-

Analysts are confident the Fed will lower rates at this week's meeting, but their views on what next year holds don't share the same consensus.

December 17 -

Donald Trump discussed various items related to the Fed and its independence and stated he would not nominate Jerome Powell for another term as chair. Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, discusses what a Trump presidency may mean for the Fed.

-

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

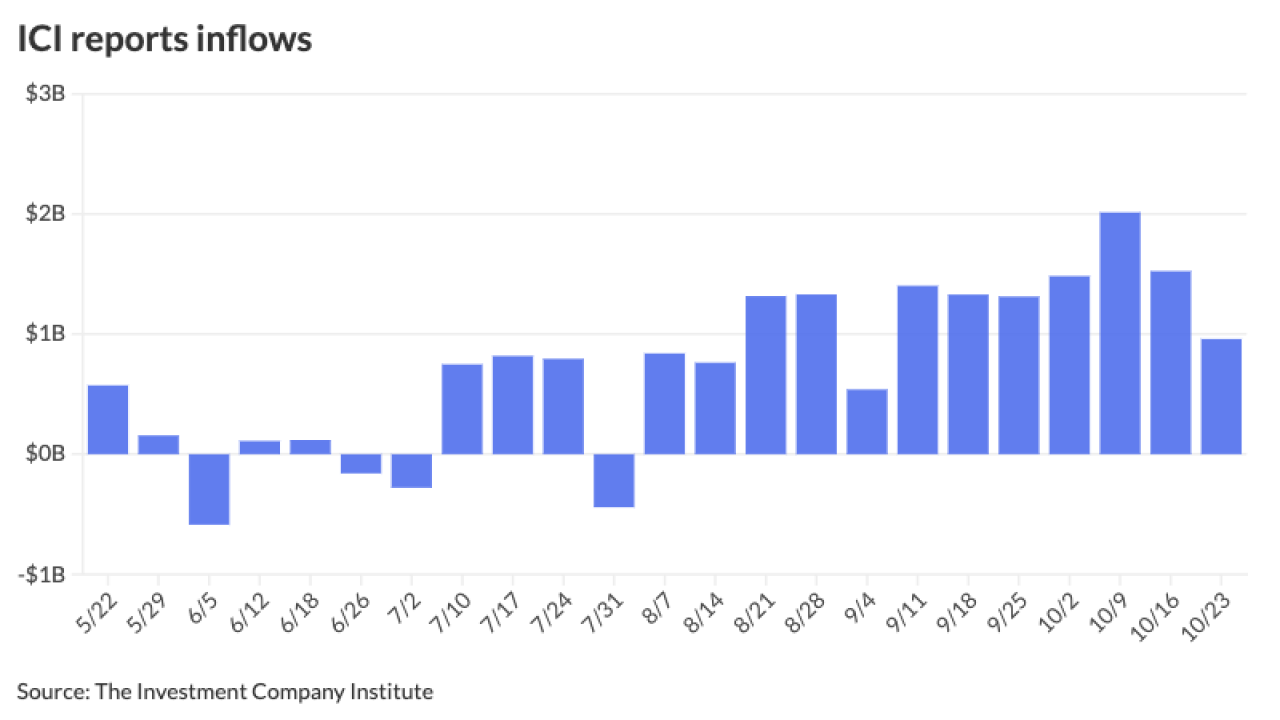

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

While this meeting is a slam dunk, the election and data makes the December meeting more of a question, some analysts said.

November 5 -

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Doug Peta, Chief Strategist, U.S. Investment Strategy, at BCA Research, discusses the meeting and future policy.

-

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

The Federal Open Market Committee is expected to cut interest rates at its September meeting, which will also provide a new Summary of Economic Projections. Marvin Loh, senior macro strategist at State Street Global Markets, examine the meeting, the SEP and Fed Chair Powell's press conference.

-

After cutting rates 50 basis points in September, the Federal Open Market Committee meets after Election Day to determine monetary policy. Gary Pzegeo, head of fixed income at CIBC Private Wealth U.S., provides his take on the latest move.

-

While the municipal market barely budged following the Fed's decision to cut rates 50 basis points, Thursday saw muni yields rise up to two basis points, depending on the scale, but still lagged the weakness in USTs. LSEG Lipper reported $716 million of inflows into municipal bond mutual funds.

September 19 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Given the Fed's reluctance to "surprise markets or take actions that could be perceived as overtly political," Interactive Brokers Chief Strategist Steve Sosnick said, "we find it hard to believe that anything other than 25 bp is the likely outcome for the upcoming FOMC meeting."

September 16 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

"The numbers are weak, but not cusp of recession weak," Chris Low, chief economist at FHN Financial, said.

September 6 -

All eyes are on Jackson Hole and Fed Chairman Jerome Powell's speech this week, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

August 21 -

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

August 21