Primary municipal bond market volume is expected to perk up to $6.9 billion in the coming week, more than one-third of it in a single deal from the Golden State.

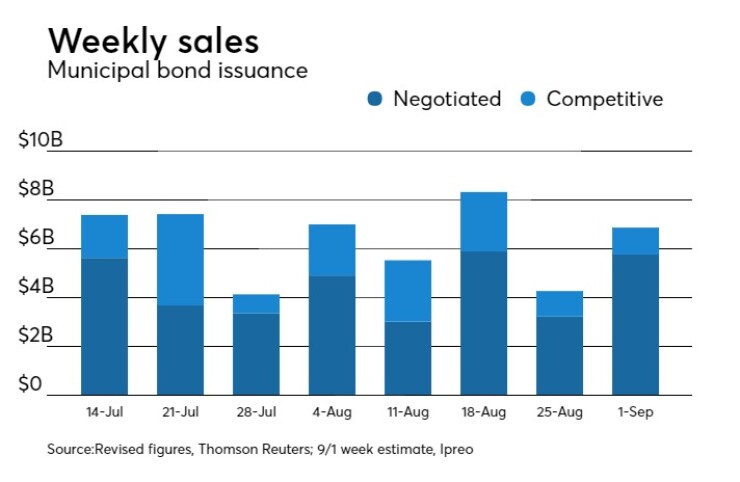

Ipreo estimates volume will increase to $6.87 billion, from the revised total of $4.37 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.77 billion of negotiated deals and $1.10 billion of competitive sales.

The calendar is top heavy. The fourth largest scheduled deal is less than $400 million. The majority of action is scheduled to take place on Tuesday including the four largest deals and eight of the top 10.

For the second time this year, the State of California is scheduled to sell $2.5 billion of various purpose general obligation and refunding bonds. Citi was the lead underwriter the first time around in March, when the state increased the size the deal to $2.8 billion. This time Goldman is running the books and is expected to price for institutions on Tuesday following a one-day retail order period. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

“Demand for the Cal deal will be extremely strong,” said Alan Schankel, managing director and municipal strategist for Janney. “New money continues to roll into funds and supply has generally been very light. It would not surprise me to see the deal upsized.”

According to a pre-marketing scale released late on Friday, the $788.82 million of various purpose GO bonds are two basis points below the benchmark Municipal Market Data interpolated scale, with 3% and 5% coupons in a split maturity to 22 basis points above the MMD scale with a 5% coupon. The premarketing scale also has a 2028 maturity 22 basis points above with a 5% coupon and 55 basis points and 25 basis points above the MMD scale with 4% and 5% coupons in a split 2032 maturity. A term bond in 2035 was listed 25 basis points above the MMD scale with a 5% coupon and a $300 million term bond in 2047 was listed as 58 basis points and 23 basis points above the MMD benchmark with 4% and 5% coupons in a split maturity.

The $1.72 billion of various purpose GO refunding bonds are being premarketed two basis points below the MMD scale with a 3% coupon in 2018 to 58 basis points and 25 basis points above the MMD scale with a 4% coupon and a 5% coupon in a split 2037 maturity. The MMD benchmarks are based on bonds with 5% coupons.

RBC Capital Markets is scheduled to price the Greater Orlando Aviation Authority’s $950 million of priority subordinated airport facilities revenue alternative minimum tax bonds on Tuesday.

The deal has been accelerated from its planned sale date in early September because of market conditions and the upcoming Labor Day holiday, according to Chief Financial Officer Kathleen Sharman.

“Airport transactions that have come to the market since the summer have met with good demand and we hope that timing will work for us as well,” Sharman said. Pre-marketing takes place Monday.

The deal, which carries S&P Global Ratings’ first U.S. airport authority “Green Evaluation” score, is expected to be structured with serial maturities between 2023 and 2037, and term bonds in 2042, 2047 and 2052. It is rated A1 by Moody’s and A-plus by S&P and Fitch.

Bank of America Merrill Lynch is slated to price the Illinois Finance Authority’s $558 million of state clean water initiative revolving fund revenue bonds on Tuesday after a one-day retail order period. The deal is rated triple-A by S&P and Fitch.

The largest competitive sale will also take place on Tuesday, when Prince George’s County, Md. auctions off two separate sales of $366.46 million and $114.385 million of GO consolidated public improvement and refunding bonds. Both deals are rated triple-A by Moody’s, S&P and Fitch.

Secondary market

Top-rated municipal bonds finished flat on Friday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.88% on Thursday, while the 30-year GO yield was steady from 2.73%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were narrowly mixed. The yield on the two-year Treasury was flat from 1.33% on Thursday, the 10-year Treasury yield fell to 2.17% from 2.19% and the yield on the 30-year Treasury bond decreased to 2.75% from 2.77%.

The 10-year muni-to-Treasury ratio was calculated at 86.7% on Friday, compared with 85.8% on Thursday, while the 30-year muni-to-Treasury ratio stood at 99.2% versus 98.6%, according to MMD.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Aug. 25 were from California, Texas and New Jersey issuers, according to

In the GO bond sector, the California 5s of 2039 were traded 27 times. In the revenue bond sector, the Texas 4s of 2018 were traded 371 times. And in the taxable bond sector, the Bergen County Improvement Authority, N.J., 2.25s of 2019 were traded 24 times.

Week's actively quoted issues

New Jersey, North Carolina and Illinois names were among the most actively quoted bonds in the week ended Aug. 25, according to Markit.

On the bid side, the New Jersey State Transportation Trust Fund Authority taxable 1.758s of 2018 were quoted by 112 unique dealers. On the ask side, the Mecklenburg County, N.C., GO 3s of 2036 were quoted by 207 dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 24 unique dealers.

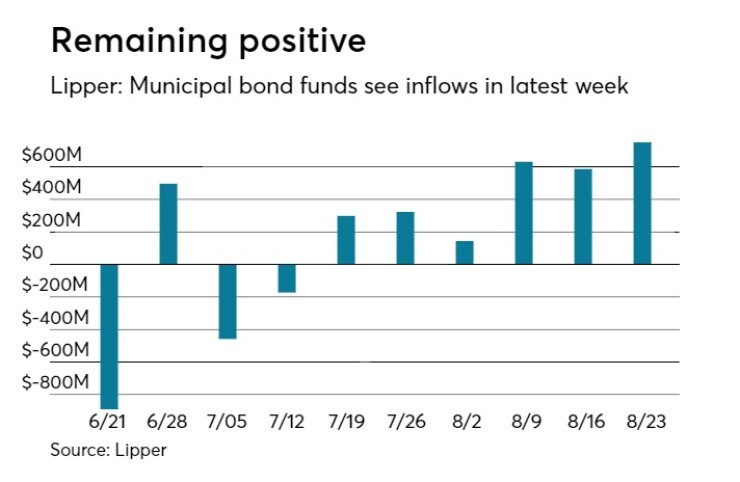

Lipper: Muni bond funds see inflows

Investors in municipal bond funds continued to put cash into the funds in the latest week, according to corrected Lipper data released late Friday. The inflow was originally reported by Lipper as an outflow.

The weekly reporters drew $750.500 million of inflows in the week of Aug. 23, after inflows of $586.766 million in the previous week.

Exchange traded funds reported inflows of $126.924 million, after inflows of $99.484 million in the previous week. Ex-EFTs, muni funds saw $623.576 million of inflows, after inflows of $487.282 million in the previous week.

The four-week moving average was positive at $528.082 million, after being in the green at $421.205 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $464.851 million in the latest week after inflows of $378.696 million in the previous week. Intermediate-term funds had outflows of $133.969 million after inflows of $158.569 million in the prior week.

National funds had outflows of $384.236 million after inflows of $555.401 million in the previous week.

High-yield muni funds reported inflows of $235.522 million in the latest week, after inflows of $185.562 million the previous week.

Shelly Sigo contributed to this report.