 states lost population, Texas' growth is expected to stand out in the belated 2020 Census.

January 4 -

While there are no major sales on the calendar for this week, some larger deals from and Texas, California, New Jersey and Colorado issuers are on tap for the first few weeks of 2021.

December 29 -

With its population continuing to grow, the nation's second-largest state expects a 10.5% bump in debt financing, according to its annual report.

December 28 -

They cite coalition building, learning from past mistakes, project planning and effective outreach during the pandemic.

December 24