-

Light primary easily absorbed while secondary trading showed a steadier market as it closes for Veterans Day. Massachusetts announces $1.4 billion of GOs for next week.

November 10 -

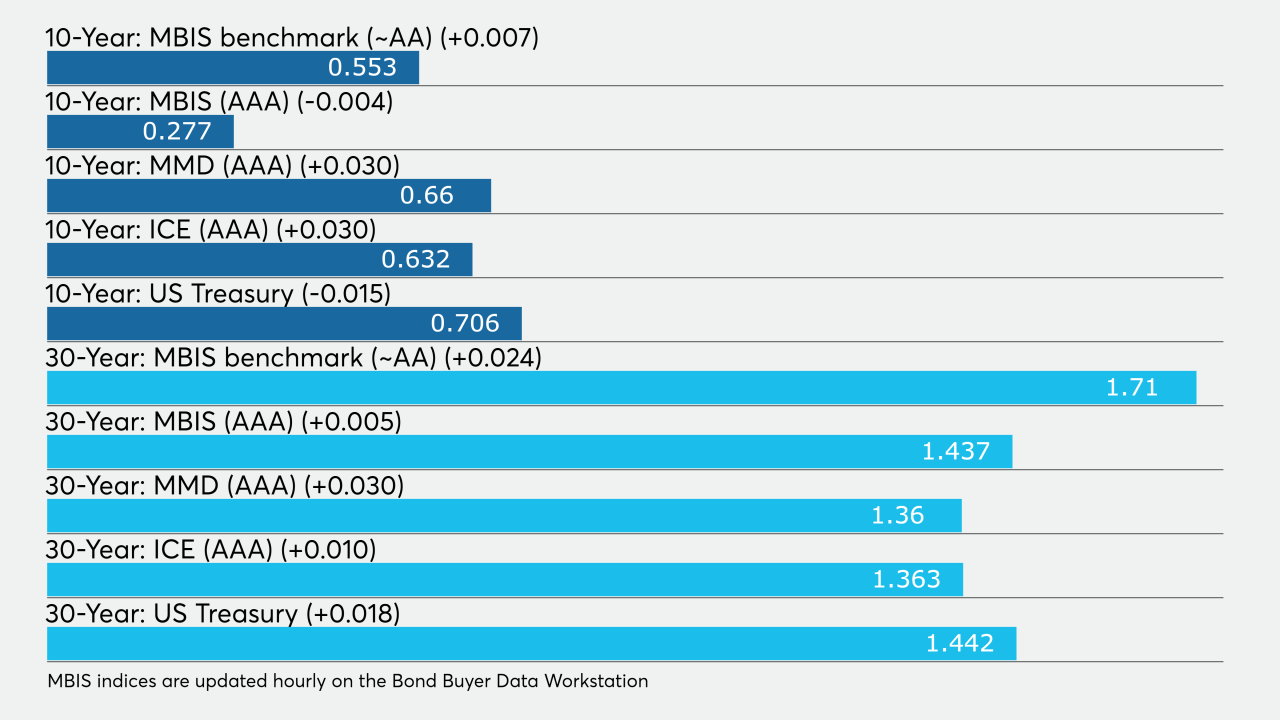

Municipal yields rose as much as five basis points on the long end, but the losses were not as pronounced as UST. Light dealer inventories and scarce secondary trading let munis outperform Treasuries.

November 9 -

As the week drew to a close, municipal bond market participants looked ahead to a smaller-than-usual supply slate dominated by revenue bond deals.

November 6 -

The Louisiana State Bond Commission will refinance $424 million of variable-rate bonds; the deal isn't expected to include the termination of underwater swaps.

October 15 -

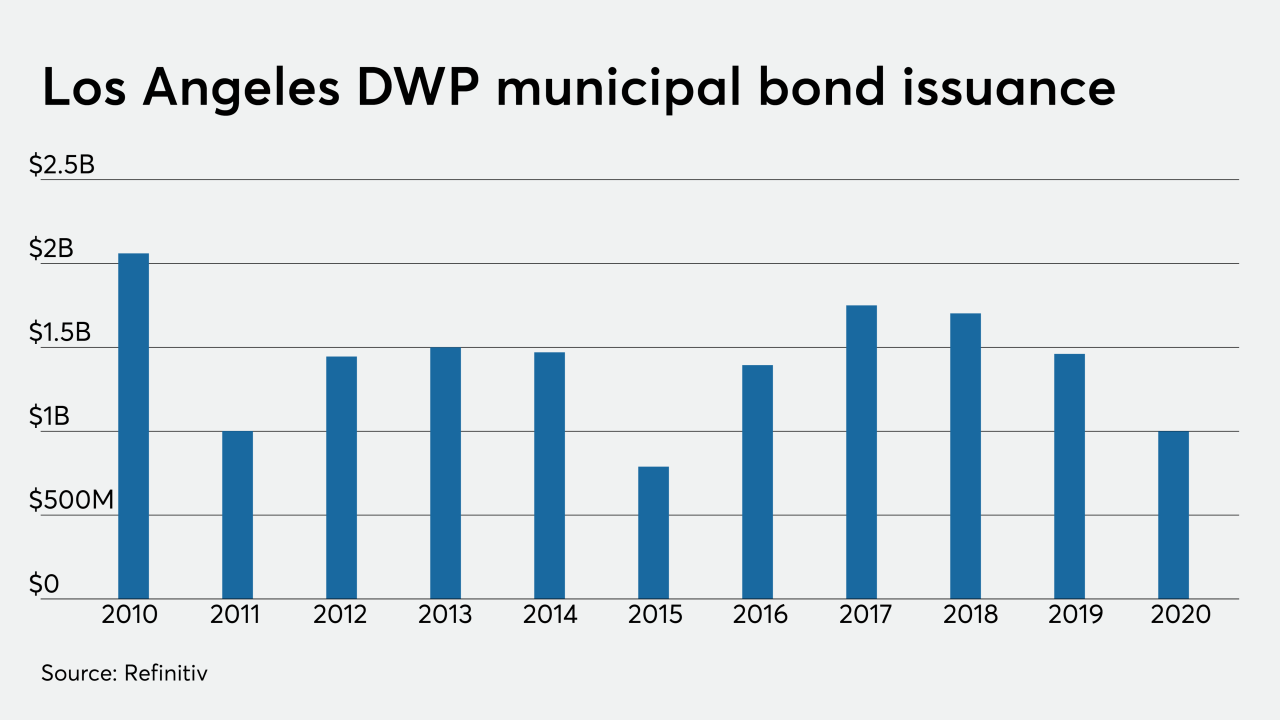

One muni bond sector that had been a go-to for heavier allocations was utilities, according to Kim Olsan.

September 28 -

The Puerto Rico Housing Finance Authority will be in the market with almost $250 million of public housing project refunding bonds.

September 25 -

Municipals were slightly weaker on Tuesday as investors take stock of inventories and exceedingly low yields for a market that might be ripe for a correction.

August 18 -

Municipals continued to correct, with yields on the AAA scales rising by as much as three basis points as signs point to investor pullback from current low yields.

August 14 -

Treasurer John Schroder, a Republican, has battled with Louisiana's Democratic governor over the funds for the past two years. He has said he will appeal.

June 1 -

State officials estimate revenue shortfalls could reach more than $2 billion, but also believe the magnitude of budget trouble is "highly uncertain."

May 13