-

Top-quality municipal bonds were stronger at mid-session as the market is seeing the lion’s share of issuance hit the screens, led by California’s $2.5 billion general obligation bond deal and the Greater Orlando Aviation Authority’s revenue bond offering.

August 29 -

The municipal bond market will see the lion’s share of issuance hit the screens on Tuesday, led by California’s $2.5 billion general obligation bond deal and the Greater Orlando Aviation Authority’s revenue bond sale.

August 29 -

Top-rated municipal bonds finished unchanged on Monday, according to traders, as California’s $2.5 billion general obligation bond deal was priced for retail investors.

August 28 -

Top-rated municipal bonds were unchanged at mid-session, according to traders, as California’s $2.5 billion general obligation bond deal was priced for retail investors.

August 28 -

The municipal bond market is looking at a $6.87 billion new issue calendar this week, dominated by the state of California’s $2.5 billion general obligation bond deal.

August 28 -

Primary municipal bond market volume is expected to perk up to $6.9 billion in the coming week, more than one-third of it in a single deal from the Golden State.

August 25 -

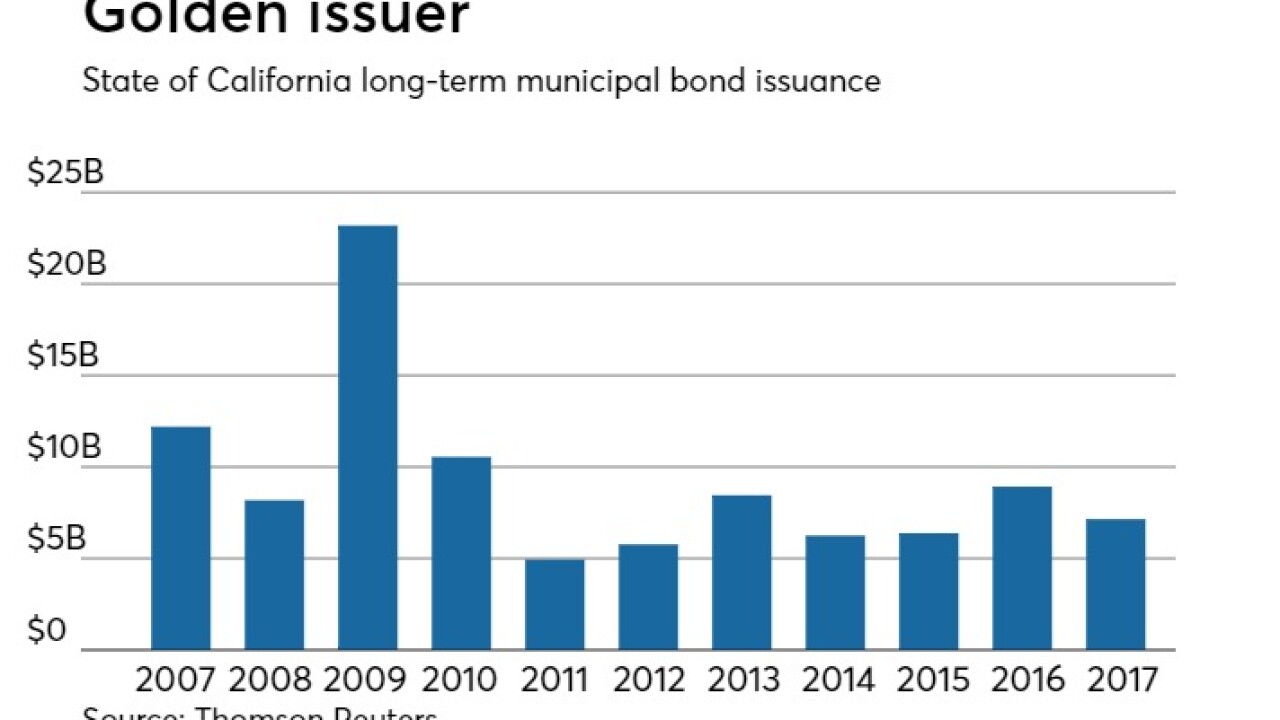

Primary market volume in California and the Far West region rose in the first half even as the national figure was down.

August 24 -

The California WaterFix could pressure some utilities, Fitch said.

August 17 -

Hazelden Betty Ford Foundation was dropped from the single A category by Moody’s Investors Service.

August 15 -

Municipal bond volume ended the month of July down 20% as refundings plummeted.

July 31