-

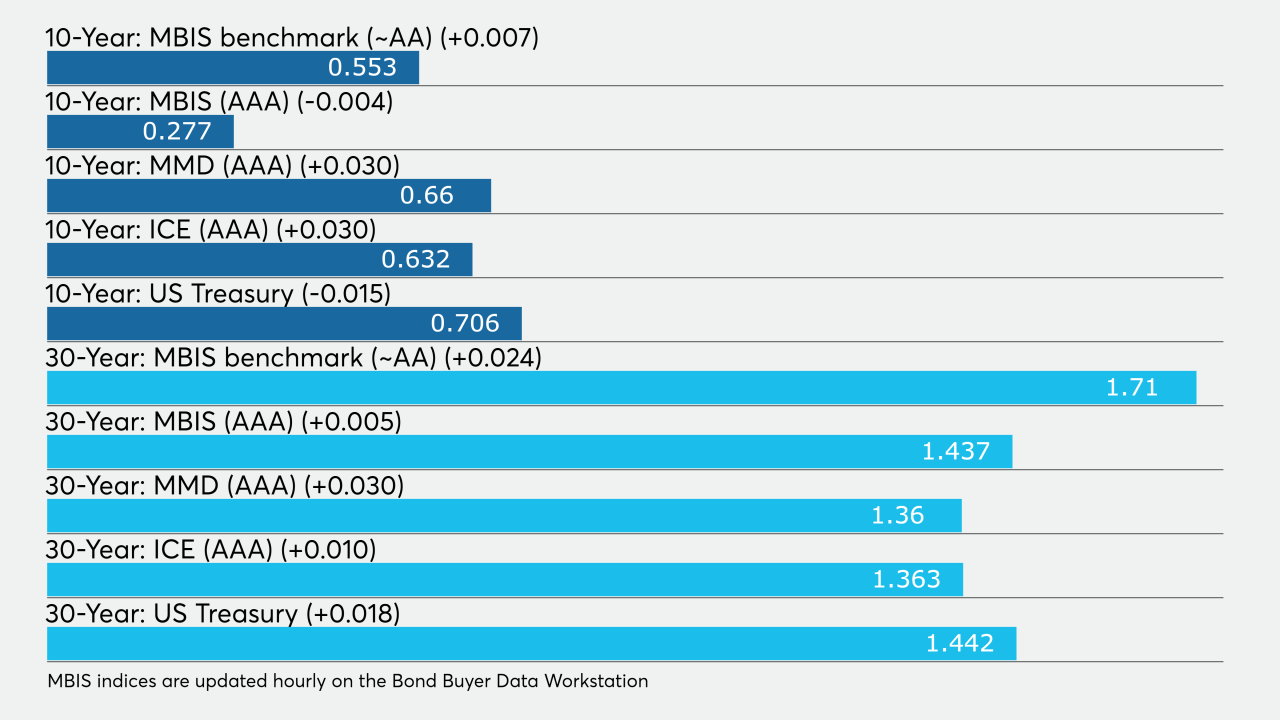

Municipals were weaker on Friday, with yields on the long end finishing out the day up one basis point. Since Aug. 12, when the muni market correction began and yields moved off record low levels, the yield on 10-year muni has risen by 23 basis points while the 30-year yield is up 29 basis points, according to Refinitiv MMD.

August 28 -

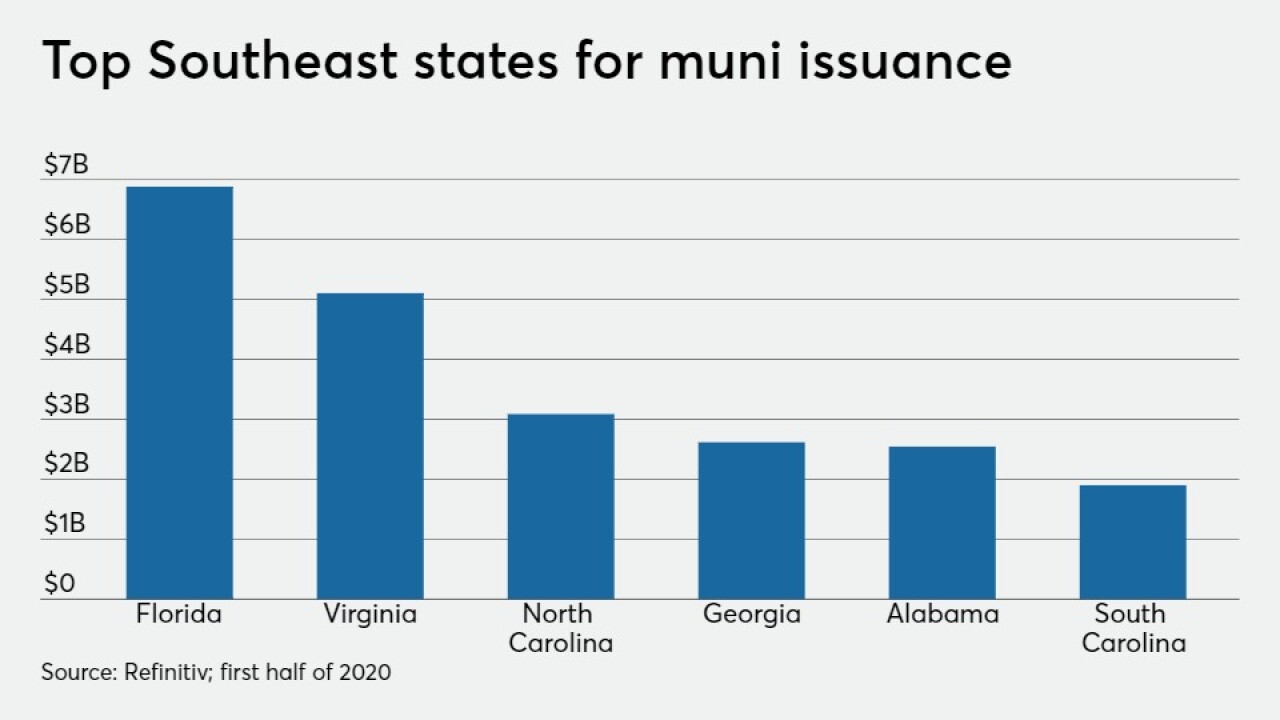

Municipal bond issuers in the Southeast sold $27.7 billion of debt, down 7% year-over-year as the region saw fewer big transportation and prepay gas deals.

August 26 -

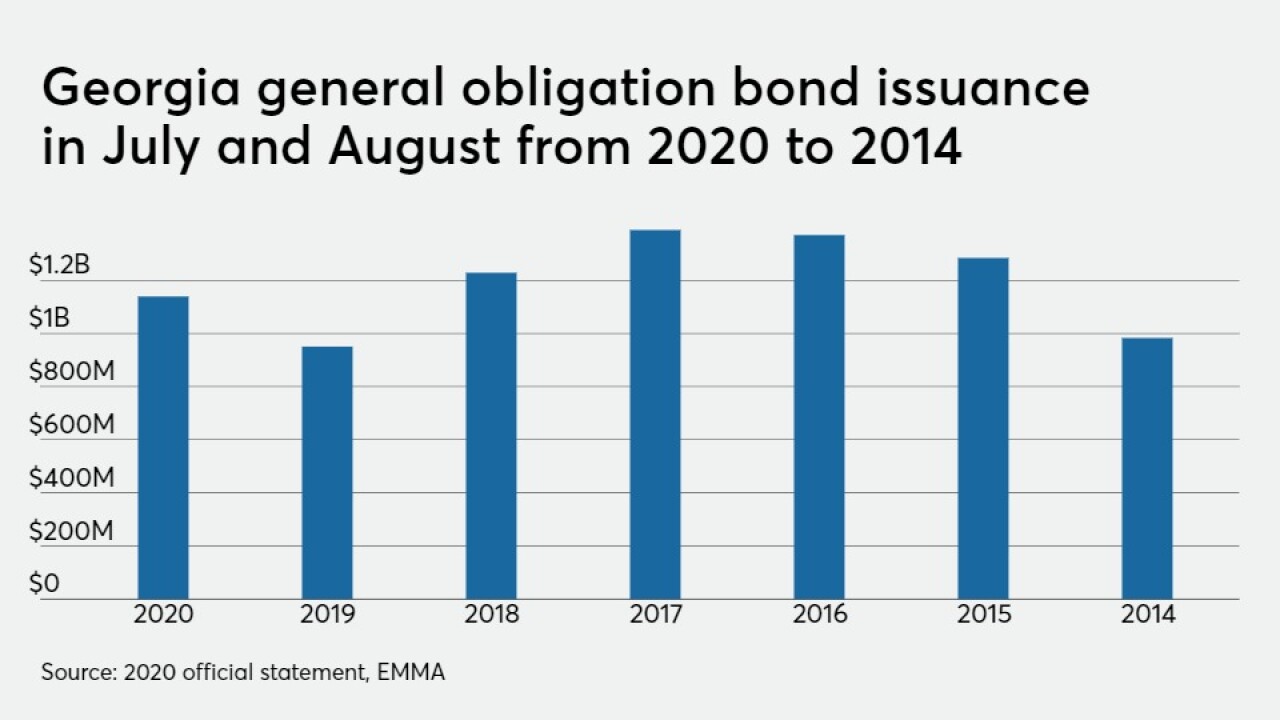

The $1.13 billion competitive deal obtained Georgia's lowest combined interest rate ever, state officials said.

August 21 -

Despite market volatility, the North Carolina Retirement Systems reported second quarter assets were valued higher than before the state’s COVID-19 shutdown.

August 20 -

Both domestic and international travel have been down sharply during the pandemic.

August 19 -

State economists project Florida will lose $5.4 billion of general revenues over the next two years, partly from reduced sales and lack of tourism.

August 19 -

Municipals were slightly weaker on Tuesday as investors take stock of inventories and exceedingly low yields for a market that might be ripe for a correction.

August 18 -

Gilt-edged Georgia boosted the amount of its borrowing this year to support the state's economy amid the COVID-19 pandemic, state official say.

August 17 -

Municipals continued to correct, with yields on the AAA scales rising by as much as three basis points as signs point to investor pullback from current low yields.

August 14 -

Federal Judge Mark Cohen formally closed out the lawsuit between the two utilities and Jacksonville after a term sheet was posted settling the litigation.

August 13