-

Even more uncertainty has been introduced into the municipal bond market as the Federal Reserve may have to tweak its monetary policy plans as the situation unfolds.

March 13 -

The Federal Reserve said further interest-rate hikes would be required to restore price stability.

March 3 -

"We think we are going to need to do further rate increases," Powell said Tuesday.

February 7 -

Many believe the Federal Reserve will slow down rate increases beginning in December.. Steve Friedman, senior macroeconomist at MacKay Shields, will join us the day after the meeting to discuss what was done and what he expects in the future.

-

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

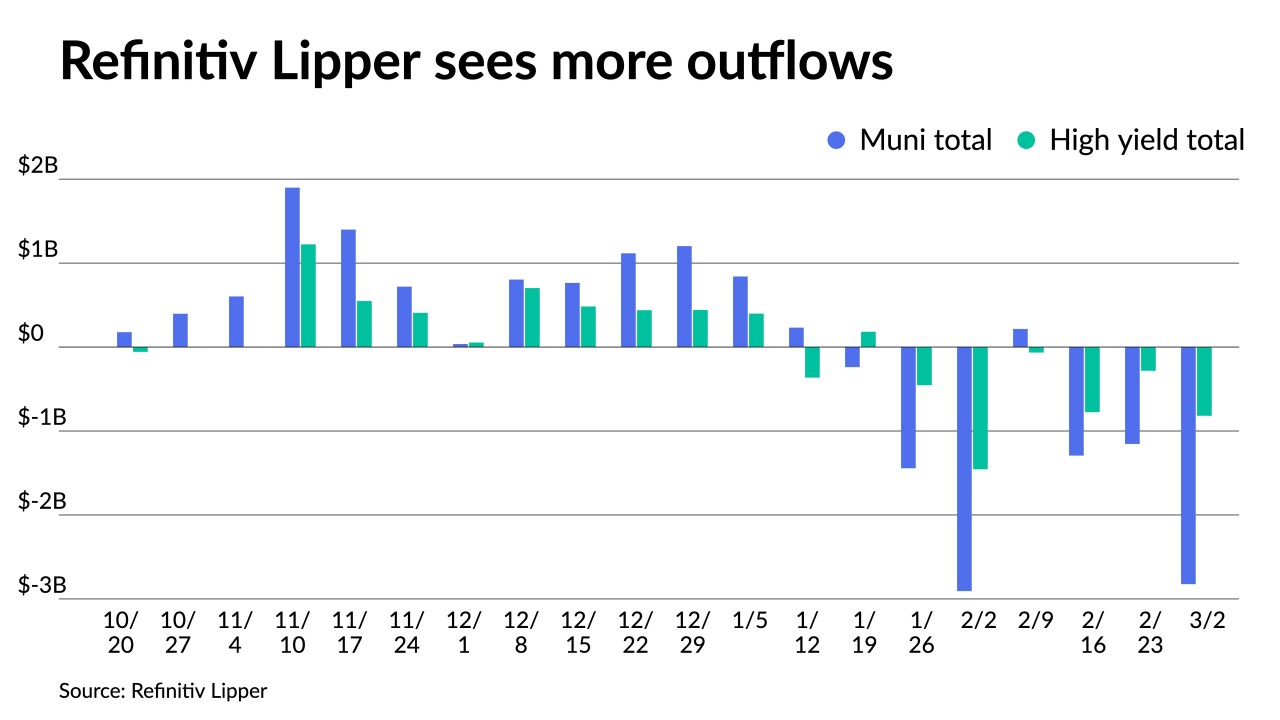

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

"We need to act now, forthrightly, strongly as we have been doing," Powell said Thursday in remarks at the Cato Institute's monetary policy conference.

September 8 -

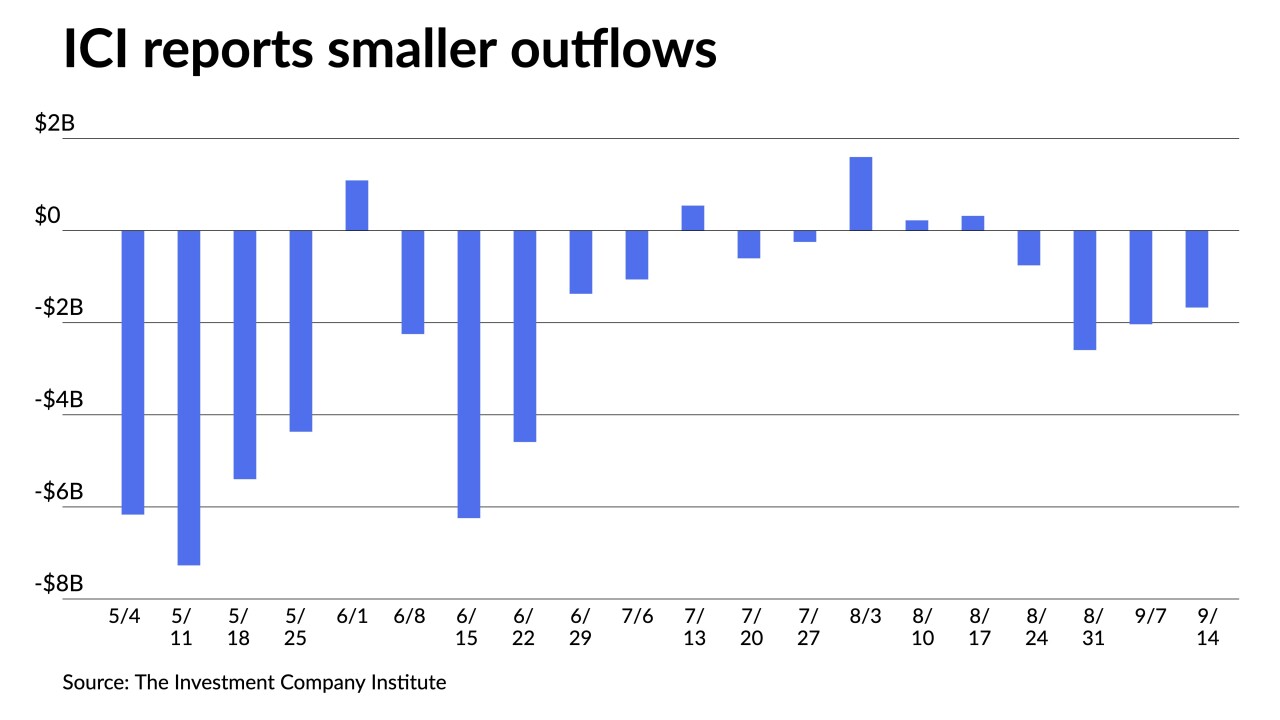

The Investment Company Institute reported $755 million of outflows from muni bond mutual funds in the week ending August 24 compared to $320 million of inflows the previous week.

August 31 -

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26 -

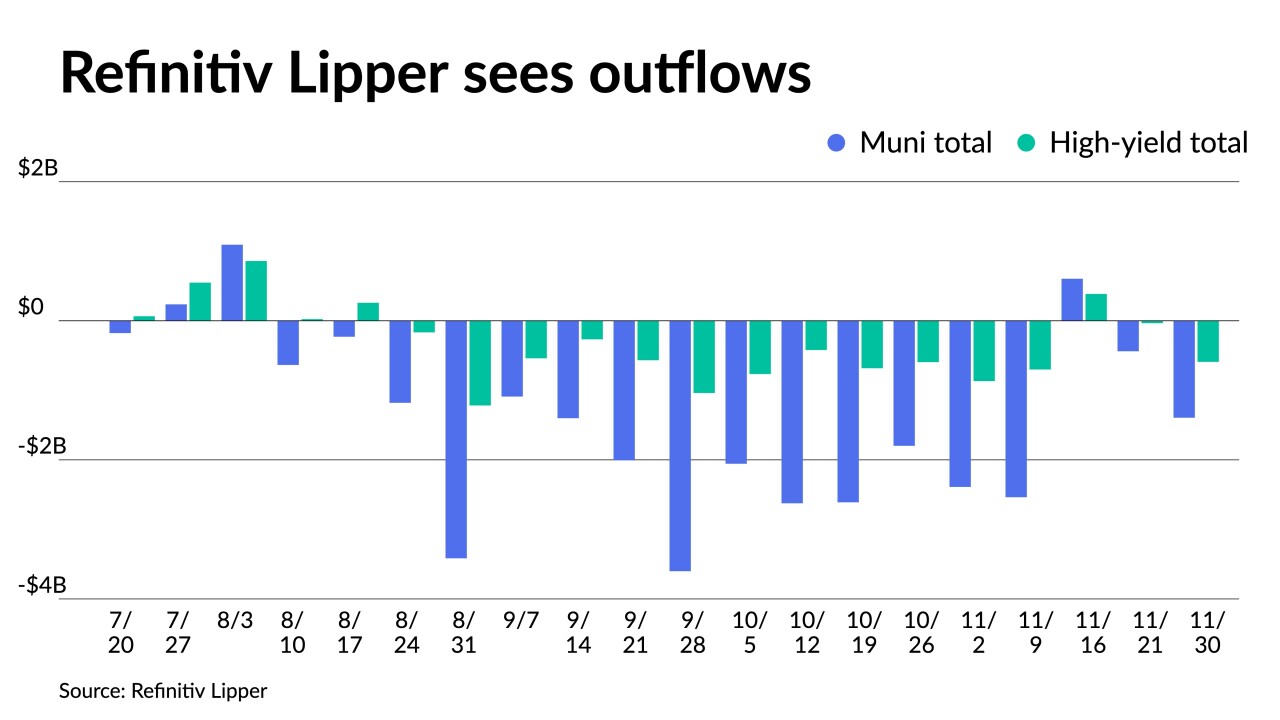

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

Former Treasury Secretary Lawrence Summers said he was concerned the Federal Reserve is still engaging in “wishful thinking” about how much it will take to bring inflation down from four-decade highs.

July 29 -

The Federal Reserve’s Inspector General said Chair Jerome Powell and former Vice Chair Richard Clarida’s trading activity had not broken any laws or rules, but the probe into the former heads of the Dallas and Boston regional Fed banks remained open.

July 14 -

Federal Reserve Chair Jerome Powell said the U.S. economy is in “strong shape” and the central bank can reduce inflation to 2% while maintaining a solid labor market.

June 29 -

Federal Reserve Chair Jerome Powell said no one should doubt the U.S. central bank’s resolve to curb the highest inflation in decades, including pushing rates into restrictive territory if needed.

May 17 -

The Senate voted to confirm Jerome Powell for a second four-year term as Federal Reserve chair on Thursday, trusting him to tackle the highest inflation to confront the country in decades.

May 12 -

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

Senate Democrats insist the GOP's boycott of President Biden's picks for the Federal Reserve is interfering with the central bank's handling of an economic crisis. But GOP lawmakers say the Fed is functioning fine and their concerns about nominee Sarah Bloom Raskin are material.

March 3