-

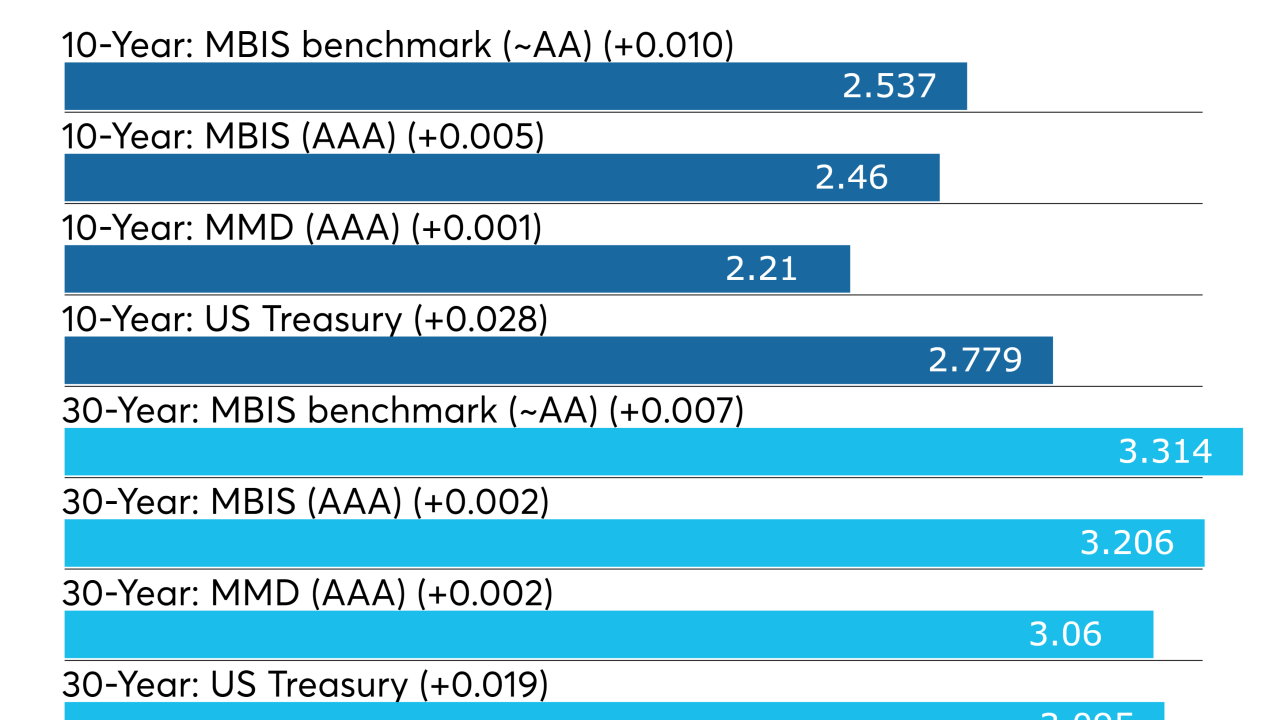

Municipals were stronger Tuesday ahead of this week’s $5 billion new issue calendar.

January 22 -

A trader said lack of follow-through on long new issues continued to plague the market as the weekly calendar shrank to $5B of issuance.

January 18 -

The municipal bond market is prepping for around $5 billion of new issuance in the upcoming holiday-shortened week.

January 18 -

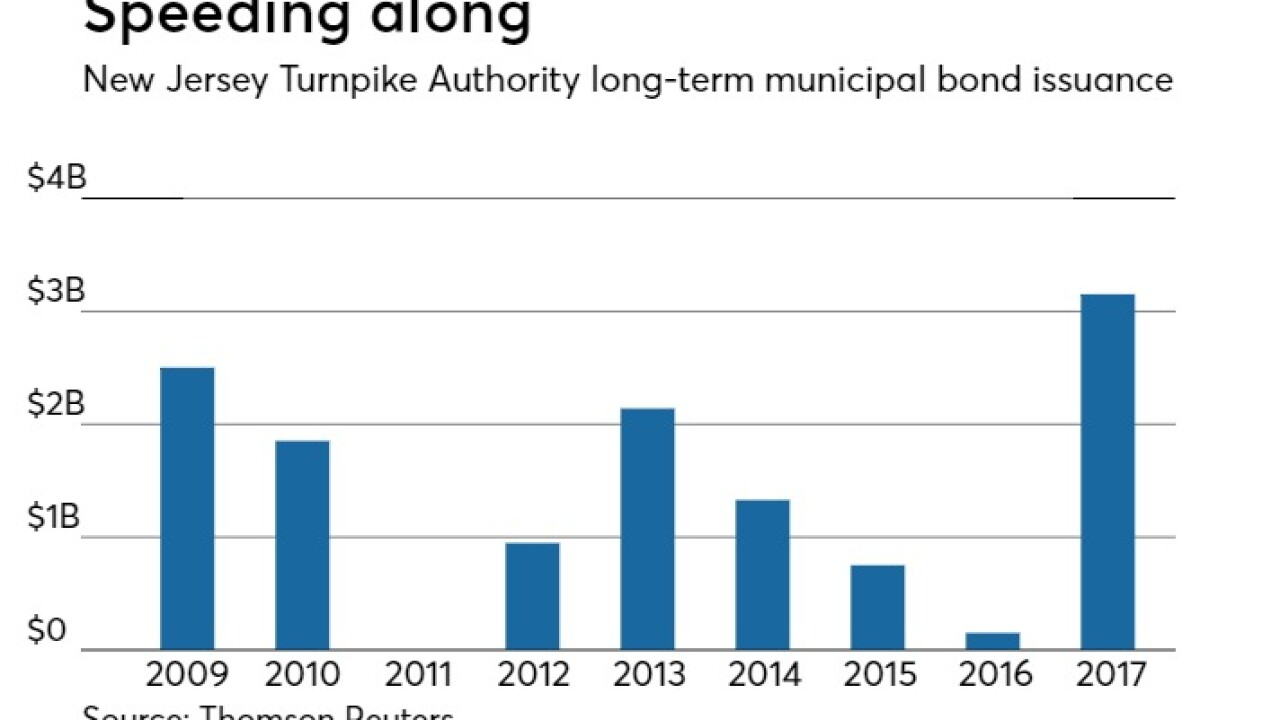

After recession-driven trouble, the authority's reserve is more than $300 million, said Donna Manuelli, its chief financial officer.

October 30 -

Although market conditions are not pristine, with rising yields and little primary action, market participants expressed reason to believe the first week of February will be a positive one.

February 2 -

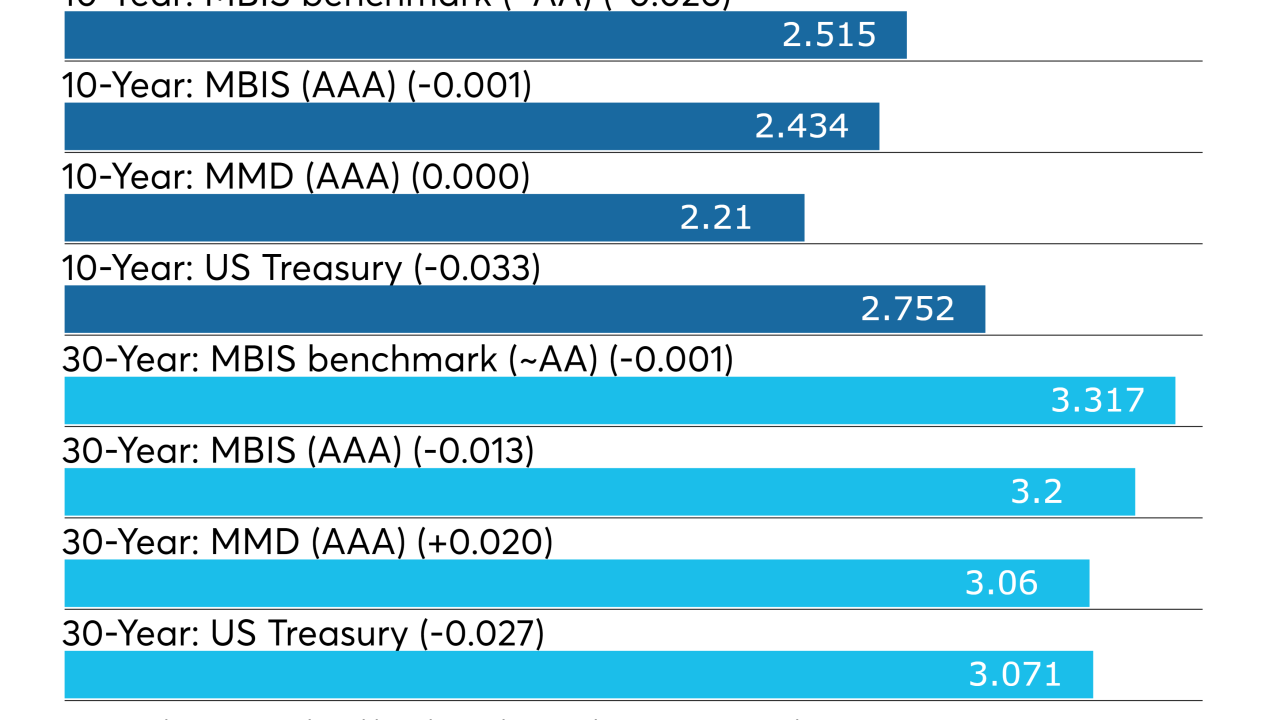

Municipal bond yields are rising as buyers look ahead to another smaller-than-average slate of sales heading to market next week.

February 2 -

Bond traders and buyers will keep an eye on rising yields as the municipal bond market sees a smaller than average primary slate scheduled for sale next week.

February 2 -

Tax-exempt issuance again dominates the calendar, after a week of mostly taxable deals .

January 12 -

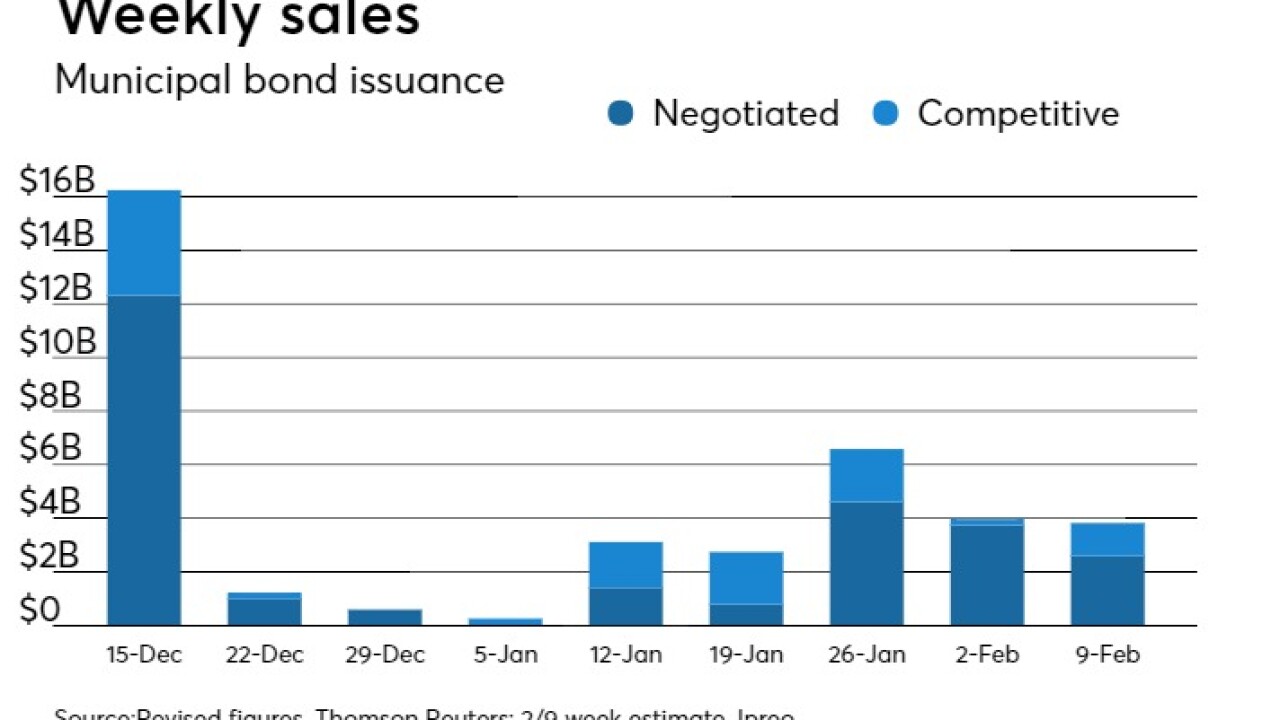

The municipal bond market will see $3.35 billion of new deals hit the screens next in a holiday-shortened week. Ipreo estimates weekly volume at $3.35 billion, up from $3.12 billion this week.

January 12 -

The municipal bond market will see a shortage of new supply kicking off the new year, after experiencing a record-breaking month in which almost $63 billion of bonds sold.

December 29 -

The municipal bond market will see a shortage of new supply going into the new year, after experiencing a record-breaking month in which more than $61 billion of bonds sold.

December 29 -

Municipal bonds strengthened Tuesday as the primary market shifted to holiday mode after breaking the December record for issuance.

December 26 -

The municipal market will be staffed by skeleton crews as the calendar has no negotiated deals and only small competitives, which don't even total $3 million — and another long holiday weekend right around the corner.

December 26 -

The muni market absorbed almost $58 billion, a record for December, before a holiday hiatus to end the year.

December 22 -

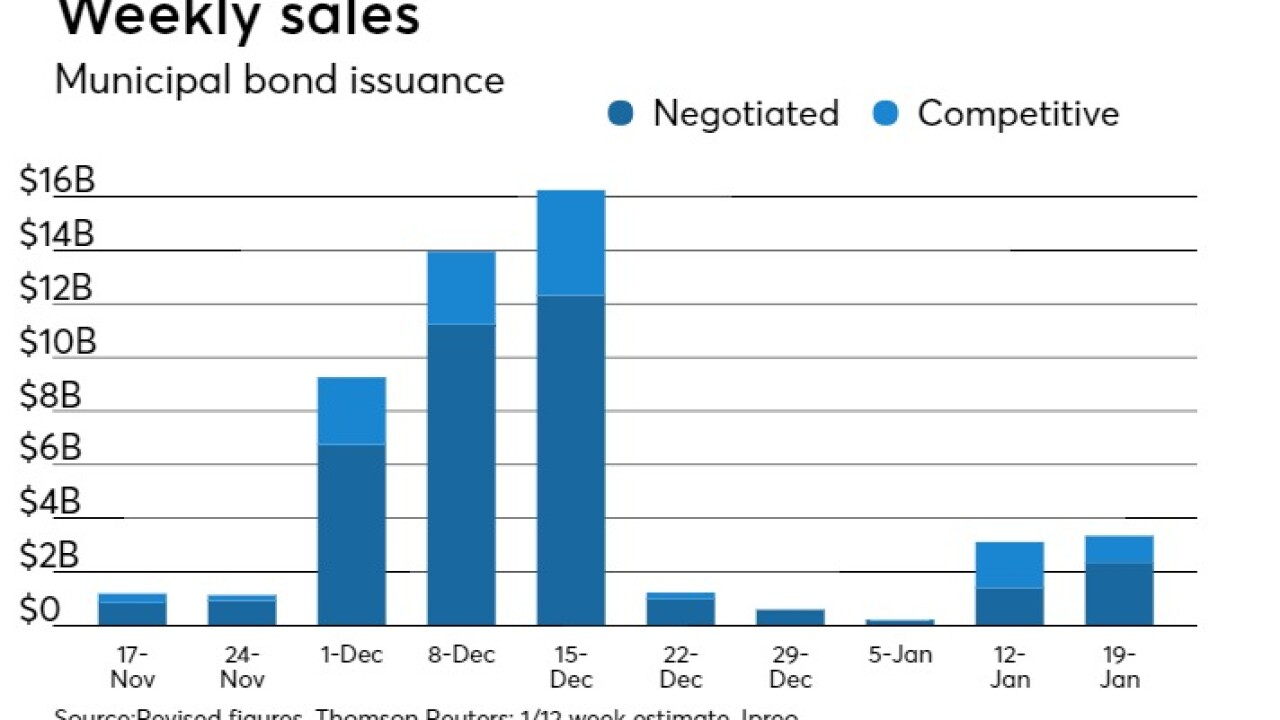

The municipal bond market next week will continue to see above-average volume, albeit at a much slower pace than this week, as $11.14 billion of deals are on the calendar.

December 15 -

The municipal bond market saw deals from far and wide this week as the threat of tax reform changes spurred a rush to issuance that will continue into the next week.

December 15 -

The municipal bond market priced deals from Partners Healthcare, South Miami Health and Empire State Development as investors waited for final details of tax law changes affecting private activity bonds.

December 14 -

Municipal bond yields continue to surge along with the supply that hit the market on Tuesday.

December 12 -

The municipal bond market will continue to see supply flood in, with several large deals set for Tuesday including the University of California and the New Jersey Turnpike's bond offerings.

December 12 -

Municipal issuers continue to race to market with deals before the calendar turns over, as the tax bill may limit issuance in 2018.

December 8