-

The Federal Open Market Committee cut the fed funds target again in December but signaled fewer cuts in 2025. There was some dissent. The markets are watching to see if the Federal Reserve pauses its easing cycle in January. Brian Rehling, head of global fixed-income strategy at Wells Fargo Investment Institute, recaps and parses the previous day's FOMC meeting and Fed Chair Jerome Powell's press conference.

-

A week ahead of inauguration day, Scott Colbert, executive vice president, director of fixed income and chief economist at Commerce Trust, takes a look at how the Federal Reserve and the economy will fare in President-elect Donald Trump's second run in the White House.

-

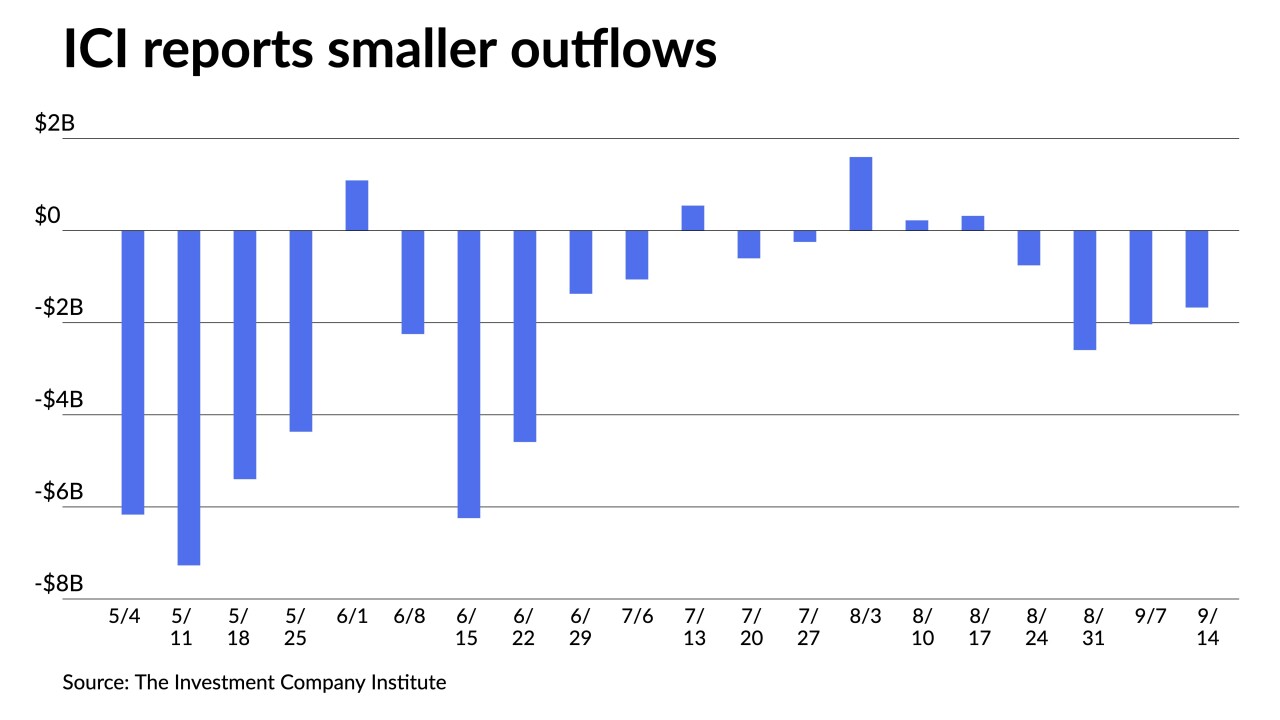

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Given the Fed's reluctance to "surprise markets or take actions that could be perceived as overtly political," Interactive Brokers Chief Strategist Steve Sosnick said, "we find it hard to believe that anything other than 25 bp is the likely outcome for the upcoming FOMC meeting."

September 16 -

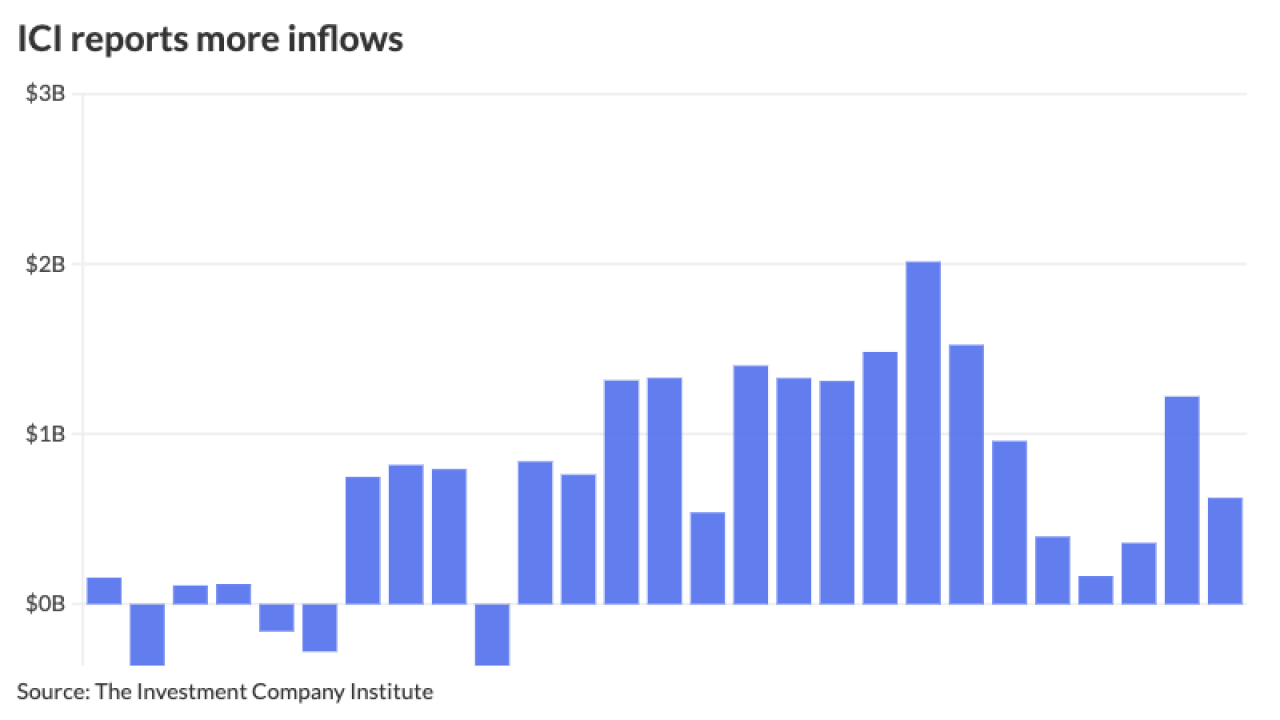

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

It was a good day for munis with larger deals clearing the primary and secondary trading showing a more constructive tone with triple-A yields falling a few basis points amid a stronger session for all markets.

March 6 -

"Although inflation has moved down from its peak — a welcome development — it remains too high," Powell said in the text of a speech Friday at the U.S. central bank's annual conference in Jackson Hole, Wyoming.

August 25 -

After holding at its last meeting, the Federal Open Market Committee may decide to raise rates again in July.

-

Powell is set to appear on Capitol Hill this week for his semi-annual monetary policy testimony, the first time the Fed chief will answer questions from Congress in public since early March.

June 21 -

Even more uncertainty has been introduced into the municipal bond market as the Federal Reserve may have to tweak its monetary policy plans as the situation unfolds.

March 13 -

The Federal Reserve said further interest-rate hikes would be required to restore price stability.

March 3 -

"We think we are going to need to do further rate increases," Powell said Tuesday.

February 7 -

Many believe the Federal Reserve will slow down rate increases beginning in December.. Steve Friedman, senior macroeconomist at MacKay Shields, will join us the day after the meeting to discuss what was done and what he expects in the future.

-

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

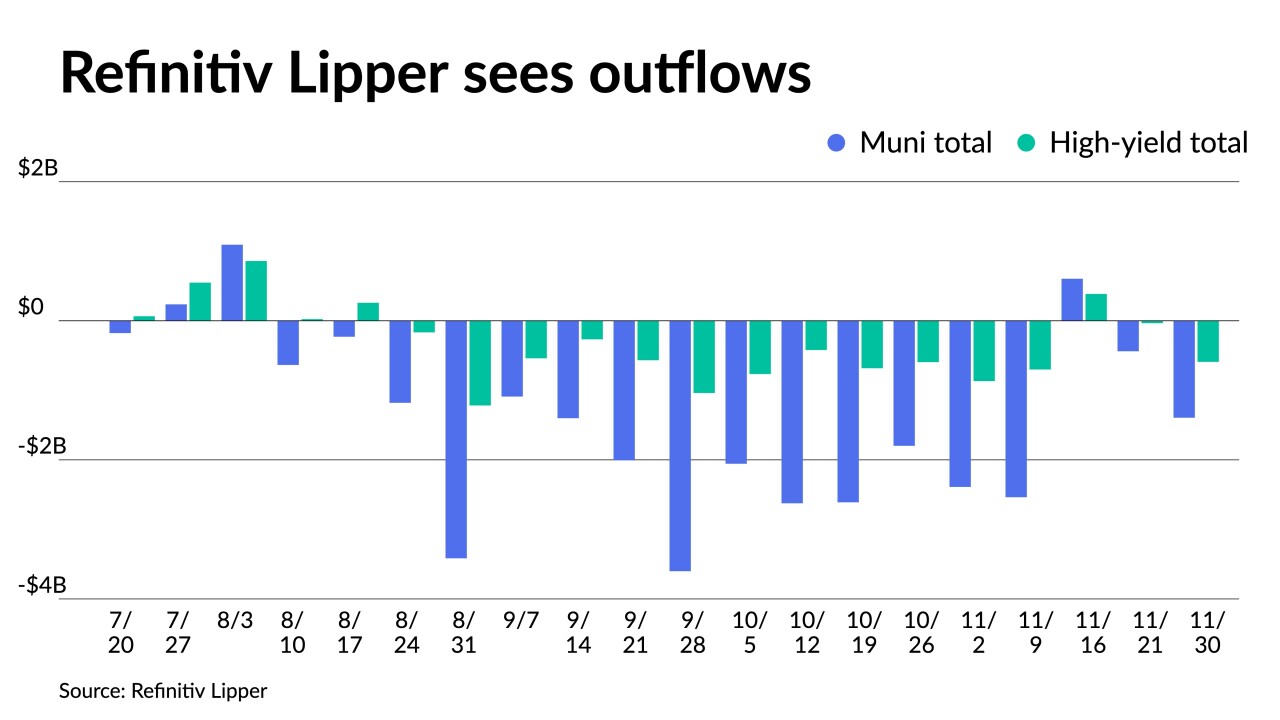

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

"We need to act now, forthrightly, strongly as we have been doing," Powell said Thursday in remarks at the Cato Institute's monetary policy conference.

September 8