-

Municipal bond yields were unchanged at record low levels, according to late reads.

February 26 -

Public pensions that relied on equity growth to ease unfunded liabilities could face a harsher reality, experts told The Bond Buyer's Texas Public Finance Conference.

February 26 -

As COVID-19 fears run rampant, investors continued to sell off equities, resulting in muni yields again following Treasury yields down to all-time lows.

February 25 -

Moody's calls the missed payments an administrative default given the district's willingness and ability to pay.

February 25 -

Municipal bonds yields continued their descent and once again rewrote the record books, as the flight to safety on fears of COVID-19 that took place Friday picked up right where it left off.

February 24 -

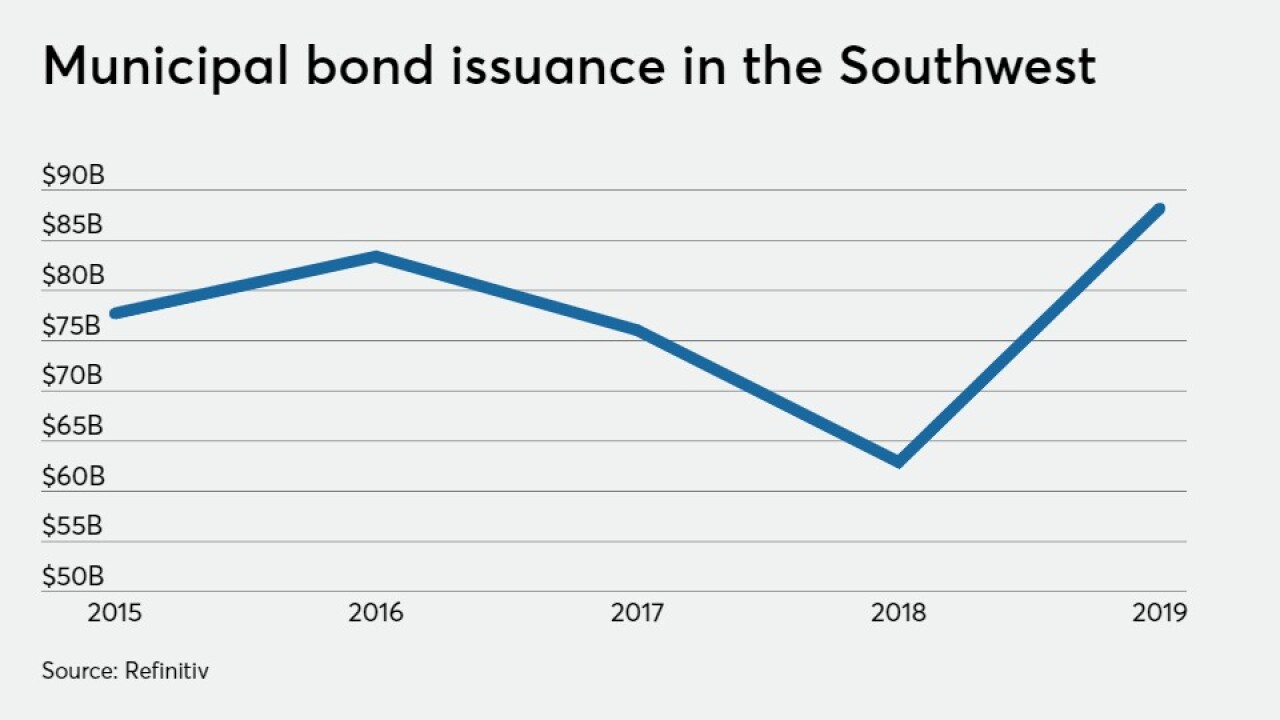

Issuers in the region sold $78.2 billion of bonds in 2019, a 24% year-over-year gain driven by growth in Texas and Colorado.

February 24 -

The market got technically stronger and the new-issue calendar builds.

February 20 -

Georgia, Wisconsin, Texas and other states have master state contracts with insurers that are available to local governments for cybersecurity.

February 20 -

New deals started to flow in and take advantage of historic lows of muni yields and rates.

February 19 -

Issuance is set to seesaw, as new-issue volume was the heaviest of the year last week, at almost 40% larger than 2019 weekly average. And this is expected to be one of the lowest-volume weeks of the year to date.

February 18