As municipal bond buyers await this week’s new-issue slate, munis were little changed on Monday, with yields steady along the AAA scales. The calendar of total municipal bond volume is estimated at $8.7 billion.

“This week's new-issue slate of tax-exempt paper is currently estimated at $5.5 billion, just shy of the running 2020 average of $5.9 billion, but well below last week's $9 billion,” said Peter Franks, senior market analyst at Refinitiv MMD. “Deals this week will offer investors a variety of credits that include airports, hospitals and toll roads while just over $200 million will be AAA paper.”

This week’s volume of exempts and taxables is estimated at $8.7 billion in a calendar made up of $7.4 billion of negotiated deals and $1.3 billion of competitive sales.

Utility sector in focus

As

Across the western United States, utilities are increasingly cutting power ahead of wind storms to reduce the chances of live wires igniting blazes.

One muni bond sector that had been a go-to for heavier allocations was utilities — including water, sewer and power bonds — and that was because of their more-defined revenue streams, according to Kim Olsan, senior vice president at FHN Financial.

She said in a comparison between stocks and bonds, muni performance has been favorable in the light of so much uncertainty.

“Municipal utility credit returns in September are nearly flat, but for all of 2020 have gained 4.37% (through Sept. 25), a full 100 basis points excess to the broad market and against a 7.89% loss in the S&P Utility index,” Olsan said. “With some GOs drawing negative outlook activity and lower-rated revenue bonds in less favor, water and sewer credits are seeing heavier allocations.”

She said that municipal utility issuance is up 29% through the end of August on volume of nearly $40 billion, which is 13% of total issuance. She added that only the education sector has seen a larger increase from last year’s totals.

“Ongoing concerns about other revenue sectors could add further support to muni water, sewer and power allocations,” she said.

Looking ahead “over a five-year horizon, though, the muni utility return closely matches that of the S&P index, with a 3.86% average gain to the 3.76% gain in the equity component,” Olsan said.

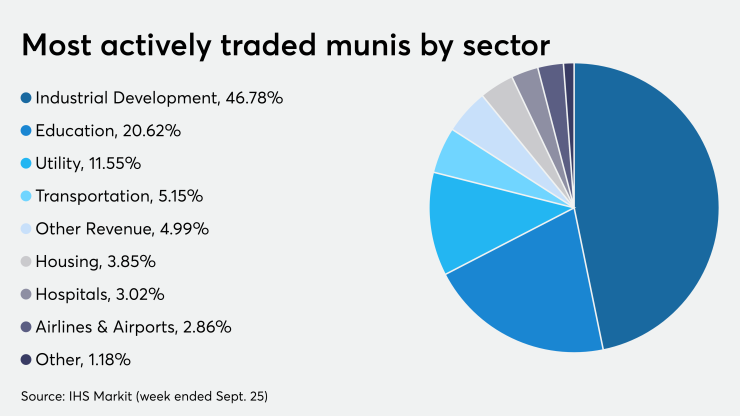

Last week, the most traded muni sector was industrial development followed by education and utilities, IHS Markit said.

Primary market

Starting off the week, Goldman Sachs is expected to price the Puerto Rico Housing Finance Authority’s $249 million of capital fund modernization program refunding bonds for Puerto Rico public housing projects on Tuesday.

JPMorgan Securities is set to price Atlanta’s $366 million of airport general revenue refunding deal, which includes bonds subject to the alternative minimum tax and non-AMT bonds on Tuesday.

BofA Securities is ready to price the Missouri Health and Educational Facilities Authority’s $366 million of revenue bonds for Mercy Health on Tuesday. Goldman Sachs is expected to price the Children’s Hospital Medical Center in Ohio’s $200 million of taxable bonds for the Cincinnati Children’s Hospital Medical Center on Tuesday.

On Wednesday, Raymond James & Associates is set to price Louisiana’s $435 million of refunding bonds.

In the competitive arena on Wednesday, the Massachusetts School Building Authority will sell $395 million of Series 2020C taxable senior dedicated sales tax refunding bonds. PFM Financial Advisors is the financial advisor; Mintz Levin is the bond counsel.

On Friday night, Morgan Stanley received the written award on the Brightline West Passenger Rail Project’s (Aaa/NR/NR/NR) $1 billion of revenue bonds subject to the alternative minimum tax.

The California Infrastructure and Economic Development Bank’s $850 million of Series 2020A revenue bonds [13034AK90] were priced at par to yield 0.45% in a 2050 bullet maturity with a mandatory tender in 2021.

The Director of the State of Nevada Department of Business and Industry’s $150 million of 2020A revenue bonds [25457VBP0] were priced at par to yield 0.50% in a 2050 bullet maturity with a mandatory tender in 2021.

Secondary market

Some notable trades Monday:

Maryland GOs, 5s of 2022, traded at 0.26%-0.18% in odd lots. Collin County Texas community college 5s of 2023 at 0.24%-0.20%. Maryland GOs, 5s of 2023, in odd lots, traded at 0.25%-0.22%.

Fairfax, Virginia, ts of 2035 were at 1.21%-1.20%.

NYC TFA 3s of 2039 in odd lots were at 2.19%-2.10%.

Charlotte, North Carolina 2.125% of 2045 traded at 2.16%-2.14% after originally pricing at 2.24%.

Out longer, Dallas waters, 4s of 2049, traded at 1.80%-1.79%.

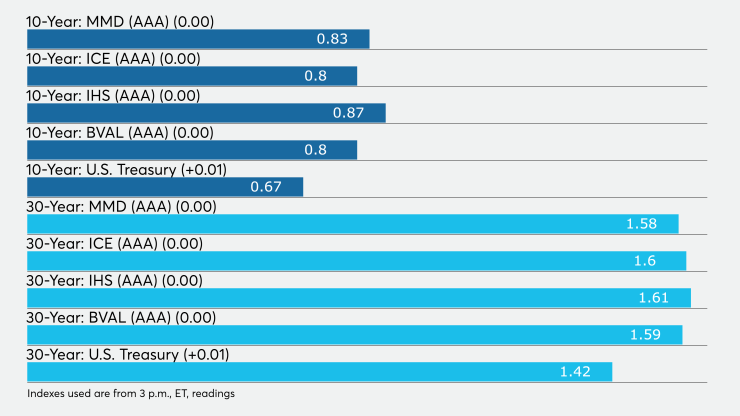

High-grade municipals were unchanged Monday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields were flat in 2021 and 2022 at 0.12% and 0.13%, respectively. The yield on the 10-year muni was flat at 0.83% while the 30-year yield remained at 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 124.4% while the 30-year muni-to-Treasury ratio stood at 110.6%, according to MMD

The ICE AAA municipal yield curve showed all maturities steady, with the 2021 maturity at 0.12%, the 2022 maturity at 0.13%, the 10-year maturity at 0.80% and the 30-year at 1.60%. The 10-year muni-to-Treasury ratio was calculated at 126% while the 30-year muni-to-Treasury ratio stood at 111%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields unchanged, with the 2021 maturity yielding 0.15%, the 2022 maturity at 0.16%, the 10-year muni at 0.87% and the 30-year at 1.61%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity unchanged at 0.13%, the 10-year steady at 0.80% and the 30-year flat at 1.59%.

Treasuries were mixed as stock prices traded higher.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.67% and the 30-year Treasury was yielding 1.42%.

The Dow rose 1.75%, the S&P 500 increased 1.75% and the Nasdaq gained 1.75%.